Analyzing the chaos in the desktop virtualization market

From major acquisitions to brand-new product launches and rebrands, Citrix, Microsoft and VMware have been shaking up the desktop virtualization space.

When I rejoined TechTarget as an analyst for Enterprise Strategy Group (ESG), one of the perks was that I'd be able to write about industry news from the same broad perspective that I once had before I worked for vendors.

Given everything that's been happening around desktop virtualization over the past few years -- especially the past few months -- this post was the obvious first choice, and it does a good job of showing how end-user computing (EUC) is always evolving.

Citrix's slow march toward acquisition is over

At the end of September 2022, Citrix's acquisition by Vista Equity Partners and Evergreen Coast Capital completed, bringing to a close a nearly decade-long discussion about the future of Citrix. Of course, many questions remain to be answered -- like, "What is Tibco, anyway, and why does it align with Citrix?" -- but after years of what sometimes appeared to be "twisting in the wind," Citrix finally has an opportunity to settle down and get back to doing what it does best without distractions like Wrike, which was also sold off as part of the deal.

Truth be told, Citrix's "focus on core" approach dates to 2015 when Elliott Management first got involved with Citrix by taking a significant stake in the company and placing some of its people on Citrix's board. This resulted in a few CEO changes, as well as Citrix divesting itself of -- or outright eliminating -- some of its more ancillary tech, such as GoTo Meeting and Octoblu. (In the case of GoTo, this also had a large effect on the stock price, which directly benefitted investors like Elliott.) Since then, it appeared that Citrix had been trying to position itself for newer, hotter markets like security and analytics to attract a buyer.

Ultimately, Elliott decided to reinvest in Citrix, this time with an even larger stake, and it's this reinvestment that led to the sale of Citrix to private equity firms Vista Equity Partners and Evergreen Coast Capital. Announced in April and completed Sept. 30, 2022, the deal created a new entity called the Cloud Software Group Holdings, under which both Citrix and Tibco will reside and operate as separate business under the leadership of Tom Krause, a former Broadcom executive.

In addition to Citrix and Tibco, Cloud Software Group consists of NetScaler, Ibi (also by Tibco), Jaspersoft, ShareFile and XenServer, all under the Cloud.com domain Citrix has owned for many years. What's interesting about this is that NetScaler, ShareFile and XenServer have been separated rather than kept under the Citrix umbrella. Why this is remains to be seen, but given that Cloud Software Group is a holding company, it's not out of the question to think that these may be pared off at some point.

The future for Citrix, according to some, is bleak. In the past month, Citrix went through a round of layoffs that most people saw coming; in fact, the sentiment of many seems to be relief. Moving forward, Citrix is expected shift most, if not all, of its focus to its top customers. I'm hopeful that we'll see some back-to-basics efforts that will refocus Citrix on what it does well and not let itself chase the shiny objects that distracts it from taking care of its customers' or its partners' needs. What will happen, of course, remains to be seen.

The immediate future seems to have Citrix positioned very closely to Microsoft, stepping back from a complete EUC product portfolio by discontinuing Citrix Endpoint Management and focusing on its desktop as a service (DaaS). It also recently announced that it has created HDX Plus for Windows 365, effectively using Windows 365 as the back end for workloads and employing Citrix Cloud for the front-end access and protocol.

Broadcom to Vista: Hold my beer

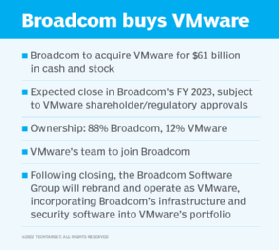

Not to be outdone, Broadcom announced in May its intent to acquire VMware for a whopping $61 billion in a deal that has implications far beyond EUC. While I can't begin to speculate on the non-EUC aspects of the deal -- there's just so much to unpack! -- I find it fascinating that both Citrix and VMware are dealing with similar acquisitions at the same time.

In the case of VMware, it's not an acquisition by a private equity firm, though in many ways it feels the same. Broadcom has a history of acquiring companies with good tech and riding that tech to large profits while cutting costs elsewhere. Many expect to see Broadcom run a similar playbook to the one they used for the CA Technologies and Symantec deals; though they say VMware is different, the company has a lot to gain by focusing on the tech that pays the bills, selling off or outright snuffing out tech that doesn't, and focusing all remaining resources on whatever Broadcom deems its core set of products and services to be.

