mPOS (mobile point-of-sale)

What is mPOS (mobile point-of-sale)?

MPOS, or mobile point-of-sale, is a smartphone, tablet or dedicated wireless device that performs the functions of a cash register or electronic POS terminal wirelessly.

MPOS solutions require little setup compared to traditional POS. Traditional POS systems will usually use a mini desktop computer connected to a barcode scanner, touchscreen monitor, cash drawer and receipt printer. MPOS can consist of as little as a normal smartphone with a credit card reader and a 5G cell service. This lets mPOS have much less setup cost and they can be used anywhere.

How does an mPOS work?

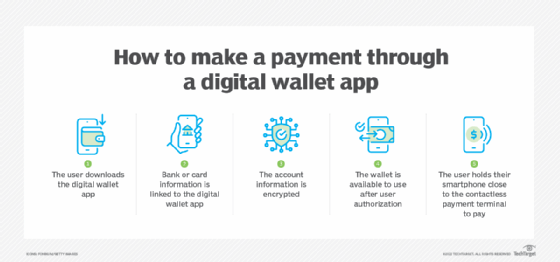

Just about any smartphone or tablet can be converted to an mPOS terminal. The business will sign up with the mPOS provider and download an app onto the device. Typically, a hardware card reader will be plugged into the device's USB-C or lightning port to process near-field communication (NFC) or chip payments. Some readers also provide barcode scanners and receipt printers. Older card readers that use the device's audio jack have been largely phased out. Some can be optionally connected to a Bluetooth receipt printer.

Modern mPOS apps can utilize the smartphone's built-in NFC reader without any additional hardware readers. This can be called tap-on-phone or software POS.

Often, the mPOS provider also acts as the credit card payment processor. No customer or payment data is stored directly on the device. The payments can then be directly deposited into the business' bank account. Other systems can be integrated into a traditional POS system. Some systems also offer entire business management systems with sales, inventory tracking, customer loyalty, returns, gift cards and individual employee accounts.

Benefits of mPOS

MPOS moves the sale to the customer. This can improve the customer experience and reduce wait times. Less space needs to be dedicated to countertop POS. MPOS systems can accommodate various payment methods, including tap to pay cards, chip cards, mobile wallets such as Google Wallet and Apple Pay, and even QR code payments.

MPOS are inherently mobile and require little infrastructure. This makes them a good fit for businesses that do not operate out of a fixed location. Some examples are food trucks, home repair services, farmers markets, vendors at stadiums and cleaning services.

Some mPOS vendors specialize in food and beverage service. They can send orders directly from the server to the kitchen, reducing wait time. A table side ordering system can let guests enter their own orders. Many waiter service restaurants have found success bringing mPOS to the table to finalize transactions.

MPOS can be cheaper than full POS terminals. This can let business open with little capital investment. Even small traditional cash only vendors, such as street vendors, can begin accepting credit card transactions quickly and cheaply. Many mPOS vendors also provide fixed POS tablet-style terminals.

During heavy traffic times establishments that mainly use traditional POS can augment their checkout capacity by equipping salespersons with mPOS terminals. They can complete a transaction on the sales floor while customer interest is at its highest.

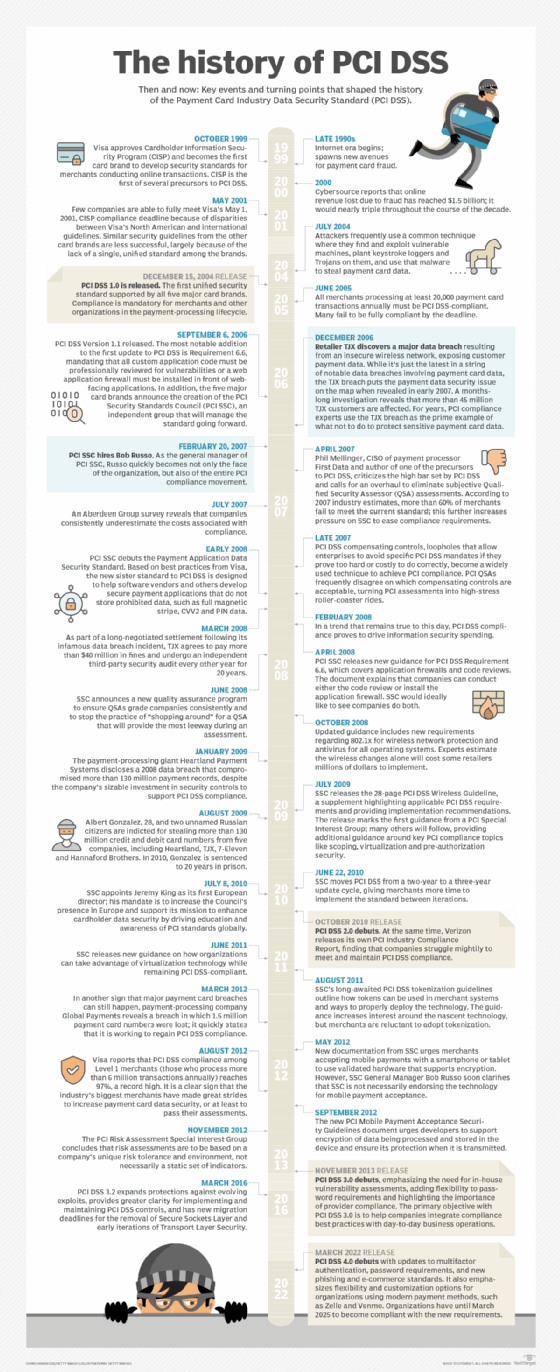

Because most mPOS systems handle the entire transaction, they can reduce the business's liability. No credit or debit card data is stored on the terminal itself. The business doesn't need to worry about most security regulations such as PCI DSS compliance. Some systems even allow for customer loyalty programs.

Drawbacks of mPOS

Total cost of ownership for mPOS might be higher than other systems. While upfront hardware costs might be lower, many mPOS ecosystems have a monthly subscription or higher card processing fees. The higher costs might be worth it for small businesses in exchange for the convenience, but larger businesses might want to investigate other card processors.

The mPOS hardware is often based on mobile phones. The battery life might not be enough to last a full business day and may require a charging dock while not in use. Since the devices are not secured, they may be a target for theft.

Digital wallets are revolutionizing the customer experience by offering greater security, accessibility and convenience. Here's a look at the eight popular digital wallet companies and what they offer.