What is SaaS (software as a service)?

Software as a service (SaaS) is a software distribution model in which a cloud provider hosts applications and makes them available to end users over the internet. In this model, an independent software vendor (ISV) can contract a third-party cloud provider to host the application. Or, with larger companies, such as Microsoft, the cloud provider might also be the software vendor.

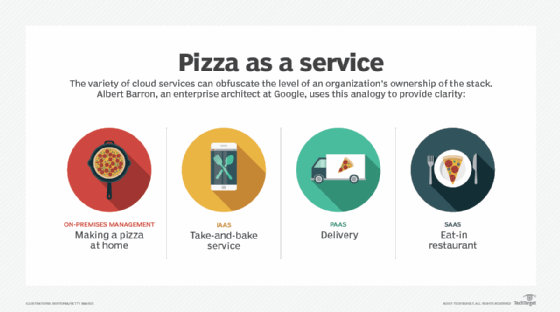

SaaS is one of three main categories of cloud computing services, alongside infrastructure as a service (IaaS) and platform as a service (PaaS). A range of IT professionals, business users and personal consumers use SaaS applications. Products range from personal entertainment, such as Netflix, to advanced IT tools. Unlike IaaS and PaaS, SaaS products are frequently marketed to both business-to-business (B2B) and business-to-consumer (B2C) users.

With a SaaS offering, users only need to focus on utilizing the software, as maintenance and infrastructure management are typically handled by the provider.

How does software as a service work?

SaaS works through the cloud delivery model, where users can access software applications through the internet instead of installing them on their local devices. A software provider hosts the application and related data using its own servers, databases, networks and computing resources, or an ISV contracts a cloud provider to host the application in the provider's data center. The application is accessible to any device with a network connection.

SaaS applications are typically accessed via web browsers. As a result, companies using SaaS applications are not tasked with the setup and maintenance of the software. Users simply pay a subscription fee to gain access to the software, which is a ready-made option.

SaaS is closely related to the application service provider and on-demand computing software delivery models, where the provider hosts the customer's software and delivers it to approved end users over the internet.

In the software-on-demand SaaS model, the provider gives customers network-based access to a single copy of an application that the provider created specifically for SaaS distribution. The application's source code is the same for all customers, and when new features or functionalities are released, they are rolled out to all customers. Depending on the service-level agreement (SLA), the customer's data for each model can be stored locally, in the cloud, or both locally and in the cloud infrastructure.

Organizations can integrate SaaS applications with other software using application programming interfaces (APIs). For example, a business can write its own software tools and use the SaaS provider's APIs to integrate those tools with the SaaS offering.

SaaS architecture

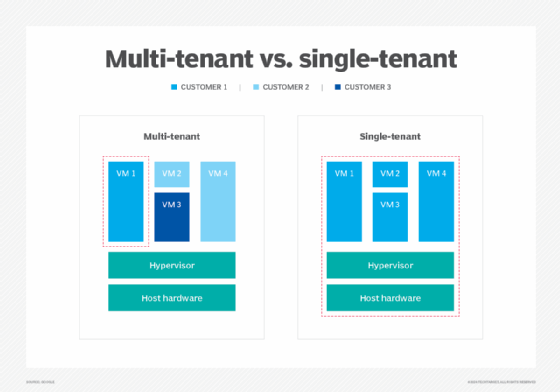

In a SaaS system, each customer is regarded as a tenant and accesses the platform by paying a subscription fee. SaaS architectures generally fall into the following two types.

Multi-tenant architecture

SaaS applications and services typically use a multi-tenant approach, which means a single instance of the SaaS application is running on the host servers and that single instance serves each subscribing customer or cloud tenant. The application runs on a single version and configuration across all customers, or tenants. Though different subscribing customers run on the same cloud instance with a common infrastructure and platform, the data from different customers is still segregated.

The typical multi-tenant architecture of SaaS applications means the cloud service provider (CSP) can manage maintenance, updates and bug fixes faster, easier and more efficiently. Rather than having to execute changes in multiple instances, engineers can make necessary changes for all customers by maintaining one shared instance. Furthermore, multi-tenancy enables a greater pool of resources to be available to a larger group of people without compromising important cloud characteristics and functions, such as security, speed and privacy.

Single-tenant architecture

In a single-tenant architecture, each customer has its own instance of the software. This instance operates on a separate server, while sharing a single infrastructure and database. This means resources are not shared between tenants and each customer's data is kept distinct.

While this setup offers greater control and customization options, it can be more costly for the provider to maintain as it requires it to manage multiple instances.

What are the advantages of SaaS?

SaaS removes the need for organizations to install and run applications on their computers or in their data centers. This eliminates the expense of hardware acquisition, provisioning and maintenance, as well as software licensing, installation and support.

Other benefits of the SaaS model include the following:

- Flexible payments. Rather than purchasing software to install, or additional hardware to support it, customers subscribe to a SaaS offering. Transitioning costs to a recurring operating expense enables many businesses to exercise better and more predictable budgeting. Users can also terminate SaaS offerings at any time to stop those recurring costs.

- Scalable usage. Cloud services such as SaaS offer high vertical scalability, which gives customers the option to access more or fewer services or features on demand.

