ESG data collection: Guide and best practices

Sustainability initiatives won't succeed without quality data. Following an ESG data collection framework and best practices ensures program and reporting success.

Data collection is a critical task for anyone managing a company's ESG initiatives -- but getting it right takes a nuanced understanding of the best processes.

As more companies focus on environmental, social and governance (ESG) strategies, they'll need more and better data. An ESG data collection process plays an essential role in operationalizing sustainability initiatives. The right data can show where the enterprise is today and help identify opportunities for improvement. Formalizing the data collection process helps ensure the organization complies with climate disclosure regulations and other ESG reporting needs.

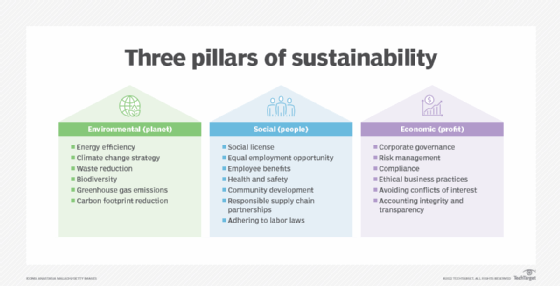

ESG data encompasses a wide array of information, but based on their industry, goals and regulatory requirements, organizations might prioritize different types of data, such as the following:

- Environmental aspects, such as energy use, water consumption and waste output. An environmental program might involve collecting emission data from the company and its partners.

- Governance programs, which might focus on financial systems and contracts. This data includes executive compensation, board diversity and data privacy protections.

- Social factors, such as living wages and gender pay gaps, training investment, employee demographics and other information commonly contained in HR systems.

"[ESG data] is of utmost importance because it forms the basis of your evaluation, rating and ranking in your publicly available ESG and sustainability reports," said Josh Prigge, founder and CEO at Sustridge, a sustainability consultancy. These ratings and rankings are based on the transparency and quality of the data and whether it has undergone third-party auditing.

This article is part of

ESG strategy and management guide for businesses

What is an ESG data collection process?

A formalized ESG data collection process provides a framework for structured data collection, aggregation, analysis and cleansing, which in turn enables accurate ESG reporting. Inaccurate reporting can lead to regulatory enforcement or litigation.

The data collection process establishes the procedure for how an organization gathers data related to ESG reporting efforts and ensures the quality of that information. As part of that, the collection process outlines which teams have relevant data and provides methods for data aggregation and data accuracy. Depending on the outlined process, teams might manually capture data themselves or use automated tools to help with data collection.

Businesses commonly set up an ESG data collection process because pulling data from various HR, procurement, risk management and compliance systems requires extensive data scraping, which is often rife with inconsistencies, said Tom Andresen Gosselin, practice director of ESG and sustainability at compliance consultancy Schellman.

Benefits of ESG data collection

Standardizing the ESG data collection process requires buy-in across the organization. Focusing on the advantages can help make the case.

Internal stakeholders should consider several benefits when making a business case to organize an ESG collection program, said Tyler Thomas, sustainability lead at AArete, a global management and technology consulting firm. Among these are the following:

- Data accuracy and reliability. A formal ESG data collection process ensures data accuracy and reliability, which provides a solid foundation for making informed decisions and setting meaningful sustainability goals. In addition, stakeholders might want to advocate for automation, since manual data capture and Microsoft Excel-based processes are prone to errors and inconsistencies.

- Effective resource allocation. Collecting relevant ESG data lets companies allocate resources strategically, which helps optimize the effectiveness of sustainability efforts. This is especially important, since ESG programs with limited resources must prioritize initiatives to deliver the most significant environmental and social effects.

- Performance monitoring and improvement. Regular ESG data collection enables businesses to measure their current state of sustainability performance. A data-driven approach helps track progress over time, identify areas for improvement and set actionable targets to reduce the organization's environmental effects.

- Enhance decision-making. Access to comprehensive ESG data empowers decision-makers to integrate sustainability considerations into various business aspects. Organizations can use the data to identify eco-friendly suppliers, evaluate energy-efficient technologies and align the organization's values and long-term objectives with sustainable investments.

Challenges to ESG data collection

Collecting and managing ESG data has several challenges:

- Data can come from different departments, systems and suppliers and in various formats.

- Organizations might have to depend on spreadsheets and manual entry to verify data, which can lead to mistakes.

- It can take a long time to collect and verify the data.

- Identifying which ESG factors are important to the business can be an issue.

ESG data collection steps

Once an organization commits to collecting ESG data, it must implement a process to compile data and ensure its quality. Experts recommend six steps to get an ESG collection process up and running.

