Nvidia's $5 billion investment gives Intel a shot in the arm

Nvidia's strategic $5 billion investment gives the GPU giant access to Intel's customer base while providing Intel with much-needed support in the competitive AI market.

Things have been looking rather bleak at Intel, with restructuring and even a government investment to help the company stay afloat. Last week, though, Nvidia -- a company that Intel weighed buying in 2005 -- announced an investment of $5 billion in Intel, and the decision has implications throughout the data center and the endpoint.

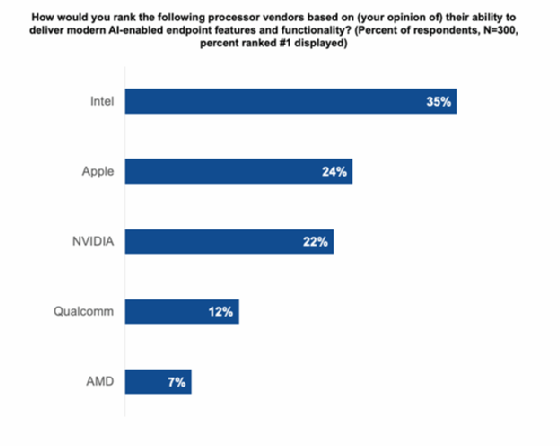

Once the darling of the tech sector, Intel has been floundering for years, held back, in part, by proprietary manufacturing techniques that are being surpassed by other manufacturers, as well as some broader missteps. On the endpoint side, which seems less affected by the changes, there has been increasing competition from AMD, not to mention Arm-based devices in both mobile and traditional PC form factors. Despite this, brand identity and trust have remained high. Research conducted into AI PCs last year shows that Intel still maintains a sizable perception advantage relative to others.

This lead is a testament to the head start on tech and brand that Intel built for itself over the past several decades, as well as a nod to the work Intel has continued to do in terms of management, security and performance. (Seriously, even if you're not using the AI parts of modern PCs, the work that's gone into hardware security, power efficiency and performance is really beneficial.)

Prior to this announcement, there were rumblings of Nvidia taking on Intel, releasing its own endpoints and servers and essentially competing with the company. Now, Nvidia has effectively bought its way into Intel's customer base and those strongly tied to its silicon.

If you look at this from a "build vs. buy" perspective, Nvidia threaded the needle to do both and shortened the on-ramp into those extended markets. I say "extended markets" because it's not like Nvidia is new. It already exists in most organizations in some capacity. This is an expansion of its footprint.

But it's not just Nvidia throwing a party. Intel should celebrate getting this lifeline that enables it to continue its reimagining and cements its seat at the table in the AI world.

Competitively -- and from my endpoint perspective -- this must be troubling for AMD, but it's accustomed to competing with Intel and Nvidia separately. In a way, this enables it to battle on one front instead of two. Qualcomm is likely less affected, since it's largely in growth and awareness mode in this market. For Qualcomm, it's more about showing people that Arm can run Windows as well as AMD and Intel can than it is about outright competition.

It's a fascinating turn of events, and one that will result in some interesting developments in the endpoint, data center and AI landscape moving forward.

Gabe Knuth is the principal analyst covering end-user computing for Enterprise Strategy Group, now part of Omdia.

Enterprise Strategy Group is part of Omdia. Its analysts have business relationships with technology vendors.