You’re driving down the highway, cruising at the speed limit (perhaps a bit over the speed limit), and then all of a sudden… traffic. It turns out there is construction up ahead and 3 lanes need to merge down to 1, causing a bottleneck of cars. While every car is capable of traveling the speed limit, there is simply not enough space for everyone to pass through the single lane while maintaining the speed they want to travel. When this happens, people feel like they are wasting time. In a similar way, when information reaches a bottleneck in a network, organizations may feel frustrated, knowing that there could be higher performance without the bottleneck. To combat this, many organizations have adopted Non-Volatile Memory Express (NVMe) technology, and specifically NVMe over Fabrics (NVMe-oF), in order to open up more lanes for information travel. While typical NVMe is attached to the peripheral component interconnect (PCI) bus, NVMe-oF gives organizations more flexibility and bandwidth to circumvent the traffic bottleneck and move more information, more quickly.

You’re driving down the highway, cruising at the speed limit (perhaps a bit over the speed limit), and then all of a sudden… traffic. It turns out there is construction up ahead and 3 lanes need to merge down to 1, causing a bottleneck of cars. While every car is capable of traveling the speed limit, there is simply not enough space for everyone to pass through the single lane while maintaining the speed they want to travel. When this happens, people feel like they are wasting time. In a similar way, when information reaches a bottleneck in a network, organizations may feel frustrated, knowing that there could be higher performance without the bottleneck. To combat this, many organizations have adopted Non-Volatile Memory Express (NVMe) technology, and specifically NVMe over Fabrics (NVMe-oF), in order to open up more lanes for information travel. While typical NVMe is attached to the peripheral component interconnect (PCI) bus, NVMe-oF gives organizations more flexibility and bandwidth to circumvent the traffic bottleneck and move more information, more quickly.

Infrastructure, Cloud & DevOps

-

-

The Importance of DevOps

Rapidly responding to business objectives is critical to future-looking organizations. The adoption of DevOps is aimed at achieving business goals consistently and rapidly. DevOps is key to many organizations to increase agility and standardization of deployment. We have seen in our latest Technology Intentions Spending research survey that more than one-third of survey respondents said their organizations are extensive users of both DevOps and agile software development methodologies. (more…)

Rapidly responding to business objectives is critical to future-looking organizations. The adoption of DevOps is aimed at achieving business goals consistently and rapidly. DevOps is key to many organizations to increase agility and standardization of deployment. We have seen in our latest Technology Intentions Spending research survey that more than one-third of survey respondents said their organizations are extensive users of both DevOps and agile software development methodologies. (more…) -

Hyperconverged infrastructure (HCI), which combines compute, storage, and virtualization resources in a single system, continues to grow in popularity as delivery models evolve. Emerging, next-generation HCI solutions that support independently managed resources can be used in conjunction with traditional, clustered HCI to expand the IT ecosystem in a more holistic approach across the entire organization.

-

Digital business initiatives are placing unprecedented pressures on both IT organizations and the infrastructure they manage.

Find out how IT storage professionals are coping with the demands of constant acceleration with this Enterprise Strategy Group Infographic, 2021 Data Infrastructure Trends.

For more information or to discuss these findings with an analyst, please contact us.

-

In order to assess technology spending priorities over the next 12-18 months, ESG recently surveyed 706 senior IT decision makers representing midmarket (100 to 999 employees) and enterprise-class (1,000 employees or more) organizations in North America, Western Europe, and Asia-Pacific. All respondents were personally responsible for or familiar with their organization’s 2021 IT spending as well as their 2022 IT budget and spending plans at either an entire organization level or a business unit/division/branch level.

-

ESG conducted a comprehensive online survey of IT professionals from private- and public-sector organizations in North America (United States and Canada), Western Europe (UK, France, and Germany), and Asia Pacific (Australia, India, Japan, New Zealand, and Singapore) between September 9, 2021 and September 29, 2021. To qualify for this survey, respondents were required to be senior IT decision makers familiar and involved with their organization’s overall 2022 IT budget and spending plans.

This Complete Survey Results presentation focuses on 2022 IT budget expectations, technology initiatives and priorities, year-over-year spending change (overall and by different technologies), cloud adoption/usage trends, and the impact of ransomware on both IT and business operations.

-

The IT infrastructure landscape has transformed. The data center, once the central cog in the IT machine, is quickly becoming only a piece of a larger and more complex environment. Contemporary IT infrastructure is often distributed across multiple locations both on- and off-premises. This research study is intended to better understand the current state of IT infrastructure, including how the increases in scale and distribution of infrastructure environments are increasing IT complexity and otherwise impacting IT operations.

-

You know those people who seem to have more than 24 hours in a day? They simultaneously balance work, hobbies, family, friends, and health (somehow). These “super humans” do it all. And although those aspects of life are separate entities, they still affect one another and must be managed concurrently. A desire to continuously “do more” creates challenges in our lives – it adds complexity and requires us to find new ways to become more efficient. Similarly, IT teams are tasked with doing more with the limited resources and budget they are provided – all in a world in which IT environments are becoming more and more complex. Organizations strive to increase operational efficiency and speed while minimizing costs and downtime; but this is no easy feat.