1. Understand the type of data

Organizations must understand the type of data they need before they initiate data collection. Start the process with a materiality assessment using input from employees, customers, investors, industry consultants and the board of directors to identify the business's significant ESG issues, and then determine the metrics and data to collect for each issue. For help identifying which metrics to track, consult various ESG reporting frameworks, such as GRI Standards developed by the Global Reporting Initiative; CDP, formerly known as the Carbon Disclosure Project; and the IFRS Sustainability Disclosure Standards, SASB Standards and TCFD Recommendations, all of which are now overseen by the International Sustainability Standards Board.

2. Identify leaders

After pinpointing the required metrics, identify the individuals in the organization responsible for -- or who will have access to -- the data. Compile a list of subject matter experts or data collectors to work with.

3. Hold a kickoff meeting

Convene a kickoff meeting to introduce the project, explain its importance and discuss the information required from each participant in the data collection process.

"If you can involve top-level leadership like the C-suite to show their support for this initiative, it often aids in data collection, fostering greater engagement across the organization," Prigge said.

4. Follow up

After the kickoff meeting, send each data collector an email specifying the needed data. It's important to work directly with data collectors to answer any questions and clarify ambiguities. If data is incomplete or unavailable, such as the waste data for a building the organization doesn't own, make an estimate based on factors such as square footage or number of employees. Carefully work through any assumptions or estimations required.

5. Set up automation

Explore automated software to streamline the aggregation and reporting process. Automated tools gather and organize large volumes of information from many sources across an organization. They can increase data collection accuracy and reduce the risk of human mistakes. Automated tools often help speed up the data analysis process and improve decision-making.

6. Assess the program

A shift toward automated tools lets teams focus more on strategy and less on manual data collection. It's important to understand the data to ensure data quality and apply it effectively.

ESG data collection best practices

When setting up an ESG data collection process, experts recommend the following best practices to maximize performance and ensure success:

- Use automation. Implement automation to improve efficiency and accuracy. Automation can cover data extraction from external systems, third-party data sources and sustainability surveys.

- Centralize efforts and standardize practices. A centralized ESG data management team helps ensure consistency and alignment across the organization. This team oversees data collection, analysis and reporting processes. It can also define consistent methodologies and metrics, enhance data comparability and ensure data integrity.

"ESG data usually lives across numerous departments, which are used to managing data in various ways, and standardizing the ESG data capture is crucial for having consistent insights," Thomas said. - Create regular data validation and verification processes. Periodically validate and verify ESG data to maintain data accuracy and reliability. Comprehensive practices include internal audits and external checks to enhance credibility, which demonstrates a commitment to transparency and accountability.

- Focus on data security and privacy. Some ESG data, such as employee records or customer information, is sensitive. Strong data protection can safeguard data from unauthorized access.

- Create a single source of truth. Look for tools to help create an SSOT dashboard. A dashboard can provide a comprehensive view of the organization's ESG metrics, enabling stakeholders to access real-time data and track ESG performance against sustainability goals. It can display KPIs, trends and targets in a user-friendly format.

- Include references. Ensure auditors or regulators can reverse-engineer any emissions reports, Gosselin said. Include original references to any calculations based on public data used to extrapolate and estimate effects.

- Work with the audit team. The internal audit should align with reliability and accuracy tests of data sets the auditors might not be familiar with, Gosselin said.

How to measure ESG data collection success

Organizations can measure the success of their ESG data collection efforts using the following approaches:

- ESG metrics. It's important to prioritize metrics irrespective of an organization's immediate ability to systematically collect the data for those metrics. There are two categories of ESG metrics:

- Quantitative metrics that measure data, such as energy use, water consumption and waste output.

- Qualitative metrics that are based on subjective data, such as a company's commitment to and achievement of a strong ESG culture and related practices.

- Standardized reporting frameworks. Organizations should verify that they meet international standards, such as the ones listed previously. For example, GRI Standards are universal, sector and topic standards that enable organizations of any size to report their effect on the economy, environment and people. IFRS Sustainability Disclosure Standards provide a global baseline to report sustainability-related information that can affect a company's financial standing.

- Compliance and regulatory requirements. Current and pending compliance and climate disclosure regulatory requirements should be analyzed to ensure they are being met.

- ESG audit. An audit reports on an organization's ESG risks and opportunities and evaluates its policies and how it implements them.

Effective ESG data collection enables an organization to monitor its progress over time, pinpoint areas that need enhancement and establish practical goals aimed at minimizing its environmental footprint. Given rising regulatory demands and updated reporting obligations, organizations need to ensure that the data they collect is traceable. It's therefore essential to have controls in place at every stage of data transfer, collection, aggregation and calculation, up to and including the final compilation of the report.

Editor's note: This article was updated in August 2025 to include information on ESG data collection challenges and how to measure ESG data collection success.

George Lawton is a journalist based in London. Over the last 30 years he has written more than 3,000 stories about computers, communications, knowledge management, business, health and other areas that interest him.