Top metaverse investors and how to start investing

Would-be metaverse investors have many ways to get in on the action. Read our coverage of the metaverse's top investors, direct investing opportunities and investment risks.

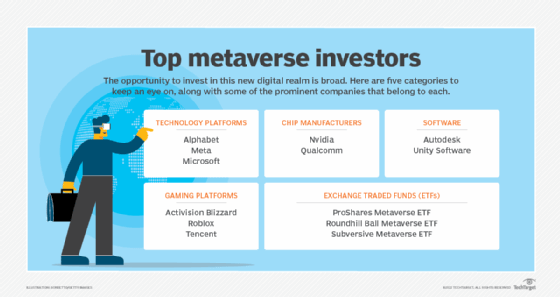

Given the footprint the metaverse ecosystem covers -- from the platforms themselves, like Meta, to virtual reality headsets to the burgeoning nonfungible token marketplaces -- the opportunity to invest in this new digital realm is broad. As with any new venture, however, there are many risks, known and unknown, for would-be investors.

This article defines the metaverse, explains the two main ways to invest in it and points readers to some of the companies betting big on the technology. We also list vehicles for direct investing and the main risks.

What is the metaverse?

The metaverse is a virtual environment in which people -- avatars in metaverse terms -- can connect, interact and transact. This convergence of the digital and physical world stems from the Greek meta, meaning beyond or after, and verse, short for universe.

There are two main forms of the metaverse:

- Virtual reality. Provides an artificial reality typically via a VR headset. It takes over a user's field of vision to provide an immersive experience. Immersive experiences include audio and positional tracking of the body to enable movement of body parts, such as the hands, to interact with the virtual environment.

- Augmented reality. Less immersive than VR. It adds virtual overlays on top of the real world via a lens of some type. Users can still interact with their real-world surroundings. AR examples include a smartphone using the Waze app. The host can see a user's location and guess their intentions.

How to invest in the metaverse

There are two primary ways to invest in the metaverse:

- Indirectly, by purchasing stocks of companies or Exchange Traded Funds (ETFs) that invest in the metaverse.

- Directly, by buying properties and assets inside the metaverse.

Top metaverse investors

There are many different types of businesses that have or will have a stake in the metaverse, thereby providing indirect investors ample opportunity to get in on the action. Here are four categories to keep an eye on, along with some of the prominent companies that belong to each.

Technology platforms

Tech giants including Alphabet; Amazon; Linden Labs, creator of the first immersive virtual platform Second Life; Meta, formerly Facebook; and Microsoft are investing heavily in creating their own metaverse platforms. Here is more information on three major technology platforms:

- Alphabet. Google's parent company is pouring millions of dollars into the development of Web3.0, the next generation of World Wide Web technologies that will form the infrastructure of the metaverse.

- Meta. The social media giant has developed and launched Meta Horizon Worlds, billed as a virtual, immersive social universe where users can explore the proliferating digital worlds created by Meta developers or create their own.

- Microsoft. Microsoft launched Azure Digital Twins, offering its users an opportunity to create a digital representation of real-world things, places, business processes and people, and providing Microsoft with valuable insights for creating and optimizing its products and customer experience.

Gaming platforms

Gaming platforms have been at the forefront of the metaverse, attracting legions of loyal fans even before the metaverse gained currency by offering immersive gaming experiences. Here is more information on three major gaming platforms:

- Activision Blizzard. Has been active in the gaming industry for more than a decade. It has successfully monetized its platform. For example, players in World of Warcraft buy in-game items such as pets and mounts with real money. Under a deal that was finalized on October 13, 2023, Activision Blizzard became a part of the Microsoft Gaming Business unit.

- Roblox. Operates an online entertainment platform, which enables users make friends, exchange experiences, build connections using common interests and embark on digital expeditions. The company also offers Roblox Studio, a free tool set that enables developers to build, publish and operate 3D worlds.

- Tencent. Owner of the messaging platform WeChat, has a stake in gaming through its subsidiary Epic Games. Epic Games developed Fortnite, one of the most popular online video games of all time. The platform has evolved to include Fortnite Creative, which enables users to create their own avatars and worlds.

Chip manufacturers

Conventional wisdom has it that chipmakers stand to benefit from the development of the metaverse, given the massive amounts of computing power required to support immersive digital experiences. It's an open question of which chipmakers will come out on top. Here are two that are investing heavily in bringing online experiences to life.

- Nvidia. Is aggressively investing in the metaverse using its flagship product Nvidia Omniverse, a platform that enables real-time acceleration of complex 3D workflows and new ways to visualize, simulate and code.

