Getty Images

Russia-Ukraine war has tech buyers reassessing spending

The Russia-Ukraine war, which affects everything from inflation to chip availability, has left half of enterprise tech leaders reassessing IT and communication spending, IDC said.

IDC predicts global information and communication technology spending will slow in response to inflation and supply chain issues resulting from the Russian invasion of Ukraine.

The analyst firm released new research this week predicting that the longer the war goes on, the more pronounced the impact on global ICT spending in 2022. Infrastructure hardware and device purchases are projected to feel the effects first.

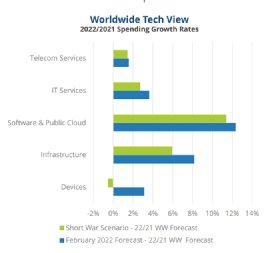

IDC has modeled three potential scenarios: a diplomatic solution within the next three months and stabilizing inflation, a prolonged war lasting over a year with inflation in the double digits, or -- most likely -- a short conflict resolving within the next 3-12 months with more limited inflation.

Previous IDC predictions expected global ICT spending to slow from over 7% growth in 2021 to just under 5% in 2022, thanks to a pandemic-related expenditure drop. A short war would further reduce growth to roughly 3.5% globally, with $240 billion in global ICT spending wiped out by the war in 2022-2025.

A rapid diplomatic solution would still lead to a slowdown in global ICT spending growth, down to just over 4%, while a prolonged war results in barely 2% growth.

Europe will feel these impacts more keenly. A rapid diplomatic solution would still reduce 2022 ICT spending growth from 4.5% to just under 3%, while a short or long war would reduce it to 2% growth or less than 1% growth, respectively. According to IDC, a brief conflict -- the most likely scenario -- would result in $143 billion in ICT spending in Europe wiped out over the next three years.

This slowed growth will hit infrastructure hardware and device spending most quickly because Capex costs are easier to cut when budgets shrink than Opex costs. However, if the war continues, spending on services could slow in the second half of 2022.

The tech sector is watching the situation with trepidation. More than half the roughly 60 CIOs responding to IDC's Quick Pulse survey reported rethinking spending, with most taking a "wait-and-see" approach.

IDC expects the global chip shortage to worsen supply chain issues because of the amount of precious metals mined in Ukraine and Russia for semiconductor manufacturing. More than 90% of U.S. semiconductor-grade neon comes from Ukraine, and about 35% of palladium from Russia. Russia also produces much of the C4F6 in advanced lithography processes for chip production.

Decreased availability of critical chip components and the time and cost of rerouting cargo around the conflict could cause further disruption to global supply chains, IDC said.

Russia is a critical oil producer, supplying more than a quarter of European imported oil. The war has caused oil prices to spike and raised expectations for higher inflation in Europe and the United States. In response, the U.S. Federal Reserve raised interest rates by 0.25 percent this week.

IDC expects increased oil costs to push countries toward renewable energy faster, a plus in the battle against climate change. However, overall inflation will drive higher prices for technology across the board, IDC analyst Andrea Siviero said.

It won't be clear for some time the actual effect the conflict will have on the ICT space. In the meantime, IDC recommends enterprises develop several contingency plans for different future scenarios to avoid being caught unprepared. The firm also recommended that enterprises prioritize people in their responses.

Siviero advised companies to note that organizations responding to the coronavirus pandemic with compassion and a focus on people tended to realize the best outcomes.

"Given the fluid nature of the conflict, IDC recommends that companies identify weak links in their value chain ecosystem, develop agile supply chain strategies, and create action plans that enable them to anticipate and react to a range of disruptive market movements," said Philip Carter, group vice president of worldwide thought leadership research at IDC, in a statement.

Madelaine Millar is a news writer covering network technology at TechTarget. She has previously written about science and technology for MIT's Lincoln Laboratory and the Khoury College of Computer Science, as well as covering community news for Boston Globe Media.