9 ESG benefits for businesses

ESG programs help businesses attract investors, build customer loyalty, improve financial performance, make operations sustainable and gain a competitive edge.

Investors are increasingly hopping on the ESG train. Concerns over climate change, growing numbers of cybersecurity incidents, global supply chain issues, economic gaps and social justice movements have become catalysts for surges in adoption rates among businesses.

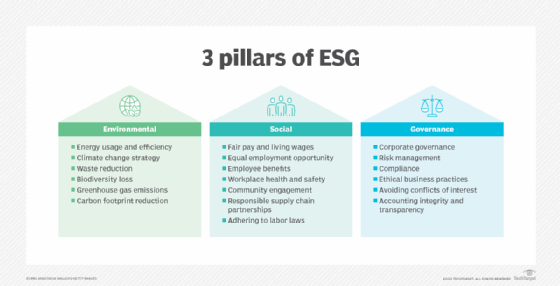

Environmental, social and governance, or ESG, is a framework for sustainability management, ethical practices and conscious consumerism that is gaining widespread popularity in the business world. But it's not a new phenomenon. Rather, it's a continuation of socially responsible investing that has gone mainstream. The term ESG officially originated in 2004 with the publication of the UN Global Compact Initiative's first "Who Cares Wins" report, and ESG investing has evolved and expanded since then.

Socially conscious investors and other stakeholders -- including employees, customers, regulators, suppliers and distributors -- want to know about a company's stance on socioeconomic factors, its sustainability efforts and its corporate governance processes. According to Bloomberg Intelligence, global ESG investment assets under management might surpass $40 trillion by 2030.

While passing the investor and stakeholder test and setting up a successful ESG plan might seem challenging for any business, a well-conceived ESG strategy can lead to various business benefits.

This article is part of

ESG strategy and management guide for businesses

What is an ESG strategy?

An ESG strategy is an organization-wide approach that adjusts a company's environmental, social and governance practices to increase business sustainability. Now more than ever, the success and growth of a business are directly tied to a solid ESG strategy, which also involves conducting business in a way that provides long-term value without producing any negative effects on the environment or society -- or minimizes the effects, at least.

A good ESG strategy includes various sustainability factors -- such as a company's efforts toward reducing its carbon footprint, going green, encouraging diversity or introducing employee wellness programs. It also focuses on initiatives that matter most to a business and are the easiest to put into action. As such, an ESG strategy paves the way for a company to gain investor confidence, earn customer loyalty, reduce operating costs and improve both asset management and financial performance.

ESG benefits for businesses

The ESG framework can bring tangible benefits to both businesses and investors. For businesses, it opens access to a larger pool of capital and promotes a stronger brand identity, and investors can demonstrate their values and often get returns that are similar to or better than traditional approaches through investments associated with an ESG-centric brand.

Here are five benefits of ESG for businesses:

1. Offers a competitive advantage

Companies participating in ESG efforts often gain a competitive advantage over business rivals. For example, PwC's "Voice of the Consumer Survey 2025" found that 44% of respondents would pay more for sustainably grown food. Similarly, 71% of the 435 IT professionals who responded to an April 2024 survey by Omdia, a division of Informa TechTarget, said they think their company would pay more than a 5% price premium for IT products from vendors that have strong ESG practices.

The various ESG metrics tracked and reported by companies are also important to consumers, employees, lenders and regulators. Company leaders who make efforts to improve labor conditions, promote diversity, give back to the community and take a stand on socioeconomic issues play a major role in strengthening a company's brand.

2. Attracts investors and lenders

The inclusion of ESG reporting in earnings reports or in separate disclosures is trending among businesses. Investors and lenders are becoming highly attracted to organizations that invest in ESG and use ESG disclosures to shed light on their sustainability efforts. For example, a 2024 Morgan Stanley survey found that 77% of global investors are interested in sustainable investing.

Public concerns caused by climate change and misuse of natural resources are driving investors to shift their lenses toward sustainable businesses and weed out the ones with outdated practices -- such as unfair wages, investments in fossil fuels, unsustainable agricultural methods and the manufacturing of non-recyclable products. By providing a comprehensive view of their practices, businesses engaged in ESG initiatives can influence investment decisions and help investors pick a company that offers a sustainable future with a low risk profile.

3. Improves financial performance

ESG can make a business favorable to investors and improve its overall financial performance. Even small efforts toward sustainability -- such as going paperless, recycling or making energy-efficient upgrades -- can improve a business's bottom line and ROI.

