Getty Images/iStockphoto

Enterprise accounting software explained

Evolving companies often turn to enterprise accounting software, especially when they grow out of SMB software, but aren't yet ready for a complex ERP system.

Counting the beans correctly is essential to running a successful company, as any mistakes could land an enterprise in big trouble. This makes accounting, and enterprise accounting software, some of the more important pieces of the IT infrastructure.

Finance departments use accounting software to manage accounts and perform a variety of financial operations within an organization, including accounts receivable (AR), accounts payable (AP), general ledger (GL) and payroll.

Within businesses, accountants use the data generated by these software applications for internal and external audits, reports and financial analyses needed to meet legal, regulatory or internal requirements.

Enterprise-class accounting software

As part of a business strategy, accounting software brings a level of automation to drive efficiency and productivity. Without these applications, accounting staff would have to perform tasks manually. By automating such tasks, the software can reduce accounting costs and provide upper management with much more accurate and timely reporting.

Accounting software comes in a variety of forms. Which system is best for an organization depends on company size and other factors.

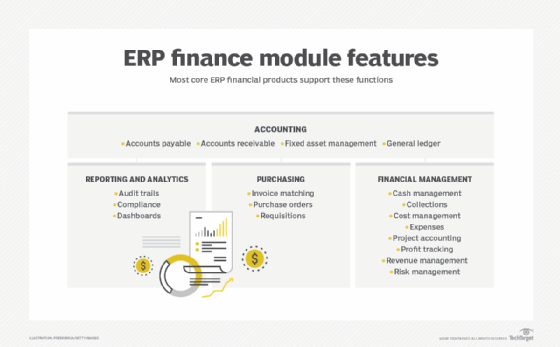

For example, large enterprises in need of lots of features, scalability and integration with other business processes might want to deploy enterprise accounting software modules in enterprise resource planning systems. Using these platforms, enterprises can tie accounting data and functionality to customer relationship management, business intelligence and human capital management systems, as well as inventory.

For SMBs with more limited budgets, there are less costly options such as basic SMB systems available via off-the-shelf -- or, more often, ready-to-download -- packages. These products support many of the basic accounting functions that smaller companies need to run their businesses. While some SMBs can get by with basic spreadsheets, there are popular SMB accounting software options they can consider.

Filling the gap between these options is standalone accounting software, which some vendors brand as financial management suites, enterprise-class accounting software or small to medium-sized enterprise accounting software. Companies in this class have outgrown simple SMB accounting software, often because of an expanding global customer base, multiple locations and distributed inventories.

As with other types of business applications, enterprise accounting software is available for on-premises platforms and the cloud.

The growing accounting software market

The accounting software market was valued at $12.01 billion in 2020 and is expected to reach $19.59 billion by 2026, a compound annual growth rate of 8.5% over the forecast period between 2021 and 2026, according to the report "Accounting software market -- growth trends, COVID-19 impact, and forecasts (2022-2027)" by research firm Mordor Intelligence. The report noted that the financial and accounting software product market has seen numerous changes over the last two decades, including the emergence of cloud-based offerings.

The increasing trend of integrating accounting software with other online applications, such as automated bank feeds and billing features, is expected to further drive the adoption of the software during the forecast period, the report summarized.

The ability to access enterprise accounting software from mobile devices provides organizations with greater flexibility, as it enables staff to handle accounting tasks regardless of time or location. Mobile accounting apps also streamline processes such as sending invoices, accepting payments, logging expenses, tracking receipts and planning budgets.

Most mobile accounting apps offer basic features, such as invoicing and expense tracking, while advanced features include bill reminders, mobile wallets and bank transfers. Mobile access to accounting apps has become especially important as many people continue to work from home or in hybrid work models.

Using optical character recognition (OCR), accounting software can convert images into readable and editable text, and many businesses have implemented the technology into their accounting processes. OCR has also eliminated the need for handwritten forms, checks or printed receipts, uploading all handwritten receipts onto an online accounting platform and extracting relevant text and data at the same time.

AR and AP

Enterprise accounting software can include numerous core modules and functions to support the basic financial processes necessary to run a business.

One such module is AR, which is the money owed to a company from outside entities, such as customers. This includes payments for goods or services, which are usually sent to customers in the form of invoices generated by the company. AR is included in balance sheets as an asset.

Software enhances the AR process by automatically tracking the money owed to a business. When a company invoices or receives payment from a customer, the application records the transaction. The software enables companies to automate AR workflows, such as creating estimates, sales orders and invoices; recording payments from customers; and depositing payments in a bank. Keeping accurate records of AR transactions is key to creating financial reports for tax purposes.

Another module is AP, which is the money companies owe to outside entities, such as suppliers and service providers. The software shows this as a liability on a company's balance sheet.

Accounting software for enterprise customers automates the processes involved in AP, including approving invoices received from suppliers, recording data in the invoices and making payments. As with AR, software automates AP workflows, such as creating purchase orders, receiving inventory from a supplier, entering bills against inventory and paying bills.

General ledger

The general ledger serves as the backbone of an accounting system. The GL includes all the transactions related to a company's assets, liabilities, equity, revenue and expenses.

The GL serves as a central repository for accounting data from all modules, such as AP, AR, cash management, fixed assets and purchasing. In some accounting packages, reports or dashboards highlight financial performance across a combination of metrics. This enables managers to quickly access the information they need to make decisions.

Payroll

Payroll is another key function that enterprise accounting software can enhance. Payroll is an organization's list of employees, as well as data about each employee's salary, bonuses and tax withholding. The term can also refer to the total amount of money paid to employees. Accurately tracking payroll is vital because it typically has an outsized effect on the net income of the organization, which must also comply with numerous regulations related to payroll.

Accounting software helps enterprise customers manage payroll and pay employees accurately and in a timely manner, while withholding the correct amount of taxes. The payroll module also helps calculate paychecks and payroll taxes accurately, and establishes parameters such as pay rates and direct deposit processing. It is often paired with modules that track employee time off and provide healthcare and retirement benefits.

These are just a few key examples of how enterprise accounting software can help companies enhance financial processes. Other areas covered by these software programs include purchase orders, bookkeeping, and budgeting and forecasting. Given the importance of all these functions to a business and ensuring the accuracy of related data, it's easy to see why selecting the right accounting software should be a high priority for any organization.