Industrial robotics market showdown banks on sophistication

Innovation in the industrial robotics market has countries across the globe racing to build robotics with discerning eyes, more programmable brains and, soon, more nimble fingers.

The industrial robotics market saw a sharp uptick in 2017 -- a 31% increase in worldwide sales over the previous year, according to the International Federation of Robotics. And according to IDC's July 2018 "Worldwide Semiannual Robotics and Drones Spending Guide," global spending on robotics technologies will reach $86.6 billion in 2018, with more than 57% of that growth in industrial applications.

China holds the lead, with a 24% compound annual growth rate in robotics sales, most of it to domestic customers. China is followed by Japan, Korea and then the U.S., said Jing Bing Zhang, IDC's director of research in worldwide robotics in Singapore. China is installing new robots at the fastest pace, however, adding 87,000 in 2016 and 138,000 in 2017.

It's no surprise to find Asian countries leading growth among adopters of industrial robots, as so much manufacturing is done there, and repetitive, assembly-line tasks are the meat and potatoes of today's industrial robots.

The U.S. isn't sitting idly by, however. In fact, the country is seeing a bit of a resurgence, and its annual manufacturing revenue outputs are inching closer to China's. As such, both countries are turning to automation and sophisticated industrial robotics applications and innovation to make their marks on the industry.

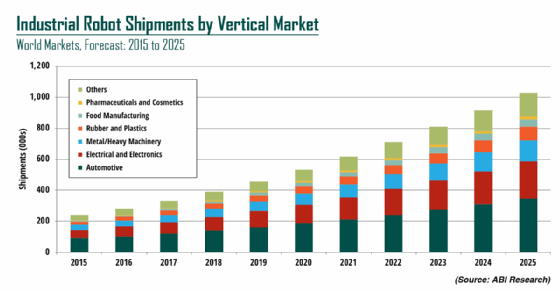

Seventy percent of today's industrial robots are classic articulated robotic arms used in traditional industrial vertical markets, the biggest being automotive, said Rian Whitton, London-based research analyst at ABI Research.

While 100,000 classic robotic arm units shipped in 2017, the greatest growth area today is in electronics, which is big in Asia, he added. Worldwide shipments of robots for electrical manufacturing rose 41% last year to about 91,000 units, according to the International Federation of Robotics' report.

In contrast to increasing robot use in Asia, the sale of robots in automotive applications -- a U.S. mainstay -- grew only 6%. This is partially because car manufacturers made major investments in robotic assembly in the early 2000s.

Made in China 2025

China's ascent in high-tech manufacturing and the industrial robotics market mirrors historic trends in manufacturing overall. The U.S. and China have switched positions in terms of overall manufacturing dominance, Whitton said. While the U.S. share of global manufactured exports fell from 18% in 1999 to 9% in 2012, China's share rose from about 5% to 17%. Though low-cost apparel accounts for much of that total, so does high tech. The U.S. fell from 25% of that advanced manufacturing market in 1999 to 15% in 2012.

These statistics have validated China's "Made in China 2025" plan to achieve dominance in high-tech manufacturing. The state-led industrial policy includes goals to increase self-sufficiency and cut reliance on foreign technology.

David Bourne, principal systems scientist at Carnegie Mellon University's Robotics Institute, visited China last December. "People's eyes were on fire about the kinds of things they were doing," he said.

The enthusiasm of the younger generation of Chinese for robotics, artificial intelligence and other cutting-edge technologies is both a result of and one of the chief drivers for the huge Chinese push into automation. According to IDC's Zhang, younger generations don't want and can't be forced to follow their parents into factory work, which has resulted in a continuous labor shortage.

In addition, with roughly equal manufacturing output -- the U.S. at an annual $1.8 trillion and China at $2 trillion -- the U.S. employs only 16 million to 17 million manufacturing workers compared with China's 120-plus million. With wages rising, China has an easy business case to make for the use of automation, as it will help close the labor gap. China is also looking to factory automation to improve quality and consistency, making its products more competitive with other countries.

Recalling his recent trip to China, Bourne said the Chinese are applying research in core industries that he was doing 10 years ago. This is a positive move, Bourne said, especially when applied in core industries like heavy metalworking. These applications might not quicken the pulse of academics, he added, but they have great automation potential.

The dark arts of technology transfer

Another issue to consider is what Whitton called "the dark arts of technology transfer." While U.S. companies might have to run factories in China to sell to the Chinese, they can't necessarily own that factory, Whitton said. As such, he added, there's a "very significant and impressive industrial espionage operation" to discover competitors' secrets.

While Bourne conceded the Chinese practice industrial espionage, he maintained entrepreneurial spirit is the main driver behind China's automation sprint. "People were excited to show me the cool things they were doing," he said.

Whitton said he sees self-interest propelling that spirit.

"Chinese government officials are generally tied to most big industrial players," he said. "And so there are a lot of incentives and pressure to basically funnel profits into strategic investment and help China advance rapidly."