To keep up with ESG programs, companies must track key metrics -- such as energy consumption, raw material usage and waste treatment -- that can eventually lead to reduced energy bills and cost reductions. Companies that stay compliant with ESG-related regulations also have less exposure to fines, penalties and other business risks, which positively affects their bottom line.

4. Builds customer loyalty

Today's socially conscious consumers, particularly Gen Z, spend at businesses that align with their values. Deloitte's "2025 Gen Z and Millennial" survey found that 65% of Gen Z respondents are willing to pay a premium for sustainable products or services. Companies that adhere to ESG principles can attract and retain more customers by being transparent and effectively communicating their ESG efforts to customers.

5. Makes company operations sustainable

Companies investing in ESG initiatives can sustain and adapt to an ever-changing business landscape. For example, businesses that properly integrate ESG principles into their core operations are better able to identify cost-saving opportunities and enjoy lower energy consumption, reduced resource waste and an overall reduction in operational costs.

While ESG reporting globally is currently only mandatory for large and publicly traded companies in some jurisdictions, it appears to be heading in that direction for the rest of the corporate world, as well. Companies that overlook ESG policies now might have to deal with them later in the form of legal, regulatory, reputational and compliance issues.

6. Widens the value chain

Boston Consulting Group found that top scorers in its annual "Sustainability Leaders" competition had three times more success in expanding their value chains, particularly evident in their distribution models and scaling models.

Sustainability improves value chains by increasing operational efficiency and reducing costs through initiatives such as waste reduction and energy savings. Sustainability build stronger stakeholder relationships and partnerships, in turn opening organizations up to new market opportunities. This positions enterprises more favorably in an eco-conscious global market.

7. Inspires innovation

ESG principles often inspire businesses to adopt innovation-focused mindsets by encouraging the development of sustainable products, services and processes. The prioritization of eco-friendly strategies can encourage companies to adopt more innovative and advanced technologies, including in renewable energy, AI and blockchain spaces. Creative problem-solving is also spurred on by ESG principles, with circular economy models and ethical and sustainable contributing to an innovation-first approach.

8. Talent attraction, growth and retention

Millennials and Gen Z are "more likely to pursue careers in sustainability and social impact roles, reflecting a shift away from the traditional career paths of older generations," stated Dr Simon McCabe, head of the Healthy Work Research Unit at Aston University.

Companies that prioritize ESG often position themselves as innovative and socially responsible, which appeals to younger generations seeking meaningful careers. By committing to ESG initiatives, businesses can attract and retain more top talent. This leads to reduced recruitment costs, improved team stability and a competitive advantage.

In addition, ESG-driven workplaces can foster a sense of purpose and alignment with employees' values, enhancing job satisfaction and long-term engagement. The result is an organization that benefits from stronger teams and has a reputation as a desired employer.

9. Increased supply chain resilience

ESG frameworks prioritize ethical sourcing and environmentally responsible practices. As a result, supply chains become diversified, reducing the risk of an organization's dependence on a smaller number of suppliers. This, in turn, mitigates service disruptions or resource scarcity, and makes businesses better equipped to withstand economic, geopolitical or technological uncertainty. ESG initiatives also promote transparency and accountability, which enable companies to proactively identify vulnerabilities in their supply chains.

Is ESG for businesses of all sizes?

Sometimes, SMBs assume their lack of resources can be a hindrance to ESG adoption or that their ESG efforts won't pay off in the long run. However, investing in ESG -- even on a smaller scale -- can always have a positive effect on a business.

While larger organizations might have extra resources to set up ESG policies or form high-level sustainability partnerships, SMBs can attract socially conscious investors without going through the bureaucracy and red tape that larger organizations face. Smaller businesses are often also in closer proximity to their customers and have ample opportunities to share their sustainability stories and connect at a deeper level.

ESG for the long term

An effective ESG plan demonstrates a company's commitment to risk management, cost reduction and care for the environment. It also indicates that a business has a strong stance on socioeconomic issues -- including customer satisfaction, labor standards, social injustice and sustainable investments -- and is willing to proactively evolve with the changing market.

With all its positives, ESG also faces some market and political backlash as critics claim that ESG investing isn't capable of producing the real-world results it promises. However, that hasn't slowed down ESG adoption rates among businesses, and ESG investments can generate solid returns as a whole. Sustainable funds outstripped conventional funds across the largest asset classes in the first half of 2025, according to a "Sustainability Reality" report from the Morgan Stanley Institute for Sustainable Investing.

Editor's note: This article was updated to reflect new survey data and to improve the reader experience.

Kinza Yasar is a technical writer for WhatIs with a degree in computer networking.

Harriet Jamieson is a senior manager on the IT Strategy team at TechTarget covering CIO and ESG topics.