The social 'S' in ESG: Examples, factors and best practices

The social factors of ESG have become more prominent over time. Here's what they involve and how companies can address social issues in ESG programs.

Organizations measure their social impact to understand how well they manage relationships with employees, suppliers, customers and communities.

Overall, business leaders track and report on the social aspects of their operations to determine their success and assess possible risks. These measures range from workforce metrics, such as employee engagement, to supply chain concerns, such as human rights violations, to data about the organization's community impact.

"Broadly speaking, 'social' is the impact the organization has on the social systems [on] which it operates," said Lukas Kay, senior director in the environmental, social and governance (ESG) and sustainability practice at FTI Consulting.

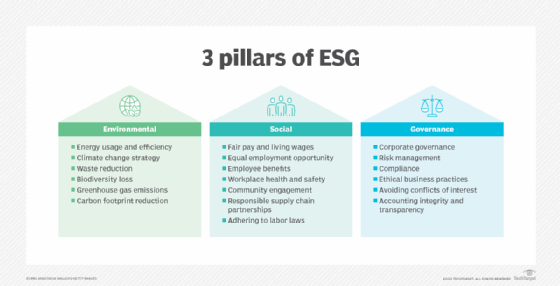

These social measures are part of ESG's trio of areas that organizations track to share insights into their activities and operations with stakeholders.

12 core ESG social factors

Regulations, longstanding best practices and frameworks guide organizations on what they should track, measure and report for the social component of ESG. These frameworks generally recommend organizations track performance and certain practices, which fall under the following categories:

This article is part of

ESG strategy and management guide for businesses

- Human capital.

- Customers and end users.

- Workplace health and safety.

- Product safety and quality.

- Community.

- Supply chains.

However, for the social aspect specifically, organizations often track and report the following 12 categories to stakeholders:

- Wages and benefits, possibly including pay gap analysis between executives and lower-level workers.

- Employee turnover rates.

- Employee training, development and skill-building.

- Work hours and scheduling.

- Workforce makeup and leadership makeup, including gender, age and racial diversity.

- Workplace accidents and injuries.

- Compliance with workplace safety programs.

- Vendor and supplier adherence to human rights and other ethical principles, such as no use of forced or child labor.

- Responsible sourcing of supplies and materials.

- Compliance with data privacy and security standards.

- Complaints or problems with product safety or quality.

- Community engagement and involvement, such as charitable donations, social program funding and employee volunteer hours.

Why are ESG social factors important?

Certain countries or regulators, like the U.S. Securities and Exchange Commission, require organizations to issue ESG reports by law, such as the EU's Corporate Sustainability Reporting Directive (CSRD). Whether an organization is subject to such laws typically depends on its size, whether it is a public company and whether it operates somewhere covered by a particular law.

Some organizations do not meet the criteria for mandatory ESG reporting but report on it nonetheless. They do so because they will soon or expect to fall under those mandates.

Additionally, some stakeholders -- whether investors, board members, customers or others -- demand such information, according to Katie Metz, an international consultant and teaching professor at Indiana University's Kelley School of Business. Other organizations see reporting ESG metrics as an opportunity to differentiate themselves in the market. Positive metrics could appeal to stakeholders who prioritize doing business with organizations that adhere to certain ESG standards, Metz said.

Reporting on ESG and its social factors in particular is important for the following reasons:

- It creates transparency, which can build credibility and trust.

- It demonstrates accountability.

- It verifies the accuracy of its assertions on safety records, as well as other policies and programs.

- It shows good risk management, as the organization can see how the social factors could affect its operations.

- It ensures compliance with laws and regulations.

- It builds resilience through good risk management and compliance.

- It offers social data, which can help businesses tell a positive story to attract and retain investors, customers, business partners and employees.

ESG's social challenges

To effectively report on the three ESG components, executives must first determine what matters to their stakeholders, which may include executives, board members, partners, employees, customers and regulators.

Business leaders often struggle to identify what matters to stakeholders regarding ESG as a whole, but they might struggle the most with the social component.

"[Social is] intended to cover what we consider the human or relationship aspect of business. It talks about how a company manages the human part of the business relative to those stakeholders, and that's the most complex of the three to define," Metz said.

Numerous issues make reporting on social metrics challenging, including the following:

- No single standard. Business leaders must follow different laws, regulations and demands from stakeholders on what to measure and report, Metz said. The various laws and regulations force some organizations to prepare multiple reports to satisfy requirements.

- Determining what's important to stakeholders. If business leaders can't determine what stakeholders care about, they won't know what to track, measure and report, said Elizabeth Kohl, assistant professor of sustainability reporting at the University of Montana College of Business. Stakeholder groups may differ in what they consider important. For example, an investor might express concern over workplace hours and scheduling, while customers care more about pay equity and diversity.

- Too much data to parse through. The scope of information required is expansive and diverse, because social factors touch all business functions in some way, Kay said. Gathering that data from different functions requires a significant amount of work, especially if some or much of the gathering is done manually.

- ESG software integration. ESG reporting software can automate data gathering and reporting, but tech leaders might struggle to integrate the software with all systems that hold the necessary data, Kay said.

- Working with external sources. Obtaining information from external sources -- most notably, from suppliers and vendors -- can be time-consuming or met with resistance, Kay said. Even when data is forthcoming, business leaders might struggle to verify it. For example, a company with a large global supply chain may not be able to verify that suppliers in countries with poor workplace conditions are not using child or forced labor.

ESG's social best practices

For effective social reporting, organizations can follow these best practices:

- Use a framework, such as those from the Global Reporting Initiative, the Sustainability Accounting Standards Board or CSRD.

- Identify key stakeholders, what social metrics they find important to track and report, and meet their expectations.

- Determine the data required to satisfy stakeholders and identify which systems hold that data.

- Collect accurate and complete data.

- Carefully select, implement and use ESG software to gather, analyze and report the information required to meet stakeholder demands.

- Establish objectives and outcomes that align with the organization's strategy.

- Benchmark the organization's social reporting against others.

Mary K. Pratt is an award-winning freelance journalist with a focus on covering enterprise IT and cybersecurity management.