Getty Images

The migration to enterprise network as a service

Enterprise network as a service is becoming a popular consumption model for networking functions. But, as with any emerging technology, it's important to weigh the options carefully.

Enterprise networking has evolved from integrated hardware appliances to software-driven innovation over the last 10 years. The next iteration is the migration to cloud-based network intelligence and the delivery of enterprise network as a service, or NaaS.

The industry is still in the early days of this migration, as most enterprise network functions need physical hardware -- such as Ethernet switches and Wi-Fi access points (APs) -- to transport data to and from PCs and other devices to the data center or to the internet. Enterprise networking functions that are software-centric -- such as software-defined WAN (SD-WAN), Secure Access Service Edge, and management and visibility -- are already available in a cloud delivery model.

Over the next five to seven years, IT teams will investigate the benefits of enterprise network as a service, including a pay-as-you-go model, rapid deployment and elasticity of capacity. This migration will have a significant effect on the structure of the networking industry, including technological innovation, channel partners and contract terms. Over time, enterprise NaaS revenue will increase significantly with hardware revenues falling as a result.

Defining enterprise network as a service

Enterprise network as a service is a new business and technology model that enables organizations to outsource networking functionality at some, or all, of their locations. It is subscription-based and uses cloud-based intelligence to deliver Layer 4 to Layer 7 networking services (i.e., SD-WAN and network security) and to manage Layer 1 to Layer 3 networking hardware (i.e., Ethernet switches and Wi-Fi APs).

Enterprise network as a service should have the following capabilities:

- subscription model;

- usage-based pricing;

- cloud-based intelligence;

- end-to-end visibility with centralized management;

- ability to easily add or remove network and security functionality; and

- vendor- or partner-operated with the ability to outsource network operations.

The NaaS supplier or partner will provide a service-level agreement (SLA) to define contracted requirements regarding uptime and problem resolution.

Enterprise NaaS offerings enable IT managers or business leaders to significantly outsource many or all of the resources required to maintain and operate a network at a given location or set of users, such as remote workers.

Questions to ask about enterprise NaaS

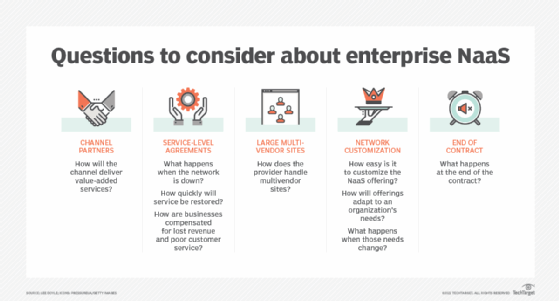

Enterprise NaaS is a new service and business model. Like any new offering, it will come with some limitations. IT and business leaders should raise the following issues when contracting for enterprise NaaS.

Service-level agreements

Suppliers or their partners will provide contracted SLAs. Ask those suppliers what happens when the network is down or degraded. How quickly will service be restored? How are businesses compensated for lost revenue, poor customer service and loss of employee productivity?

Network customization

How easy is it to customize a given enterprise NaaS offering? How will offerings adapt to specific needs of an organization? What happens when an organization's requirements change?

Large multivendor sites

Enterprise NaaS may be ideal for home employees or new branch offices, but migrating a large enterprise campus or data center network to a NaaS model will be extremely challenging. It is unlikely a NaaS supplier will be able to support a multivendor network model, thus locking the organization into a specific vendor.

End of contract

What happens at the end of the contract? The organization will not own its network and will need to rapidly shift to a new supplier if it doesn't renew the contract -- and this may complicate contract negotiations.

Channel partners

Suppliers have a lot of work to do in terms of getting their channel partners educated and "bought in" to their enterprise NaaS offerings. How will the channel continue to deliver value-added services? How easy will it be to customize NaaS offers?

Enterprise NaaS suppliers

A range of network vendors already deliver some of their offerings as a service. More comprehensive offerings have been, or soon will be, announced.

The following are a couple examples of NaaS offerings.

Cisco Plus

Cisco recently announced Cisco Plus, its enterprise NaaS offering. Cisco has committed to providing its customers a range of enterprise network offerings -- home, branch, campus and data center -- over the next one to two years.

HPE GreenLake for Aruba

As part of the HPE GreenLake family of products, Aruba introduced its NaaS offering in 2020. The offerings include Aruba Edge Services Platform and Managed Connectivity Services.

Additional suppliers

Additional suppliers with NaaS offerings include Alkira, Aryaka, Aviatrix, Cradlepoint, Infoblox, Palo Alto Networks and VMware, among others.

Enterprise NaaS requires a transition stage

The growth of networking software over the last 10 years has been significant. But, currently, the overwhelming majority of networking revenues relate to hardware and software licensed to specific network elements.

Enterprise NaaS offers buyers and suppliers a new business model for delivering cloud-driven, integrated network and security services. It provides significant benefits to IT organizations, including the following:

- financial, with a move from Capex to Opex;

- flexibility;

- agility; and

- ability to outsource network operations.

Enterprise networks with the requirement to move traffic at high speeds on location are more difficult to deliver as a service than software or compute. Enterprise NaaS will require a transition from the current model where highly trained network engineers operate complex networking appliances.

NaaS offerings provide new options for IT leaders to build and operate their networks. Issues to consider include pricing, SLAs and the ability of the offering to meet the specific needs at a given location.

Most existing campus and data center networks will continue to operate in the traditional manner through the purchase of hardware and software. Enterprise NaaS will gain traction for smaller locations, home and remote networking and new sites over the next five years.