The digital economy is fueled by the seemingly unstoppable creation and insatiable consumption of data. To optimize costs, streamline management, and meet governance and regulatory requirements, organizations have traditionally archived non-production data on lower-cost storage tiers for years with little intention or need to reuse them. Things are evolving: The emergence and adoption of advanced digital transformation initiatives in recent years have placed data at the heart of the business and changed the nature of how archives can and should be leveraged. Rather than passive, “locked away” data sets, the past few years have seen the emergence of new requirements and solutions to make archives more “active” and leverageable to unlock business value.

Insight

-

-

ESG conducted a comprehensive online survey of IT professionals from private- and public-sector organizations in North America (United States and Canada) between September 2, 2021 and September 15, 2021. To qualify for this survey, respondents were required to be IT professionals responsible for their organization’s on-premises infrastructure, specifically usage of or plans for hyperconverged infrastructure.

This Master Survey Results presentation focuses on hyperconverged infrastructure technology solutions, including benefits and challenges, as well as how these platforms interact with cloud services and how they are leveraged at edge locations.

-

This year’s KubeCon + CloudNativeCon did not disappoint! As a hybrid event, there were many attendees in person as well as virtual, and the event coordinators did a great job at seamlessly transitioning between the attendees. At this year’s North America event, the coverage areas focused on application definition/development, orchestration/management, runtime, and provisioning. There was also a “special” category for offerings supporting cloud-native technology that did not fit into the other groupings. (more…)

-

ESG conducted a comprehensive online survey of business and technology professionals from private- and public-sector organizations in North America (United States and Canada) between June 17, 2021 and June 28, 2021. To qualify for this survey, respondents were required to be business and technology professionals responsible for their organization’s programs for data privacy, compliance, and data security.

This Master Survey Results presentation focuses on the technologies and processes in place to support compliance and data privacy programs, as well as what organizations are doing to secure their data regardless of where it resides.

-

ESG conducted a comprehensive online survey of IT professionals from private- and public-sector organizations in North America (United States and Canada) between May 18, 2021 and May 25, 2021. To qualify for this survey, respondents were required to be IT professionals responsible for data protection technology decisions for their organizations, specifically data archiving and long-term retention strategies. Additionally, organizations were required to have an active archive strategy.

This Master Survey Results presentation focuses on the technologies and processes in place to support data archiving and long-term retention requirements, with specific attention to the impact of active archive strategies.

-

The powerhouse VMware is doing it again—leading the way in the industry with innovation focused on the next generation of multi-cloud offerings. The question is: Will it be enough to differentiate VMware from the pack?

Let’s take a closer look. VMware entered the market as a virtualization leader and grew in strength throughout the early 2000s. As the market evolved, so did VMware. The company expanded into the next phase of the market as a leader in the private cloud space. The established footprint of the virtualization business provided a natural transition into the private cloud arena, but as the industry continues to evolve to multi-cloud, where does that leave VMware? VMware’s next chapter will be key to maintaining its growth as the established industry leader.

VMware’s Chapter 3: The Next Endeavor

At VMworld 2021, VMware announced its focus on several new areas with the intent to simplify multi-cloud operations. To no one’s surprise, multi-cloud adoption is taking off. According to ESG’s 2021 Data Infrastructure Trends research survey, 48% of respondents indicated their organizations have a cloud-first approach. Management of heritage and cloud-native applications, as well as microservices, are a large part of success for IT organizations. Like most vendors, VMware is taking on multi-cloud and application management services as their next area of evolution.

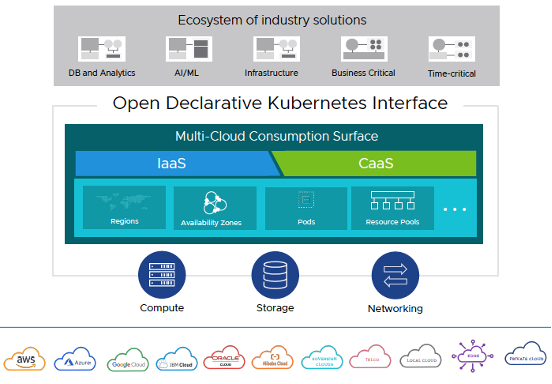

Multi-cloud support can be viewed in several areas. Application platforms, cloud management security and networking, and digital workspaces are several key cross-cloud service areas that VMware is focused on for cloud support. With its recent announcement, it is clear that VMware is emphasizing its focus on cloud infrastructure, which demonstrates the company’s intention to amplify support of its services to build, run, and secure applications across any cloud.