You know those people who seem to have more than 24 hours in a day? They simultaneously balance work, hobbies, family, friends, and health (somehow). These “super humans” do it all. And although those aspects of life are separate entities, they still affect one another and must be managed concurrently. A desire to continuously “do more” creates challenges in our lives – it adds complexity and requires us to find new ways to become more efficient. Similarly, IT teams are tasked with doing more with the limited resources and budget they are provided – all in a world in which IT environments are becoming more and more complex. Organizations strive to increase operational efficiency and speed while minimizing costs and downtime; but this is no easy feat.According to Enterprise Strategy Group research, 3 in 4 respondents believe their IT environments to be more complex than they were 2 years ago.[1] With this heightened complexity comes an even greater need for solutions that can simplify, automate, and streamline IT operations. Like the “super humans” that can unify and balance all aspects of life so efficiently and smoothly, hyperconverged infrastructure (HCI) blends the various components of your IT environment in order to streamline operations. Uniting compute, networking, storage, and (oftentimes) the ability to virtualize and connect to cloud environments, HCI can be considered the “super infrastructure.” It seems to do it all… effortlessly.

99% of organizations believed that HCI technology has made their IT environments more agile, and 53% of organizations identified increased productivity of IT staff as a means of cost savings with HCI, according to a new ESG research study.[2] With this agility and productivity, organizations can operate more quickly and IT teams can put a greater focus on their core business needs. Implementing HCI can save space, money, and headaches, and organizations are increasingly adopting the technology.

HCI is designed to meet organizations’ specific and varied needs, so finding the right solution can require extensive research. But by testing each solution and communicating the differentiated value propositions, the ESG Validation Team helps buyers to identify and better understand solutions that meet their requirements.

Enterprise Strategy Group (ESG) is an IT analyst, research, validation, and strategy firm that gives the global IT community access to market intelligence and actionable insight. The Validation Team creates assets, such as Economic and Technical Validation Reports, videos, webinars, and more, that help to communicate the technological and economic value of IT products and solutions.

[1] Source: ESG Research Report, 2021 Technology Spending Intentions Survey, January 2021.

[2]Source: ESG Master Survey Results, Hyperconverged Infrastructure 2.0, October 2021.

-

ESG conducted a comprehensive online survey of IT professionals from private- and public-sector organizations in North America (United States and Canada) between September 2, 2021 and September 15, 2021. To qualify for this survey, respondents were required to be IT professionals responsible for their organization’s on-premises infrastructure, specifically usage of or plans for hyperconverged infrastructure.

This Master Survey Results presentation focuses on hyperconverged infrastructure technology solutions, including benefits and challenges, as well as how these platforms interact with cloud services and how they are leveraged at edge locations.

-

This year’s KubeCon + CloudNativeCon did not disappoint! As a hybrid event, there were many attendees in person as well as virtual, and the event coordinators did a great job at seamlessly transitioning between the attendees. At this year’s North America event, the coverage areas focused on application definition/development, orchestration/management, runtime, and provisioning. There was also a “special” category for offerings supporting cloud-native technology that did not fit into the other groupings. (more…)

-

The powerhouse VMware is doing it again—leading the way in the industry with innovation focused on the next generation of multi-cloud offerings. The question is: Will it be enough to differentiate VMware from the pack?

Let’s take a closer look. VMware entered the market as a virtualization leader and grew in strength throughout the early 2000s. As the market evolved, so did VMware. The company expanded into the next phase of the market as a leader in the private cloud space. The established footprint of the virtualization business provided a natural transition into the private cloud arena, but as the industry continues to evolve to multi-cloud, where does that leave VMware? VMware’s next chapter will be key to maintaining its growth as the established industry leader.

VMware’s Chapter 3: The Next Endeavor

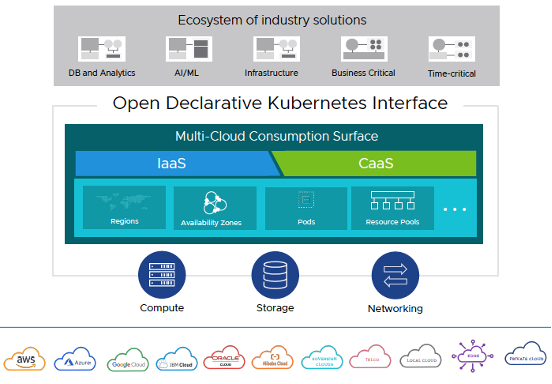

At VMworld 2021, VMware announced its focus on several new areas with the intent to simplify multi-cloud operations. To no one’s surprise, multi-cloud adoption is taking off. According to ESG’s 2021 Data Infrastructure Trends research survey, 48% of respondents indicated their organizations have a cloud-first approach. Management of heritage and cloud-native applications, as well as microservices, are a large part of success for IT organizations. Like most vendors, VMware is taking on multi-cloud and application management services as their next area of evolution.

