Indoor 5G gets a boost as small cells come to the rescue

Indoor small cells are becoming more common in consumer and enterprise markets. Along with distributed antenna systems and Wi-Fi networks, small cells increasingly enable RF coverage.

5G indoor small cells are low-power cellular base stations designed to provide high-speed 5G coverage within buildings, offices and other indoor locations that traditional macrocell towers struggle to cover effectively.

These small cells are crucial for enterprises because they enable reliable wireless connectivity that supports bandwidth-intensive applications and mission-critical business operations that require high performance throughout indoor facilities.

Why enterprises choose 5G

5G offers faster download speeds than previous cellular standards, but the technology still doesn't offer anywhere near the coverage of 3G and 4G networks, depending on the frequencies the base stations use.

5G operates in three frequency bands, each with its own benefits and challenges:

- Low-band 5G operates from 600 megahertz to 900 MHz.

- Mid-band 5G operates from 1 gigahertz to 6 GHz.

- High-band 5G operates from 24 GHz and higher.

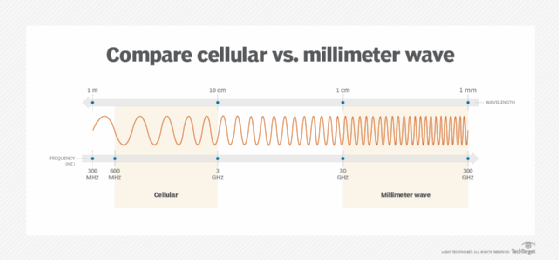

Low-band 5G is slower than mid-band and high-band 5G, but its longer wavelengths enable it to travel farther and penetrate through obstacles such as walls or glass. Mid-band 5G, also known as Sub-6 5G, offers more capacity than low-band 5G and provides greater geographic coverage than high-band 5G. High-band 5G is ideal for achieving fast speeds, but it struggles to cover large distances due to its short wavelengths.

High-band 5G also uses millimeter wave (mmWave) frequency bands, typically from 24 GHz to 100 GHz. While mmWave spectrum offers promising speeds, it struggles with signal interference, attenuation, degraded capacity and object penetration. These drawbacks prevent wireless high-band technology from functioning effectively indoors.

In fact, since AT&T and Verizon first deployed mmWave 5G in 2019 and 2020, respectively, many users have found it difficult to access high-band 5G signals, largely because they aren't consistently available. While users can get fast mobile 5G download speeds of more than 1 gigabit per second (Gbps) if they're outdoors and close to a 5G cell tower, this isn't always possible for those in an office or working from home.

As a result, most carriers have purchased the right to use frequencies in all three spectrum bands to broaden their 5G coverage. Carriers are also deploying networks of small cells for more consistent coverage.

Small cells boost indoor coverage

Cellular small cells are another answer to this coverage problem. First introduced as part of the 3rd Generation Partnership Project 4G Long-Term Evolution (LTE) specification in 2009, these radio access points can increase the density of a cellular network.

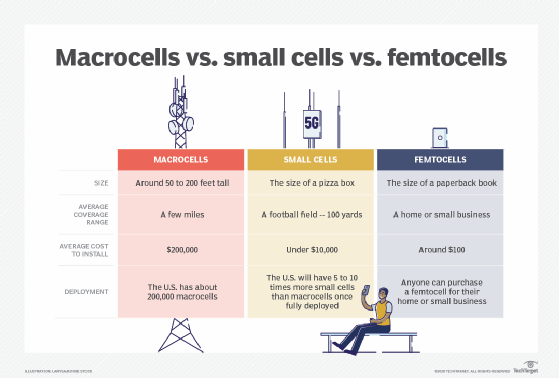

A small cell is a low-powered cellular base station that operates using a variety of frequencies. Depending on their size, small cells can offer a transmission range from 40 feet to a few kilometers. These mini base stations link back to the main cellular network using an Ethernet, fiber or wireless connection.

Small cells can be deployed indoors or outdoors. The indoor variety is generally small -- around the size of a pizza box. These compact gadgets can be installed on the ceilings and walls of homes and offices to boost the radio frequency (RF) signal strength of cellular networks, enabling connected devices to achieve higher data speeds and more reliable connectivity.

5G networks are becoming increasingly dependent on indoor small cells. This trend is likely to continue as more 5G small cells are deployed in offices, homes and apartments.

Carrier developments in the indoor 5G network space

With the deployment of low-band and mid-band 5G cellular networks by U.S. mobile network operators (MNOs), indoor access to 5G technology is becoming more common.

The three major MNOs in the U.S. -- AT&T, T-Mobile and Verizon -- now offer a combination of low-, mid- and high-band 5G networks, with 5G coverage gradually expanding across the U.S. It can take an MNO anywhere from 12 to 18 months to add new small cell 5G sites. Any infrastructure that can be deployed in a shorter time frame is an advantage for a carrier. Carriers are gradually building standalone 5G networks that run on true 5G cores instead of existing 4G LTE core infrastructure.

General 5G access -- indoor and outdoor -- has improved over the years as carriers have rolled out macro network infrastructure, such as macrocell base stations. While small cell deployment has been slower than expected -- due to carrier focus on macro networks -- major carriers are deploying small cells to broaden and intensify coverage as the cellular 5G network expands.

