6 hyperconverged infrastructure trends for 2026

Hyperconverged infrastructure is rapidly changing. Read what HCI has to offer in 2026 and what projected growth it may have within the next couple of years.

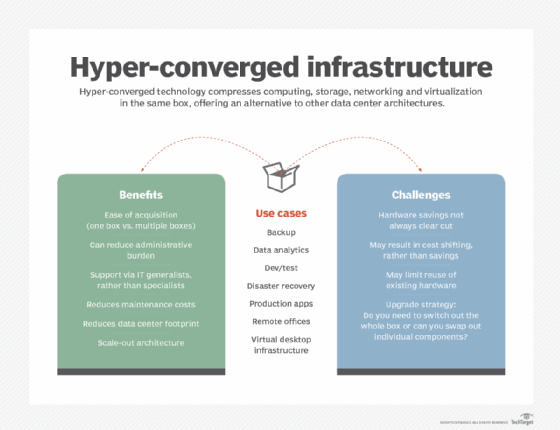

Hyperconverged infrastructure technology has made significant strides since emerging more than a decade ago, finding a home in data centers seeking to ease procurement headaches and management tasks.

Vendors initially positioned the technology as a simple-to-deploy, all-in-one offering that combined compute, storage and networking with a hypervisor. This now-mainstream technology's essential selling points around simplicity remain the same today. This article uncovers predicted HCI trends for the next several years.

Growth of the hyperconverged market

The HCI market is expected to continue growing in 2026 and beyond. According to Fortune Business Insights, the HCI market is predicted to grow from $11.98 billion in 2024 to $61.49 billion by 2032.

According to SNS Insider, the HCI market size was $16.16 billion in 2025 and is expected to reach $84.72 billion by 2033 -- over $23 billion more than Fortune Business Insights' 2032 forecast.

Companies fuel this growth by seeking ways to cut costs and improve operational efficiency.

Benefits to HCI

HCI systems use modular nodes. Each node contains dedicated compute, memory, storage and network resources. This reliance on uniform nodes makes HCI easy to deploy and manage. Organizations can increase their capacity or scale workloads at any time by installing additional nodes.

HCI is more than hardware. It abstracts hardware resources, enabling them to be allocated in a manner similar to that used by public cloud providers. The architecture can be software-defined and offered as consumable services, making HCI an option for those who want to build private or hybrid clouds.

Additionally, the HCI architecture is designed to be low cost -- admins can construct it with inexpensive hardware. The hardware nodes can collectively provide high availability and fault tolerance for mission-critical applications.

Challenges to HCI

HCI has disadvantages. For example, a modular design might require hardware that an organization does not need. If an organization purchases a node because it needs additional compute resources, it also pays for storage that may not be necessary.

Vendor lock-in can be another disadvantage. While it is possible to use reference architecture to build an HCI deployment from commodity hardware, prebuilt systems tend to use proprietary components that are not compatible with other vendor tools.

Another challenge occurs when hardware vendors provide HCI tools that integrate numerous components into a chassis. This can require significant power, which can be a problem if the chassis deploys in an edge environment. High power usage increases heat, so cooling can also be an issue.

HCI trends

1. Edge computing will continue to fuel HCI adoption

Edge computing, especially as it relates to AI driven or containerized workloads, continues to fuel demand for HCI. Edge computing generates vast amounts of data, particularly when it involves IoT devices. The volume of this data often makes cloud computing impractical because it may exceed the network's ability to send data to the cloud. Even if sufficient bandwidth is available, processing data in the cloud could be costly or lead to latency.

While traditional servers can, and sometimes do, support edge workloads, HCI is often a better fit. HCI can be less expensive and complex to deploy and manage than other tools. HCI is designed for clustered operations, making it easier and less costly to provide hardware redundancy for mission-critical applications. For example, it often costs less to build a three-node HCI cluster than to mirror a conventional server. It is worth noting that three-node HCI clusters were once the norm, but some vendors have begun supporting smaller HCI deployments, including single-node deployments.