- Reduced workload on IT. Outsourcing software development and management to a SaaS provider alleviates pressure on internal IT teams, enabling them to concentrate on strategic initiatives instead of routine maintenance tasks.

- Automatic updates. Rather than purchasing new software, customers can rely on a SaaS provider to automatically perform updates and patch management. This further reduces the burden on in-house IT staff.

- Accessibility and persistence. Since SaaS vendors deliver applications over the internet, users can access them from any internet-enabled device and location.

- Customization. SaaS applications are often customizable and can be integrated with other business applications, especially across applications from a common software provider.

- Improved collaboration. Various SaaS applications are designed with collaboration in mind, which enables multiple users to work on the same project simultaneously. This enhances teamwork and improves productivity.

- Reliability. It's typical for SaaS vendors to invest in rigorous cybersecurity protocols and disaster recovery capabilities. Many of these vendors promise 99% or even 99.9% uptime, indicating that users only need a reliable internet connection for swift operations.

- Improved security. The centralized nature of SaaS helps with consistent security management. Most SaaS providers invest significantly in advanced cybersecurity planning and measures, such as encryption, regular updates and strong access controls. They also have dedicated security teams that comply with industry standards and regulations.

What are the challenges and risks of SaaS?

SaaS also poses some potential risks and challenges, as businesses must rely on outside vendors to provide the software, keep that software up and running, track and report accurate billing, and facilitate a secure environment for the business's data. Those risks and challenges include the following:

- Issues beyond customer control. Issues can arise when providers experience service disruptions, impose unwanted changes to service offerings or experience a security breach -- all of which can have a profound effect on customers' ability to use the SaaS offering. To proactively mitigate these issues, customers should understand their SaaS provider's SLA and make sure it is enforced.

- Lost control over versioning. If the provider adopts a new version of an application, it rolls out to all its customers, regardless of whether or not the customer wants the newer version. This can require the organization to provide extra time and resources for training.

- Difficulty switching vendors. As with using any CSP, switching vendors can be difficult. To switch vendors, customers must migrate large amounts of data. Furthermore, some vendors use proprietary technologies and data types, which can further complicate customer data transfer between different cloud providers. Vendor lock-in is when a customer cannot easily transition between service providers due to these conditions.

- Security. Cloud security is often cited as a significant challenge for SaaS applications. This is primarily due to the shared responsibility model that SaaS offers, where both the provider and the customer must ensure security, leading to potential gaps in protection. Additionally, complexities such as data breaches, misconfigurations and lack of visibility into cloud environments can expose sensitive information and increase vulnerability to cyberattacks.

- Cost management. While SaaS can be cost-effective, managing expenses can be complex. Organizations can incur unexpected costs from overprovisioning resources or inadequate usage monitoring, which can quickly outweigh the financial benefits.

SaaS security and privacy

The cybersecurity risks associated with software as a service are different from those associated with traditional software. With traditional software, the software vendor is responsible for eliminating code-based vulnerabilities, while the user is responsible for running the software on a secure infrastructure and network. As a result, security is more the responsibility of the ISV and third-party cloud provider.

Despite the rapid adoption of cloud-based models for fully serviced software products, organizations still have certain reservations about SaaS products when it comes to security and privacy. These concerns include the following:

- Encryption and key management.

- Identity and access management.

- Security monitoring.

- Incident response.

- Poor integration into broader, company-specific security environments.

- Fulfillment of data residency requirements.

- Data privacy.

- Cost of investing in third-party tools to offset the SaaS security risk.

- Lack of communication with technical and security experts during the sales process.

To keep SaaS secure, organizations should conduct the following best practices:

- Adopt a multilayered security strategy, such as multifactor authentication, to ensure that only authorized users can access the system.

- Regularly update software, and apply security patches to protect against vulnerabilities.

- Employ strict access controls through a zero-trust approach. This ensures that all user traffic is verified thoroughly, irrespective of its origin. Encrypt data both in transit and at rest to help safeguard sensitive information from unauthorized access.

- Conduct regular security audits and risk assessments to identify potential weaknesses in the system.

- Educate employees about security best practices, such as recognizing phishing attempts and using secure passwords to help enhance overall security posture.

- Establish clear and successful data governance policies and compliance with relevant regulations to ensure data is handled responsibly and securely.

SaaS vs. IaaS vs. PaaS

SaaS is one of the three major cloud service models, along with IaaS and PaaS. All three models involve cloud providers that deliver their own hosted data center resources to customers over the internet. Where the models differ is in the completeness of the product.

SaaS products are complete and fully managed applications. The application users do not have to download software, manage any existing IT infrastructure or deal with any aspect of software management. Vendors handle maintenance, upgrades, support, security and all other aspects of managing the software.

IaaS is used by companies that want to outsource their data center and computer resources to a cloud provider. IaaS providers host infrastructure components, such as servers, storage, networking hardware and virtualization resources. Customer organizations using IaaS services must still manage their data use, applications and operating systems (OSes).