Multi-cloud support can be viewed in several areas. Application platforms, cloud management security and networking, and digital workspaces are several key cross-cloud service areas that VMware is focused on for cloud support. With its recent announcement, it is clear that VMware is emphasizing its focus on cloud infrastructure, which demonstrates the company’s intention to amplify support of its services to build, run, and secure applications across any cloud.

VMware is announcing several new areas to support these initiatives, including:

- Project Arctic – Focuses on capacity on demand, deploying VMware cross-cloud services rapidly, and growing multi-cloud support without disruption.

- Project Cascade – Enables open multi-cloud consumption while leveraging Kubernetes, enabling developers, and allowing DevOps to consume infrastructure through virtual machines and containers. This empowers IT abstract resource pools across the cloud and avoids lock-in by leveraging open platforms.

VMware Project Cascade

- Project Capitola – Addresses the growing memory needs of applications. It provides cost-effective scale for memory tiers, improves memory resiliency, and simplifies memory infrastructure operations.

- Project Ensemble – Provides a unified view of vRealize cloud management, enabling users to provision and configuring how much provisioning is possible.

Data protection is a key part of the multi-cloud strategy. VMware announced hybrid cloud disaster recovery. This includes 30-minute recovery point objective (RPO), accelerated ransomware recovery, and integrated data protection for cloud virtual machines, in addition to continued support at the edge with enhancements and introductions to VMware edge, VMware SASE, and Cloud platform.

What’s New With VMware?

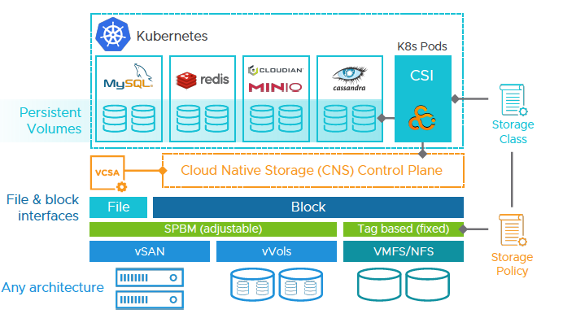

VMware announced several enhancements and improvements to vSAN and vSphere as part of this launch. vSAN 7 update 3 expands on its simple, reliable, and future-ready messaging by delivering enhancements that deliver a developer-ready infrastructure, simplify operations, and provide additional platform enhancements to continue this vision.

VMware Increased Availability for Cloud-native Applications

With vSphere 7 update 3, VMware adds increased delivery AI and developer-ready infrastructure, improved scalability, and simplification of operations. All with the goal of delivering towards the vision to manage, deploy, and deliver with ease.

Paul’s POV

VMware is an industry leader. There is no doubt that VMware’s past success will help accelerate its future vision, but VMware has its work cut out. The future direction VMware laid out is where the industry is going. In fact, 92% of respondents to ESG’s 2021 Data Infrastructure Trends survey leverage public cloud infrastructure services. However, VMware is not the only vendor looking to achieve this goal. In fact, they are one of many vendors in the market looking to solve, address, and “crack the multi-cloud code.” This is a very different market from the early 2000s when VMware seized the virtualization opportunity. VMware will need to increase and align partnerships in this space to fulfill its vision. Their partnerships will not only accelerate their go-to-market strategy and drive adoption but will also create less competition for them.

-

ESG conducted a comprehensive online survey of IT and data storage professionals from private- and public-sector organizations in North America (United States and Canada) between June 22, 2021 and June 30, 2021. To qualify for this survey, respondents were required to be professionals responsible for evaluating, purchasing, and managing data storage technology for their organization.

This Master Survey Results presentation focuses on investigating storage trends for both on- and off-premises technology environments, including challenges, opportunities, and evolving strategies for both.

Rapidly responding to business objectives is critical to future-looking organizations. The adoption of DevOps is aimed at achieving business goals consistently and rapidly. DevOps is key to many organizations to increase agility and standardization of deployment. We have seen in our latest

Rapidly responding to business objectives is critical to future-looking organizations. The adoption of DevOps is aimed at achieving business goals consistently and rapidly. DevOps is key to many organizations to increase agility and standardization of deployment. We have seen in our latest  You know those people who seem to have more than 24 hours in a day? They simultaneously balance work, hobbies, family, friends, and health (somehow). These “super humans” do it all. And although those aspects of life are separate entities, they still affect one another and must be managed concurrently. A desire to continuously “do more” creates challenges in our lives – it adds complexity and requires us to find new ways to become more efficient. Similarly, IT teams are tasked with doing more with the limited resources and budget they are provided – all in a world in which IT environments are becoming more and more complex. Organizations strive to increase operational efficiency and speed while minimizing costs and downtime; but this is no easy feat.

You know those people who seem to have more than 24 hours in a day? They simultaneously balance work, hobbies, family, friends, and health (somehow). These “super humans” do it all. And although those aspects of life are separate entities, they still affect one another and must be managed concurrently. A desire to continuously “do more” creates challenges in our lives – it adds complexity and requires us to find new ways to become more efficient. Similarly, IT teams are tasked with doing more with the limited resources and budget they are provided – all in a world in which IT environments are becoming more and more complex. Organizations strive to increase operational efficiency and speed while minimizing costs and downtime; but this is no easy feat.