In EUC circles, the biggest question appears to be around whether Broadcom values the EUC business unit at VMware. If so, there are number of products and services that could be of interest, and lots of opportunity to hone the product line around a single overall vision. How many versions of Horizon are there, anyway? If Broadcom wants to take that on, it could fit nicely into Broadcom's software group, which will be renamed to VMware once the acquisition completes.

It's also possible that Broadcom only sees the non-EUC parts of VMware as integral to its plans and sells off EUC -- it has too much value to just kill off -- but it's way too early in the process to see that as anything more than just one of many options.

It's thought that the Broadcom deal will close in 2023, but the deal might take some additional time due to an antitrust investigation conducted by the European Union. If the deal doesn't go through for some reason, things might get interesting.

Meanwhile, in Redmond

All of this comes at an advantageous time for Microsoft. In addition to corporate uncertainty that undoubtedly causes VMware and Citrix to take their eyes off the ball from time to time, the COVID-19 pandemic - which occurred just months after Microsoft released Azure Virtual Desktop (AVD) -- increased demand for remote work and has elevated desktop and app virtualization to the top of many IT departments' priorities.

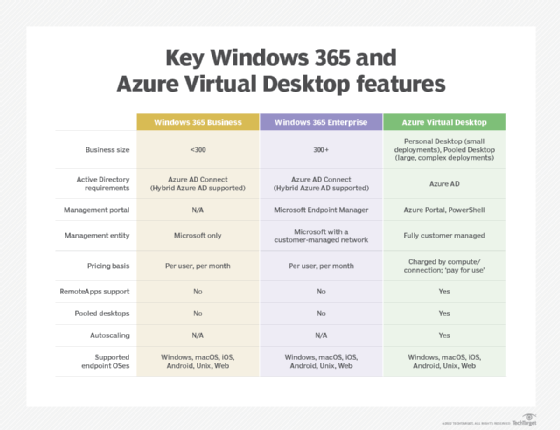

It is coincidental that this happened alongside the pandemic, but none of this is an accident. After years of leaving enterprise desktop virtualization up to partners like Citrix and VMware, Microsoft realized in 2018 that it could convert Windows desktops into Azure revenue, and it has remained laser-focused on it ever since. Azure Virtual Desktop -- a cloud-native service with exclusive features only accessible to customers with a Microsoft Enterprise Agreement -- was the first step, released in late 2019. In 2021 Microsoft launched Windows 365, aka Cloud PC, which applied the investment it made in AVD to build a fully managed DaaS platform that offered desktops managed by Microsoft Endpoint Manager at a fixed price.

VMware and Citrix partnered with Microsoft to deliver the features of AVD as part of their respective Azure-based cloud offerings. Nerdio also drew closer to Microsoft, building a system that made AVD management easier by reducing the barrier to entry and lowering costs. In all of these scenarios, though, Microsoft is at the center.

Where is this heading?

It would appear that Microsoft has claimed, for perhaps the first time, the driver's seat in desktop virtualization. The vendor is certainly the most stable company in the space right now, and it doesn't look like it's going to relinquish the position. If you're a Microsoft Azure customer, that's not necessarily a bad thing, since you can lean on your investment in Microsoft and call on VMware and Citrix for additional capabilities that Microsoft doesn't support yet or will likely not support for a while, like comprehensive app management -- at least in the case of VMware.

But if you're not invested in Azure, life gets harder. Gone is the ability to run locally installed Office 365 apps from cloud desktops, though customers must buy perpetual licenses or leverage Office 365 web apps only. Gone is the built-in Virtual Desktop Access licensing as part of your Microsoft Enterprise Agreement. Gone is Windows 11 multisession. Microsoft has made it more expensive, and difficult, to use other clouds. You might say that it's fully aware of its position at the top of the heap.

That said, there are lots of options for both the Azure and non-Azure crowd, and we'll get into them in the coming weeks and months. For example, AWS Workspaces Core is a new offering that is worth a close look; Frame is positioned well to help in a variety of situations; and companies such as Parallels, Workspot and Cameyo are also finding new footing. Plus, plenty of changes are sure to come as the dust settles from all the disruption in the industry.

Buckle up! Desktop virtualization is as interesting as ever.

ESG is a division of TechTarget.