VMware is announcing several new areas to support these initiatives, including:

- Project Arctic – Focuses on capacity on demand, deploying VMware cross-cloud services rapidly, and growing multi-cloud support without disruption.

- Project Cascade – Enables open multi-cloud consumption while leveraging Kubernetes, enabling developers, and allowing DevOps to consume infrastructure through virtual machines and containers. This empowers IT abstract resource pools across the cloud and avoids lock-in by leveraging open platforms.

VMware Project Cascade

- Project Capitola – Addresses the growing memory needs of applications. It provides cost-effective scale for memory tiers, improves memory resiliency, and simplifies memory infrastructure operations.

- Project Ensemble – Provides a unified view of vRealize cloud management, enabling users to provision and configuring how much provisioning is possible.

Data protection is a key part of the multi-cloud strategy. VMware announced hybrid cloud disaster recovery. This includes 30-minute recovery point objective (RPO), accelerated ransomware recovery, and integrated data protection for cloud virtual machines, in addition to continued support at the edge with enhancements and introductions to VMware edge, VMware SASE, and Cloud platform.

What’s New With VMware?

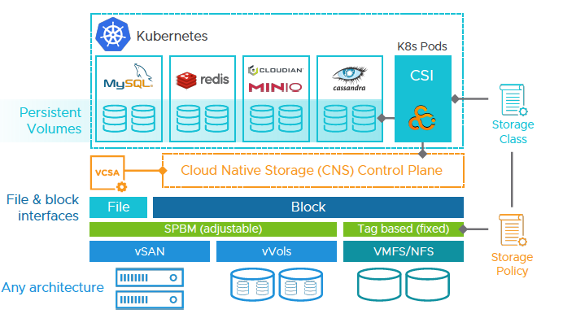

VMware announced several enhancements and improvements to vSAN and vSphere as part of this launch. vSAN 7 update 3 expands on its simple, reliable, and future-ready messaging by delivering enhancements that deliver a developer-ready infrastructure, simplify operations, and provide additional platform enhancements to continue this vision.

VMware Increased Availability for Cloud-native Applications

With vSphere 7 update 3, VMware adds increased delivery AI and developer-ready infrastructure, improved scalability, and simplification of operations. All with the goal of delivering towards the vision to manage, deploy, and deliver with ease.

Paul’s POV

VMware is an industry leader. There is no doubt that VMware’s past success will help accelerate its future vision, but VMware has its work cut out. The future direction VMware laid out is where the industry is going. In fact, 92% of respondents to ESG’s 2021 Data Infrastructure Trends survey leverage public cloud infrastructure services. However, VMware is not the only vendor looking to achieve this goal. In fact, they are one of many vendors in the market looking to solve, address, and “crack the multi-cloud code.” This is a very different market from the early 2000s when VMware seized the virtualization opportunity. VMware will need to increase and align partnerships in this space to fulfill its vision. Their partnerships will not only accelerate their go-to-market strategy and drive adoption but will also create less competition for them.

-

Businesses are operating with a distributed workforce while executives, managers, and team leaders lack the direct insight and daily contact with employees. As a result, organizations are looking for ways to leverage data-driven insights and intelligence to generate technology telemetry, establish employee engagement, and create personalized recommendations.

Businesses are operating with a distributed workforce while executives, managers, and team leaders lack the direct insight and daily contact with employees. As a result, organizations are looking for ways to leverage data-driven insights and intelligence to generate technology telemetry, establish employee engagement, and create personalized recommendations. -

Citrix recently announced a new App Delivery and Security Service to enable organizations to rapidly and securely deliver applications. This service is well timed and will help organizations that are accelerating digital transformation efforts and expanding their modern application environments in highly distributed environments.

Citrix recently announced a new App Delivery and Security Service to enable organizations to rapidly and securely deliver applications. This service is well timed and will help organizations that are accelerating digital transformation efforts and expanding their modern application environments in highly distributed environments. -

Data security is changing dramatically as organizations are rapidly expanding the use of SaaS-based applications, public cloud services (IaaS/PaaS), data analytics platforms, and artificial intelligence (AI)/machine learning (ML) workloads. The threat landscape saw a reemergence of ransomware attacks (and payouts) against every industry, and data breach disclosures are the highest recorded. Meanwhile, new consumer privacy protection acts are imposing stronger financial penalties, and the cybersecurity insurance/reinsurance marketplace is rethinking policies, premiums, and coverage limits.

