Cisco IOS (Cisco Internetwork Operating System)

What is Cisco IOS (Cisco Internetwork Operating System)?

Cisco IOS (Internetwork Operating System) is a collection of proprietary operating systems (OSes) that run on Cisco Systems hardware, including routers, switches and other network devices.

Developed in the 1980s by William Yeager, an engineer at Stanford University, the core function of Cisco IOS is to enable data communications between network nodes. Cisco IOS enables the administration, operation and management of Cisco network devices.

Cisco IOS includes the following key features:

- Interface configuration.

- Network management and monitoring.

- Quality of service (QoS).

- Routing.

- Security.

- Switching.

Cisco IOS offers dozens of additional services that an administrator can use to improve the performance and security of network traffic. Such services include authentication, encryption, firewall capabilities, policy enforcement, deep packet inspection, intelligent routing and proxy server capability. In Cisco's Integrated Services Routers, IOS can also support call processing and unified communications services.

In addition to the standard Cisco IOS, there are three primary variants of the OS: IOS XE, IOS XR and NX-OS.

Cisco IOS is not to be confused with Apple iOS, the consumer OS for Apple's mobile devices.

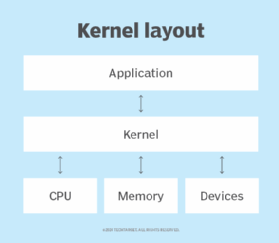

What is Cisco IOS based on?

As proprietary software, Cisco IOS is not based on other OSes, like Linux. It is a monolithic OS with a custom kernel. However, newer incarnations, including IOS XE, are based on a Linux kernel. This provides modularity and other modern features absent in basic IOS, including memory protection, virtualization support, high availability (HA), scalability, automation capabilities, enhanced security features and in-service software upgrades.

Cisco IOS software releases are categorized into what Cisco calls trains, throttles and rebuilds:

- Trains. Trains contain numbers and letters. The number is akin to a software version number, such as 8 or 12. The letter represents the type of release. For example, T (technology) train releases include the newest features and functionality but may be considered less stable. Conversely, M (mainline) train releases focus more on stability, including time-tested features and bug fixes, though that often comes at the expense of more contemporary and novel features.

- Throttles. Throttles are represented as numbers in parentheses, such as (5) or (11). Cisco calls these "a minor version number" to reflect smaller feature updates that do not warrant a full software version update.

- Rebuilds. Rebuilds appear as a number after the train. They are issued primarily for incremental bug fixes.

What is Cisco IOS XE?

Cisco IOS XE is a version of IOS that runs on top of a Linux kernel. It is supported in Cisco's newer enterprise switching, routing and wireless devices. IOS XE is found in a number of Cisco products, including its Catalyst 9000 switches, 1000 Series Aggregation Services Routers and Catalyst 9800 wireless controllers, among others.

Although IOS XE and IOS share a lot of the same code, IOS XE is a more modular, feature-rich version. IOS XE provides more advanced functionality and scalability. Notably, it separates the data plane and the control plane -- providing greater agility -- and enables programmability using open, standards-based interfaces. Other key features and benefits of IOS XE include enhanced user experience, unified management, virtualization of modular architecture, HA and software redundancy.

What is Cisco IOS XR?

Cisco IOS XR runs on networking devices intended for service providers. It has an entirely different codebase from IOS XE. Since its 6.x release, Cisco IOS XR has been based on Linux. Previously, it was based on QNX, a Unix-like OS.

IOS XR is designed for scalability and reducing complexity across massive networks operated by carriers and internet service providers. The latest versions of IOS XR focus on a modular design with management application programming interface (API) integration and network automation. Other key features and benefits of Cisco IOS XR include HA, advanced multicast, extensive QoS and software package management.

What is NX-OS?

Cisco NX-OS is a network OS specifically for data center-oriented products, most notably the Nexus series of switches. NX-OS provides modularity, resilience and scalability. NX-OS also offers enhanced features optimized for modern data centers hosting hybrid clouds and other complex enterprise environments. Key features and benefits of Cisco NX-OS include operational simplicity, architectural flexibility, system resilience and end-to-end visibility.

What are Cisco IOS devices?

Cisco IOS devices are networking hardware devices that run IOS. These devices include a range of networking products, like routers, switches, network security devices, wireless controllers and specialized hardware for wide area network aggregation.

What is Cisco IOS Firewall?

Cisco IOS Firewall is a security feature set available in Cisco IOS. IOS Firewall provides integrated firewall functionality directly within Cisco routers, enabling simultaneous routing and firewall capabilities.

IOS Firewall includes the following features:

- Application inspection and control.

- Context-based access control.

- Disk OS protection.

- Intrusion detection system.

- URL filtering.

- Java blocking.

- Per-user authentication and authorization.

- Stateful packet inspection.

- Virtual private network integration.

What are Cisco IOS commands?

Cisco IOS commands are used to configure, manage and troubleshoot Cisco networking devices. Administrators can enter these commands through Cisco IOS' command-line interface (CLI). These commands can be categorized based on their functionalities, such as global configuration, interface configuration, routing, diagnostic and maintenance commands.

The specific commands and their syntax often vary depending on the IOS version, the device type and the installed feature sets. IOS commands include various subsets of arguments and keywords to enable additional functionality.

What is the help command in Cisco IOS?

IOS' CLI provides context-sensitive help accessible via a question mark (?) prompt. Whenever users type a question mark, it presents a list of available options and commands relevant to the current context. It is important to master Cisco IOS commands to engineer and administer Cisco devices.

Read how network automation software eases challenges for IT and why automation and orchestration software fuel network modernization. Explore seven characteristics of next-generation networking, and learn about elements of modern network security architecture. Check out 12 common network protocols and their functions, and discover four network resiliency factors.