Tasks taken over

Manufacturing tops the list of uses across the industrial robotics market. IDC broke discrete manufacturing down into relatively rote processes; it assigns more than 15% of all robotics spending to welding. Other categories include using robotics for assembly, machine tending -- reorienting parts for each manufacturing step -- soldering, painting, mixing and automated production in mining. Another top growth area is picking and packing in warehouses, an initiative led by Amazon. This benefits from advances in robotics, but doesn't fall under the definition of industrial as defined by IDC.

Aviation is another use for industrial robotics applications in the U.S., according to Bourne. Boeing is using mobile robots to move and position airplane parts or fuselages from construction station to station.

"The assembly line idea doesn't work so well if you're talking about airplanes, because there aren't that many of them," Bourne said.

Airplanes also don't fit well on conveyor belts. So, instead, mobile robots can move huge parts like wings from one stage to another, making flexible use of the factory floor.

Machine vision, sensors, machine learning

Advances in machine vision, sensors and machine learning are expanding the industrial robotics market and applications in assembly. The first two, benefiting from major improvements in the last five to 10 years, are already having an impact, according to Bourne. The last is in the pilot stage.

"We can now do pretty easily what we were dreaming of doing 10 years ago," Bourne said. "We want a robot to see where a part is, then go and pick it up."

That may sound easy, but robots must be trained to see. Many visual variations need to be considered and programmed into a robot, he added, even things as simple as whether it is an overly sunny or overcast day.

"There can be light coming in from a door that's been opened, and things can look totally different depending on shadows, for instance. If you look objectively, you realize how crazy different it is. We've busted through this problem, giving the robot 'eyes' [that can detect these differences]."

As for sensing, Matt Fitzgerald, former vice president of product at Rethink Robotics, the pioneer in collaborative robots that closed last month, and current global director of product management at Universal Robots A/S, described Rethink's Sawyer and Baxter robots as big bundles of sensors. In addition to using smart, embedded cameras -- which are now fairly cheap -- the Sawyer and Baxter robots track cycle time and how much force was used to place something into a fixture. They can also track runtime hours and the parts count, detect load, slippage and notify humans when assemblies fail visual inspection. The robots can then send the data out for analysis, feeding into the next trend: machine learning.

Led by Google, machine learning and material handling are major areas of research whose impact has yet to be felt in sales trends, Bourne said.

Cobots, human-robot interaction

Another driver pushing the industrial robotics market into more workplaces is the robot's improved versatility. Industrial robotics software and visual programming interfaces have made it easier to fit and train robots for a range of tasks. As seen in YouTube demonstrations of Rethink Robotics' Intera software, a formerly specialized coding task was reduced in some instances to a combination of graphical interface and "teaching by showing" -- literally picking up a robotic hand and manually guiding it through its paces. Graphically configured decision trees program robots to choose from among several different condition-dependent behaviors. These programs also can be simulated in software before being physically tested.

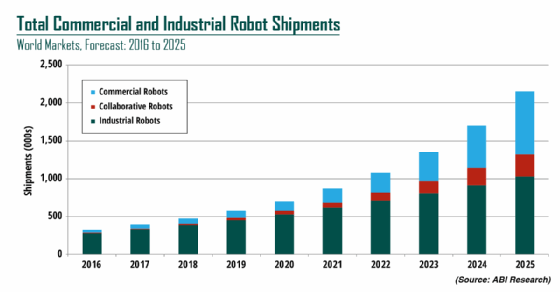

This robot-see, robot-do approach is the province of collaborative robots, or cobots. Until now, industrial robots have had to work in cages, because they exert too much force to risk allowing humans within a robotic arm's reach. But the further miniaturization of chips and advances in materials, machine vision and cognitive processing have given rise to lighter, smaller, slower, more intelligent, more versatile -- and less dangerous -- machines.

Progress on programmability and human-robot coexistence has not been altogether straightforward, however. In October 2018, Rethink Robotics closed up shop. But its intellectual property and its programming language have been picked up by Hahn Group, a German reseller and integrator with Baxter and Sawyer experience.

Actuator choices to make Rethink robots' arm muscles more flexible and forgiving had a negative effect on their accuracy, and sales suffered as a result. Ease of programming hasn't mattered that much to a nascent market, Bourne said.

"Large [manufacturing] companies don't care about this too much, because they have experts on staff that set the robot up before production begins," Bourne said. "Small companies don't have any experts, so almost anything is too hard. They usually count on the robot supplier to take care of programming before they make the purchase." Then, the robot just runs.

"Manufacturers just want to make stuff as fast as possible, whether there is programming or not," Bourne added. "There is a niche in the middle, where the volumes are lower and the product range is higher. The Rethink robots were targeted here, but only for applications where you need modest precision."

Taken together, that didn't leave many customers, he said, adding that Universal Robots, based in Denmark, has had much better market success in the industrial cobot category.