agsandrew - Fotolia

Enterprise flash adoption poised for new uses, experts say

Enterprise flash memory technologies are evolving with NVMe fabrics, QLC drives and storage class memory. The new options will enable data centers to expand flash use cases.

Flash storage appears poised for greater adoption in enterprise data centers during 2020.

A developing NVMe flash ecosystem and new quad-level cell (QLC) NAND SSDs will extend enterprise flash storage to workloads previously relegated to disk. Edge computing will to spur interest in storage class memory and customers will start experimenting with persistent storage for AI and containers.

Those conclusions surfaced from interviews with flash analysts and storage vendors. Here is a summary of what enterprises should watch for in 2020.

Flash isn't only for big companies

Enterprise flash arrays first appeared around 2008, incorporating solid-state media to replace electromechanical hard disk drives. Vendors first aimed all-flash arrays at high-end enterprises that could justify the premium cost to support performance-heavy applications. Hybrid arrays that combine HDDs and SSDs followed for midrange and smaller organizations.

Flash was at such a premium in early days of enterprise use that it was limited mostly to large organizations and the most important applications. But prices consistently dropped over the past decade. Steve McDowell, a senior analyst for storage and data center technologies at Moor Insights & Strategy, said falling flash prices have made the technology a realistic option for more organizations.

"Nearline storage is pretty much all on flash right now, at least as far replacement cycles happen. Companies may not be ripping out their disk systems now, but they realize flash gives you better efficiency and density per rack unit," McDowell said.

Prices have dropped enough that there is little difference between enterprise flash and high-performing hard disk drives, said Eric Herzog, the vice president of worldwide storage channels at IBM Storage.

"In many cases, it doesn't pay to use disk arrays or even hybrid anymore. The price of all-flash arrays now is basically on par with high-performance disk, plus you get better total cost of ownership," Herzog said.

Tiering is in vogue again

Nonvolatile memory express (NVMe) flash is expected to further make inroads in the data center. Intel Optane SSDs combine dynamic RAM and flash memory. The Optane drives are based on 3D XPoint memory technology that was initially developed by Intel and Micron Technologies, a partnership that ended in 2018. Micron in October 2019 launched its own 3D XPoint products.

Major storage vendors are adding NVMe flash to their arrays, usually in conjunction with SAS or SATA SSD connectivity. NVMe SSDs use PCI Express lanes to enable faster communication between applications and storage.

QLC is a lower-cost alternative to TLC NAND SSDs, and vendors see it as suitable for read-intensive and light write workloads. While QLC has 25% greater capacity than TLC, it has poorer performance and write endurance. Storage vendors are retooling their data management software to support QLC, NVMe and persistent memory in the same system, said Eric Burgener, a research vice president of storage at analyst firm IDC.

"We are starting to see the return of tiering for high-performance applications," Burgener said.

Although fabrication plants are still ramping production of QLC NAND, vendors are designing systems that place a tier of superfast persistent storage on the controller, backed by a standard tier of NVMe SSDs. Examples include Dell EMC PowerMax, Hewlett Packard Enterprise Primera, the Hitachi Vantara Virtual Storage Platform VSP5000, NetApp MaxData and Pure Storage FlashArray//C.

Flash for backup, object storage

AI at the edge is also expanding flash use cases, said Sudhir Srinivasan, CTO at Dell EMC storage.

Srinivasan said more customers have moved to flash due to its operational simplicity, even for traditionally disk-based workloads.

"Most backup is still on disk, but we do have customers placing certain primary data sets on secondary devices for analytics. And that data needs a higher level of performance," Srinivasan said.

Backup and rapid recovery is an unexpected use for Pure Storage FlashBlade all-flash NAS. The product's massively parallel bandwidth helped Domino's Pizza reduce dependence on disk-based backup, said Dan Djuric, a Domino's vice president of global infrastructure and enterprise information systems.

"Anytime we have to share file systems, we launch FlashBlade. We also use Pure FlashBlade as the framework for all our data capture, so it's more than just backup and recovery," Djuric said.

Flash is also penetrating converged systems, said Octavian Tanase, a senior vice president of the NetApp OnTap software and systems. NetApp FlexPod is a converged infrastructure based on NetApp FAS storage and Cisco compute and networking. Roughly 60% of FlexPod sales were for all-flash systems, Tanase said.

McDowell said all-flash is also coming to object arrays to help enterprises analyze unstructured data created in edge environments.

"Some data never leaves the edge. Some gets consumed in the cloud, and object is the language it speaks. It's an object-centric world and all-flash is a natural fit," McDowell said.

Don't write off disk yet

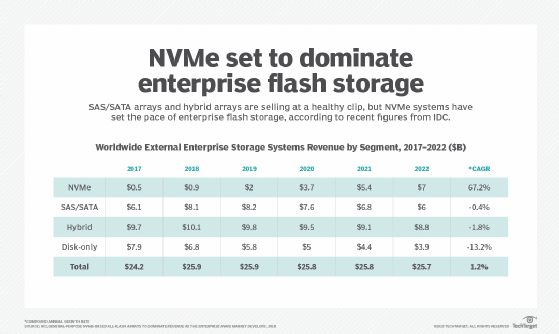

IDC's Burgener said demand for NVMe all-flash will grow 67% during the next five years, with SCSI-based flash arrays growth approaching 11%. IDC expects the market for hybrid arrays to contract by 2%.

Still, enterprise flash is not in every data center. Nearly one-third of companies have no plans to install flash, according to a recent survey by 451 Research Group. The survey of nearly 500 data center administrators found that 48% of enterprises have flash, while 6% are running proofs of concept and 13% plan all-flash purchases within two years.

"There are a surprisingly high percentage of enterprises that haven't even looked at flash yet, so there is a ways to go" before the arrival of an all-flash data center, said Tim Stammers, a senior analyst for storage at 451 Research.

Stammers said high-capacity disks are hitting the market as larger enterprises deploy converged systems and archive data to the hybrid cloud. "Disk isn't dead," he said. "With so much data going to the cloud, disk has a long and healthy future" as archival storage.