Getty Images/iStockphoto

HP, Dell report cooling PC sales as business demand wavers

Businesses have delayed and reduced their desktop and laptop orders from HP and Dell, executives reported. The PC market has weakened after a two-year winning streak.

Dell and HP have reported softening enterprise demand for computers as the PC market's pandemic-era boom ends.

The companies recently warned investors that while commercial PC sales grew last quarter, business appetite for computers slackened. Executives from both firms cited economic uncertainty as a driving force for flattening enterprise demand. Inflation and high energy costs have led to fears of a downturn.

"We saw a meaningful shift in corporate sentiment over the course of the quarter," with companies delaying and reducing the size of orders, Dell Co-Chief Operating Officer Chuck Whitten told investors on Aug. 25.

HP also saw delays in orders, HP CEO Enrique Lores said in an earnings call on Tuesday, according to a Seeking Alpha transcript.

The city of Happy Valley, Oregon, plans to slow its PC buying, information systems manager Will Wilson said. During the pandemic, the city sped up its typical four- to five-year computer replacement cycle to handle remote work. As a result, it now has many laptops purchased within the last two years.

"This restarted the clock, if you will, for those systems going forward," he said, noting that Happy Valley will return to its usual replacement schedule.

Another municipality, the city of Corona, Calif., intends to spend less on computers because it has adopted cloud-based virtual desktop technology. The shift of the processing burden to the cloud has reduced the need to give employees high-performing machines, meaning the city can use cheap devices and replace them less often, CIO Chris McMasters said.

"[We've run] engineering [computer-aided design] systems on tablets, for example, which generally would require some serious hardware," he said.

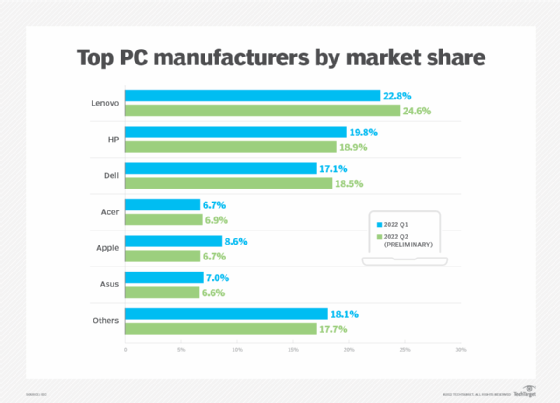

The PC market recently saw its two-year winning streak end, with many firms fully stocked with new computers and fears of a recession driving cost-cutting. Worldwide desktop, laptop and workstation shipments have fallen for the last two quarters, research firm IDC reported. Plummeting consumer demand drove much of last quarter's 15.3% drop, but analysts saw wavering enterprise purchasing as well.

While commercial buying has cooled, it will likely be more resilient than the consumer market, IDC analyst Jitesh Ubrani said.

"We believe that large enterprises are in a better position to weather the economic storm" than consumers, he said. "As a result, they are more likely to delay purchases rather than let demand perish completely."

Despite the downturn, the PC market's floor is higher than in the pre-COVID years, Ubrani said. Hybrid work, hardware replacement cycles and the end of Windows 10 support will drive the need for new computers in future years.

The slowdown in buying does not mean computers have lost the importance they gained during the pandemic, Lores said.

"PCs are way more relevant now than they were three years ago," he said.

Mike Gleason is a reporter covering unified communications and collaboration tools. He previously covered communities in the MetroWest region of Massachusetts for the Milford Daily News, Walpole Times, Sharon Advocate and Medfield Press. He has also worked for newspapers in central Massachusetts and southwestern Vermont and served as a local editor for Patch. He can be found on Twitter at @MGleason_TT.