- Qualcomm. Launched a $100 million metaverse fund in 2022 to target strategic investments in mixed-reality companies and developers. It plans to become the leader in metaverse hardware for immersive experiences, such as VR headsets, AR glasses and holographic projectors.

Software

What does it take to simulate a building or a concert venue? Here are two companies that are all-in on developing the enabling software of the metaverse.

- Autodesk. Provides 3D design, engineering and entertainment software and services. The company's foray into the metaverse includes virtual, augmented and extended reality platforms such as Civil 3D, Fusion 360, Maya and 3ds Max. The value proposition is to enable customers to build digital twins and run simulations in a cost-effective manner.

- Unity Software. Started as a video game software development company and now operates an interactive 3D content platform that invests heavily in the metaverse. Earlier this year, it partnered with the world's leading live music experience creator, Insomniac Events, to bring a persistent metaverse world to its fan community where they can gather and engage virtually for live music performances.

Exchange Traded Funds

An ETF is a collection of securities that can be bought and sold through brokerage firms on a stock exchange. A few forward-leaning ETFs offer investors exposure to the metaverse, such as:

- ProShares Metaverse ETF.

- Roundhill Ball Metaverse ETF.

- Subversive Metaverse ETF.

Investing directly in the metaverse

Vehicles for investing directly in the metaverse include the following:

- Virtual neighborhoods. Buying virtual land requires choosing a metaverse platform and building an account there. Two of the most popular ones are Sandbox and Decentraland. Sandbox is a decentralized gaming metaverse built on Ethereum where players may purchase or rent simulated homes. Decentraland also uses the Ethereum blockchain to power its virtual environment. In Decentraland, customers can develop, explore and profit from their generated content. As in physical real estate, where sites like Zillow or Redfin enable users to compare and assess property values, sites such as NonFungible.com assess virtual properties in the metaverse. When purchasing land in the metaverse, users receive an NFT as proof of the asset purchase.

- Cryptocurrencies. Crypto is the currency of choice to purchase anything in the metaverse -- including NFTs -- and some of the most popular ones are Decentraland's MANA, The Sandbox's SAND, Star Atlas' Atlas and Axie Infinity's AXS.

- NFTs. These are buyer ownership rights to property, artwork, digital collectibles and music in the metaverse. Well-known brands like Gucci and Adidas, as well as auction powerhouses like Sotheby's all sell assets based on NFTs that guarantee uniqueness of ownership.

Attributes of the metaverse

The term metaverse, coined by sci-fi writer Neal Stephenson in his 1992 novel Snow Crash, generally refers to a shared persistent 3D digital world where people work and play.

Matthew Ball, author of a bestselling primer on the metaverse, defines this world as having the following features:

- Massively scalable, interoperable, real-time 3D.

- Synchronous and persistent.

- Continuity of data, identity, history, entitlements, objects and payments across worlds.

Risks of investing in the metaverse

The metaverse is an evolving universe, and users must be aware of the risks involved in investing in it.

Cryptocurrencies come with investment risks. Since cryptocurrencies are relatively new concepts compared to traditional stocks, bonds or tangible assets such as real estate, there's a lack of regulation and oversight, creating a lack of stability in the market. Because there's also low liquidity every time large investors or institutions enter or exit positions, it creates massive price shifts. Finally, the hype and high levels of speculation can lead people to buy cryptocurrencies at inflated prices before selling them off either for profit or due to buyers' remorse.

Market hype can lead to aggressive investments. The dot-com bust of the early 2000s was fueled primarily by overhype of the internet and excessive speculative investment in internet-first companies. Webvan -- a trailblazer in internet groceries -- is an example of a company that burned $2 billion USD between 1999 and 2001. Likewise, in the metaverse -- akin today to where the internet was in the early 2000s -- companies investing predominantly in the metaverse need to be assessed before investment decisions are made -- and monitored carefully thereafter.

NFT purchases and ownership come with risks. Anyone on the internet can create an NFT out of anything, so there's a lot of risk for creators and purchasers of NFTs tied to digital assets. For instance, a creator could have spent time collecting a prized digital asset and think they can sell it for a profit -- and the market tanks. Or there's a digital auction and, in a frenzy, a purchaser might overpay for possessing an NFT for a unique artwork.

Ashwin Krishnan is a technical writer based in California. He hosts StandOutin90Sec, where he interviews cybersecurity newcomers, employees and executives in short, high-impact conversations.