Verizon

Verizon, the largest U.S. MNO, leased 15,000 small cells from shared communications infrastructure provider Crown Castle to support its nationwide 5G deployment through 2025. The lease on each 5G radio lasts 10 years. In March 2025, Crown Castle finalized the sale of its small cell portfolio to EQT, which now manages Verizon's small cell operations. This deal supplements the thousands of 5G small cell sites Verizon has built for itself. Verizon is also deploying small cells that are compatible with C-band spectrum, which operates between 3.7 GHz and 3.98 GHz.

The operator bought licenses for frequency bands in low-, mid- and high-band spectrum, with a focus on its mmWave frequencies at 28 GHz and 39 GHz and C-band spectrum. Verizon's 5G Ultra Wideband service largely relies on C-band and covers 200 million customers in the U.S.

T-Mobile

The second-largest U.S. mobile operator, T-Mobile, has also signed a deal with Crown Castle to deploy 35,000 small cells through 2027, which EQT will also manage. The lease on the units runs for 12 years. T-Mobile has also committed to other small cell initiatives, such as East Hampton Town's plan to build around 200 small cell towers.

T-Mobile primarily relies on low-band spectrum at 600 MHz for its 5G coverage, known as Extended Range 5G. Another important component of T-Mobile's 5G strategy is the mid-band spectrum at 2.5 GHz it received from its merger with Sprint in 2020. T-Mobile's Ultra Capacity 5G combines its mid-band and mmWave frequencies, covering 260 million customers in the U.S.

AT&T

The third-ranked MNO, AT&T, has attempted to reduce the time it takes to acquire sites and permits for deploying small cells. It has field-tested and is deploying commercially available Ericsson Street Radio 4402 small cells in multiple U.S. cities. AT&T, however, hasn't said how many indoor or outdoor small cells it plans to deploy.

AT&T offers low-band 5G that covers 290 million customers in the U.S., while its 5G+ service uses a combination of mid-band and mmWave spectrum. In October 2025, AT&T launched its nationwide 5G standalone network, and continues to deploy Open RAN technology in collaboration with Ericsson and 1Finity, a Fujitsu company.

How do small cells aid 5G indoor coverage?

Despite plans from major MNOs, private enterprises will deploy the majority of 5G small cells.

Research firm IDTechEX predicts that 45 million 5G small cells will be distributed globally by 2031. Some of these small cells will be installed by companies looking to create their own private 5G network for business use cases. For example, according to the Small Cell Forum, the largest small cell investors are manufacturing, utility, energy, retail and transportation companies, as they need to support large geographic areas. By combining a private 5G core with a small cell network, enterprises can implement a secure, reliable, low-latency and high-speed private network on premises.

As both private 5G deployment and enterprise connectivity needs increase, enterprises are installing indoor small cells through multiple approaches: some connect to MNO public networks for enhanced coverage, while others deploy private 5G networks with dedicated small cell infrastructure for secure, mission-critical applications.

Increasing 5G network densification will greatly improve indoor coverage. As noted, indoor environments are not particularly friendly to high-band mmWave 5G radios. Walls can block high-band signals entirely, but even mid-band 5G RF can be weakened by office partitions and furniture.

Enterprises that require high-speed cellular connectivity typically benefit more from mid-band 5G small cells rather than mmWave. While mmWave can deliver speeds of 1 Gbps or more, its limited range and poor building penetration make it impractical for most indoor enterprise environments. Mid-band small cells offer a better balance of speed, coverage and cost-effectiveness.

Distributed antenna systems

Many enterprises use a distributed antenna system (DAS) to distribute cellular signals throughout buildings. Small cell networks can supplement these systems for improved indoor mobile coverage.

DAS vendors, such as CommScope and Corning, work with major carriers to install indoor antenna systems in hotels, hospitals, large office buildings and stadiums. While DAS typically has higher upfront costs than small cells, the cost-effectiveness depends on factors such as building size, user density and coverage requirements. Many enterprises now deploy a hybrid architecture that combines DAS and small cells for optimal coverage and capacity.

Wi-Fi 6

Many smaller businesses can use Wi-Fi to provide indoor mobile coverage for employees, particularly because most cellphones available these days support Wi-Fi calling. Modern Wi-Fi 6 -- 802.11ax – access points increase throughput and reduce congestion on public network bandwidth. Compared to previous Wi-Fi standards, Wi-Fi 6 interoperates more effectively with 5G services, enabling a more heterogeneous network when using both technologies.

Key vendors in the indoor 5G space

Examples of vendors in the 5G small cell market include the following, in alphabetical order:

- Airspan Networks.

- Cisco Systems.

- CommScope.

- Ericsson.

- Mavenir Systems.

- NEC Corp.

- Nokia Corp.

- Samsung.

The blocklisting of Chinese vendors Huawei and ZTE Corp. in 2019 has splintered the global radio access network market, including small cells. In the U.S. and parts of Europe, Chinese vendors are banned from selling telecom infrastructure. In the rest of the world, Huawei is the top telecom vendor.

Editor's note: This article was originally written by Dan Jones and has been updated to reflect industry changes.

Jennifer English is editorial director for Informa TechTarget's AI & Emerging Tech.

Dan Jones is a tech journalist with 20 years of experience. His specialties include 5G, IoT, 4G small cells and enterprise Wi-Fi.