PaaS provides a framework of resources and development tools for an organization's in-house developers. This hosted platform enables developers to create customized applications. The vendor manages the data center resources that support the tools. Customer organizations using PaaS services do not have to manage their OSes, but must manage applications and data use.

SaaS vendors and examples

The SaaS market includes a variety of software vendors and products that optimize operations across different sectors. Industry players include small, single-product vendors all the way up to cloud giants, such as Amazon Web Services (AWS) and Google Cloud.

SaaS apps and products are also diverse, ranging from video streaming services and messaging apps to IT business analytics tools. There are SaaS applications for fundamental business applications, such as email, sales management, customer relationship management, financial management, human resource management, billing and collaboration. Enterprise SaaS products for specific industries, such as insurance or medical, are known as vertical SaaS products.

SaaS products can be primarily marketed to B2B, B2C markets or both. Some commonly used examples of current SaaS products are the following:

- Adobe Creative Cloud.

- AWS products.

- Atlassian.

- DocuSign.

- Dropbox.

- GitHub.

- Google Workspace apps.

- HubSpot.

- LinkedIn Premium.

- Mailchimp.

- Microsoft 365.

- Netflix.

- Salesforce.

- Shopify.

- Slack.

- Trello.

- Zendesk.

- Zoom.

SaaS pricing

Generally, using a SaaS product is more cost-effective than a traditional software license for enterprise software, as setup and installation onto hardware are not necessary. SaaS providers typically use one of many subscription-based pricing models for customers. By analyzing the available components and business models, companies can craft a pricing strategy that aligns with their goals and fulfills customer expectations.

Common SaaS pricing models include the following:

- Free, or ad-based. A service can be free for users, with the SaaS provider generating revenue through selling advertisement space. In this model, there is typically an option to upgrade to a paid tier that doesn't include intrusive ads.

- Flat rate. Customers are granted access to the software's full suite of features for a fixed monthly or annual subscription fee.

- Per user. Pricing is determined by how many people are using the service for each subscription. There is a fixed price for every user.

- Per-user tiers. Pricing tiers are based on a range of how many active users can exist on a single subscription.

- Storage tiers. Customers can have free access to a service but are required to pay for storage if they wish to continue using the product after they pass the free limit.

- Pay as you go, or usage-based. The more customers use the service, the more they are billed and vice versa in the pay-as-you-go model.

- Per active user. This incorporates aspects of the per-user and pay-as-you-go strategies. Subscribers are billed per user -- but only if the user has been actively using the service beyond a defined threshold.

- Feature-based tiers. Price tiers are determined by the amount of features the subscriber seeks. In this model, reduced versions of the software with limited features are available for a lower price than the maximum functionality tier. Additional feature tiers in between the minimum and maximum functionality tiers can also exist.

- Freemium. The service is generally free to use with an entry-level tier. However, there are typically functional restrictions in place that are designed to upsell customers to a paid tier.

The future of SaaS

The SaaS market is expected to grow considerably, with one report suggesting that 70% of business applications in use today are SaaS-based. This number is projected to rise to 85% by 2025. Key trends shaping the future of SaaS include the following:

- Adoption of artificial intelligence. AI is increasing SaaS adoption by automating management processes. For example, AI automates routine tasks, improves decision-making and provides valuable insights into customer behavior. It also enhances user experience with tools such as chatbots and personalizes interactions through advanced algorithms.

- Vertical SaaS options. There is a growing demand for vertical SaaS options tailored to specific industries, such as healthcare, real estate and manufacturing. These specialized applications address unique industry challenges and requirements, enabling businesses to benefit from more relevant features and functionalities.

- Personalized experiences. Businesses are starting to realize how important it is to provide personalized client experiences. Data-driven customization and AI integration enable SaaS companies to meet individual user needs, which, in turn, fosters loyalty and encourages higher customer spending.

- Cybersecurity enhancements. As cyberthreats evolve, SaaS providers are making significant investments in cybersecurity to safeguard sensitive data and uphold customer trust. They are achieving this goal by utilizing advanced security protocols for their offerings and ensuring compliance with regulations.

- Development of white-label SaaS. White-label software is an application created by one company that can be rebranded, resold or licensed by another company. By rebranding and reselling preexisting software, white-label software enables businesses to join the market more quickly and affordably than they might by creating proprietary products.

- Focus on customer success. Customer success is essential in today's SaaS landscape and is becoming a top priority for most businesses. A Salesforce study indicated that 67% of customers report having high standards than ever for good experiences, emphasizing the need for SaaS companies to invest in customer success initiatives to meet these expectations. By prioritizing customer outcomes and success, companies can not only enhance user satisfaction, but also drive retention and increase profitability.

- Push for environmental, social and governance (ESG) initiatives. Companies are increasingly integrating and adopting ESG practices that not only minimize their ecological footprint, but also enhance their reputation and appeal to socially conscious customers and investors. Some examples of ESG initiatives include securing SaaS ecosystems, adopting sustainability initiatives for data center energy use and designing SaaS products with sustainability in mind to reduce consumption and waste throughout their lifecycle.

Discover key factors to consider when crafting a SaaS security policy. Look into attributes that focus on effective SaaS strategy, such as visibility, user experience and workflow, for enhanced protection.