The role of HCI at the edge is also beginning to change. HCI was once viewed solely as a platform for hosting VMs. Now HCI is increasingly being used to host Kubernetes clusters and containerized workloads. Some organizations have also begun equipping HCI nodes with GPU resources, enabling them to perform AI inference at the edge rather than sending raw data off-site for interpretation.

2. HCI remains a preferred tool for hybrid cloud

Organizations adopted a cloud-first approach to IT when public clouds first came out. This adoption led companies to use the cloud over physical data centers. However, it became apparent that some workloads need to run on-premises. This led to the adoption of hybrid cloud usage.

While there are many ways to create a hybrid cloud, HCI offers a compelling option. Consumption-based pricing and on-demand scalability have led many businesses to adopt the public cloud. HCI's reliance on modular nodes enables it to scale in a similar way.

Early on, many organizations looked to HCI because it simplified workload migrations to and from the public cloud. Now that this type of workload mobility has become the norm, organizations have shifted their priorities from mobility to consistency. Specifically, organizations want to make sure that they can ensure consistent management, governance and tool usage across environments, and HCI aligns well with this drive toward consistency.

Cost governance has also become a huge consideration in hybrid cloud environments. As such, organizations are increasingly treating HCI deployments as a strategic, cost-saving operation.

3. VDI will remain a significant use case

At one point, VDI had become the dominant use case for HCI. Today, VDI remains one of the primary HCI use cases, but it is no longer as dominant as it once was. Part of this stems from organizations increasingly turning to cloud-based virtual desktops. However, the bigger reason is that HCI is proving useful for other workloads, including containerized and AI workloads.

Nevertheless, HCI remains a suitable platform for hosting virtual desktops. Each virtual desktop requires a specific number of CPUs, storage, memory and network resources. As such, companies can determine how many virtual desktops an individual HCI node can support and install additional nodes as needed. Additionally, HCI nodes generally offer good storage performance, which is essential in VDI environments, especially if an organization wants to support persistent virtual desktops.

4. HCI will help organizations reduce IT complexity

The move toward HCI adoption often comes down to operational efficiency and ease of management. Organizations are increasingly automating IT ops wherever possible to drive down costs, reduce the risk of human error and increase scalability. HCI aligns well with these types of lifecycle automation goals.

Modern HCI platforms support automated upgrades, patching and other maintenance tasks. HCI has evolved, shifting its focus from "easy to deploy" to prioritizing automation, observability and compliance. As such, HCI is increasingly being treated as a general-purpose IT platform that is useful at the edge or for replacing siloed systems.

5. HCI will see increased use for AI workloads

Hyperconverged infrastructure is increasingly being used to host certain AI or machine learning workloads, particularly at the edge. This is especially true when an organization needs to minimize latency or when data residency requirements are in effect.

Most modern HCI platforms support GPU-enabled nodes and high-performance storage, which enables HCI to handle many AI workloads with ease. HCI is being increasingly used for workloads involving real time analytics, computer vision or predictive maintenance. It is worth noting, however, that large-scale model training continues to be handled in the data center or in hyperscale clouds.

6. HCI will play a key role in security and zero-trust

Organizations are finding that HCI adoption can sometimes simplify their security and zero-trust initiatives. HCI simplifies policy enforcement, making it relatively easy to prevent configuration drift. Additionally, vendors have incorporated security features such as encryption, role-based access control and secure lifecycle management, which help HCI platforms more easily align with an organization's zero-trust initiatives. In fact, HCI is no longer just an option for simplifying infrastructure; it is a tool that an organization can use to make its on-premises resources more resilient and more easily defensible.

Organizations face rising costs and the risk of significant security breaches, so they look to minimize IT complexity wherever possible. One of the easiest ways to reduce complexity is through standardization. HCI adoption enables standardization, reducing management and maintenance costs and making it easier to keep an organization's IT assets secure.

Editor's note: This article was updated in January 2026 to reflect changing technology information.

Brien Posey is a former 22-time Microsoft MVP and a commercial astronaut candidate. In his more than 30 years in IT, he has served as a lead network engineer for the U.S. Department of Defense and a network administrator for some of the largest insurance companies in America.

John Moore is a writer for Informa TechTarget covering the CIO role, economic trends and the IT services industry.