What is procure-to-pay (P2P)?

Procure-to-pay (P2P), also known as purchase-to-pay, is the process organizations use to obtain essential resources. It is an ordered sequence of financial and procurement processes, starting with the initial requisition for the good or service and ending with the final payment to the provider. Each step in the P2P lifecycle is a comprehensive business process that enables organizations to acquire what they need while fostering relationships with suppliers.

The procure-to-pay process is vital to supply chain management. It helps ensure organizations can acquire what they need in a timely manner while managing costs and enabling better financial planning and operational excellence.

Procure-to-pay software, which often integrates with enterprise resource planning (ERP) software and other financial systems, can handle the entire procure-to-pay process and its components, including invoicing and related processes such as inventory management and accounting.

Why is procure-to-pay important?

Procure-to-pay provides a structured approach to managing the purchasing lifecycle. It can help organizations eliminate operational inefficiencies and maintain better control over their expenses. P2P can also help automate and standardize tasks in the procurement cycle while minimizing the potential for human error. This includes tasks such as creating purchase orders, matching invoices to orders, and billing.

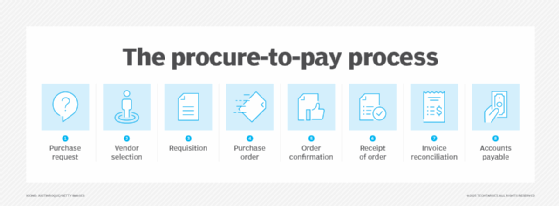

The procure-to-pay process

The procure-to-pay process consists of the following steps:

- An employee requests the purchase of an item or service.

- The organization evaluates suppliers and service providers by reviewing criteria specific to its needs, such as quality, cost and reliability. A vendor is selected.

- A purchase requisition is created and forwarded to the person or department within the organization that is responsible for approving the request. The requisition typically includes the item, quantity and other details.

- Once the purchase requisition is approved, a purchase order (PO) is created and sent to the vendor. It documents specific details of the goods or services being acquired.

- The supplier sends an advanced shipping notice and an order confirmation back to the company, notifying it that the order has been received and that the fulfillment process is underway.

- The company receives, inspects and signs off on the order.

- The supplier submits an invoice for payment, which is compared against the PO and other relevant documents to ensure the accuracy of the shipment.

- Once the invoice is reconciled, accounts payable pays the supplier.

In practice, most organizations have several additional steps in each major phase of the procure-to-pay process. Procurement might require using an approved product catalog or issuing a request for a quote. Managerial approval is typically required before a purchase order is sent to a supplier or payment is approved. There are often additional processes to inspect received goods, acknowledge their acceptance and enter them into inventory.

Benefits of procure-to-pay

Procure-to-pay systems offer ways to reduce the pain points and delays that many organizations experience with purchasing and payments. The benefits of procure-to-pay include the following:

- Streamlined automation that eliminates manual errors. In many companies, procure-to-pay is a complex process that is done using manual processes. With an end-to-end P2P system, manual work can be eliminated or drastically reduced, saving time and money.

- Seamless integration. Many P2P systems include data conversion processes like extract, transform, load that enable data normalization and integration across multiple systems. This eliminates data inconsistencies.

- Built-in predictive modeling. Procure-to-pay software includes built-in analytics that identify problems and optimization opportunities. The analytics assist companies in fine-tuning their procure-to-pay processes to maximize their performance.

- Improved visibility. The end-to-end P2P process is visible to all participating departments in the enterprise, enabling them to see the processing of every requisition and order. This information is also available to corporate financial systems so that members of finance and upper management can readily monitor the organization's cash flow. This information aids purchasing and other decision-makers in negotiating contracts and payment cycles with suppliers.

- Better fraud detection. Matching invoices to purchase orders that P2P systems provide trigger alerts for reviews before payments are made, reducing the risk of fraud.

Challenges of procure-to-pay

Procure-to-pay also has potential disadvantages, including the following:

- Integration challenges. P2P software might not integrate seamlessly with other ERP or financial software, requiring manual workarounds.

- Inefficiencies. P2P software might not be able to accommodate an organization's specific workflows or regulations, leading to inefficiencies and compliance issues.

- Cost. P2P software can be expensive for smaller organizations to implement and manage.

- Complexity. Complicated P2P software design and poor user interfaces can create a bad user experience, limiting users' willingness to use the P2P product.

Procure-to-pay platforms

Since P2P touches virtually every corner of the enterprise, it is no surprise that many established ERP and even accounting software vendors now include P2P modules in their offerings. There are also vendors that exclusively offer P2P software.

Most vendors of ERP software -- Infor, Microsoft, Oracle and SAP being the market share leaders -- provide modules that handle the major phases of procure-to-pay. ERP suites typically have procurement and order management modules, inventory, warehouse management and logistics functions for the middle phase of procure-to-pay.

ERP core financials, including accounts payable and general ledger functions, handle the invoicing, payment and accounting stages. Some ERP vendors claim to have integrated the procure-to-pay process across their various modules.

Numerous vendors specialize in one of these ERP business processes and support at least parts of the procure-to-pay workflow. Vendors of e-sourcing and procurement software, such as SAP Ariba and Coupa Software, have significant procure-to-pay features. A few niche players, among them Basware, BirchStreet Systems, GEP, Jaggaer and Zycus, claim to automate the entire process.

One of the biggest benefits of integrated procure-to-pay software is its ability to consolidate data, enabling a process called spend management that executives can use to get more control over expenses.

Learn about the most popular career paths in supply chain management and the education that's required to secure these high-paying roles.