-

Much of the data economy about individuals being amassed in our digital world is subject to consumer data privacy regulations and controls; yet on a near-daily basis, sensitive data is shared, lost, leaked, and breached in organizations. ESG recently completed research to uncover how organizations view the state of data privacy and compliance and how navigating these regulations affects their programs, teams, spending, and the maturity of privacy-enhancing and data security technologies.

-

It can be easy to think, “That sounds horrible! But it probably won’t happen to me.” From getting into a fender bender, to spilling ketchup on your new white shirt, to… ransomware attacks. Believing ransomware attacks will only happen to “somebody else” can put your organization at a huge risk. On a much larger scale than buying car insurance or bringing an extra shirt, taking precautions against ransomware attacks can save your organization millions of dollars, as well as employee confidence, customer trust, and more.

It can be easy to think, “That sounds horrible! But it probably won’t happen to me.” From getting into a fender bender, to spilling ketchup on your new white shirt, to… ransomware attacks. Believing ransomware attacks will only happen to “somebody else” can put your organization at a huge risk. On a much larger scale than buying car insurance or bringing an extra shirt, taking precautions against ransomware attacks can save your organization millions of dollars, as well as employee confidence, customer trust, and more.Ransomware is a type of malware, spread by methods such as phishing. It encrypts the files of a user or organization and blocks access to these files until a ransom is paid. Statistically, it is more likely than not that your organization will be met with a ransomware attack in the next 12 months, as attacks are becoming more and more common. According to ESG research, 70% of respondents experienced, “At least one attempted ransomware attack within the last year.”* Cyber criminals are getting more creative in their attacks, so it is crucial to have an equally thoughtful protection plan.

It pays to do the proper research and narrow in on the data protection and storage solutions that can help you plan for a quick and reliable recovery after a ransomware attack. These solutions include features like tamper-proof backup images (a.k.a. immutability) and network-isolated disaster recovery (e.g., air gap). Organizations should also take into consideration the solution’s speed, ease of management, reliability, etc.

To make it easier to narrow in on the right solution for your organization, Enterprise Strategy Group has evaluated and documented these features for many solutions, and “Why This Matters” to the business, in a variety of recently published reports. If you’d like to learn more about how to reliably recover from a ransomware attack, and about “Why This Matters” for your business – check out these recently published ESG Validation reports: Dell EMC PowerProtect Cyber Recovery with CyberSense and IBM Cyber Resilience Solutions. These reports are designed to give organizations an independent perspective of a product or solution and help you to better understand the value propositions.

Enterprise Strategy Group (ESG) is an IT analyst, research, validation, and strategy firm that gives the global IT community access to market intelligence and actionable insight. The Validation Team creates assets, such as Economic and Technical Validation Reports, videos, webinars and more, that help to communicate the technological and economic value of IT products and solutions.

*Source: ESG Research Report, Tape’s Place in an Increasingly Cloud-based IT Landscape, January 2021.

-

ESG conducted a comprehensive online survey of IT and data storage professionals from private- and public-sector organizations in North America (United States and Canada) between June 22, 2021 and June 30, 2021. To qualify for this survey, respondents were required to be professionals responsible for evaluating, purchasing, and managing data storage technology for their organization.

This Master Survey Results presentation focuses on investigating storage trends for both on- and off-premises technology environments, including challenges, opportunities, and evolving strategies for both.

Businesses are operating with a

Businesses are operating with a  Citrix recently announced a new App Delivery and Security Service to enable organizations to rapidly and securely deliver applications. This service is well timed and will help organizations that are accelerating digital transformation efforts and expanding their modern application environments in highly distributed environments.

Citrix recently announced a new App Delivery and Security Service to enable organizations to rapidly and securely deliver applications. This service is well timed and will help organizations that are accelerating digital transformation efforts and expanding their modern application environments in highly distributed environments. It can be easy to think, “That sounds horrible! But it probably won’t happen to me.” From getting into a fender bender, to spilling ketchup on your new white shirt, to… ransomware attacks. Believing ransomware attacks will only happen to “somebody else” can put your organization at a huge risk. On a much larger scale than buying car insurance or bringing an extra shirt, taking precautions against ransomware attacks can save your organization millions of dollars, as well as employee confidence, customer trust, and more.

It can be easy to think, “That sounds horrible! But it probably won’t happen to me.” From getting into a fender bender, to spilling ketchup on your new white shirt, to… ransomware attacks. Believing ransomware attacks will only happen to “somebody else” can put your organization at a huge risk. On a much larger scale than buying car insurance or bringing an extra shirt, taking precautions against ransomware attacks can save your organization millions of dollars, as well as employee confidence, customer trust, and more.