What is risk assessment?

Risk assessment is the process of identifying hazards that could negatively affect an organization's ability to conduct business. These assessments help identify inherent business risks and prompt measures, processes and controls to reduce the effects of these risks on business operations.

Different industries present different types of hazards, and as such, risk assessments vary from industry to industry.

Risk assessments identify potential hazards to help ensure the health and safety of employees and customers. The goal of this process is to determine what measures should be used to mitigate those risks. For example, certain hazards or high risks might determine the type of protective gear and equipment a worker needs.

As a risk assessment is conducted, vulnerabilities and weaknesses that could make a business more hazardous are analyzed. Potential vulnerabilities include construction deficiencies, security issues and process system errors. A company can use a risk assessment framework (RAF) to prioritize and share the details of the assessment, including risks to its IT infrastructure. The RAF helps an organization identify hazards and the business assets those hazards put at risk, as well as potential short- and long-term fallout if these risks happen. If a hazard has a large enough impact, then a mitigation strategy can be constructed.

In large enterprises, the chief risk officer (CRO) or a chief risk manager usually conducts the risk assessment process. Risk assessments are also a major component of a risk analysis, which is a similar process of identifying and analyzing potential issues that could negatively affect key business initiatives and projects.

The goal of risk assessments

The overall goal of a risk assessment is to evaluate potential hazards, determine the inherent risk that they create and remove or mitigate them. The specific goals of a risk assessment vary based on the industry, business type and relevant compliance rules.

For example, an information security risk assessment should identify gaps in the organization's IT security architecture, as well as review compliance with infosec-specific laws, mandates and regulations. Some common goals and objectives when conducting an IT risk assessment include the following:

- Develop a risk profile that provides a quantitative analysis of the types of threats the organization faces.

- Develop an accurate inventory of IT assets and data assets.

- Justify the cost of security countermeasures to mitigate risks and vulnerabilities.

- Develop an accurate inventory of IT assets and data assets.

- Identify, prioritize and document risks, threats and known vulnerabilities to the organization's production infrastructure and assets.

- Determine budgeting to remediate or mitigate the identified risks, threats and vulnerabilities.

- Understand the return on investment if funds are invested in infrastructure or other business assets to offset potential risk.

- Encourage ongoing risk evaluation and adjustment of risk controls to adapt to new threats and changes in operations.

- Prepare for and recover from disruptions to minimize downtime and loss.

Risk assessment steps

How a risk assessment is conducted varies widely, depending on the risks unique to a business's industry and the compliance rules applied to that given business or industry. However, organizations can follow these five steps, regardless of their business type or industry:

- Identify the hazards. Identify any potential hazards that, if they were to occur, would negatively influence the organization's ability to conduct business. Potential hazards that could be considered or identified during risk assessments include natural disasters, utility outages, workplace accidents and cyberattacks.

- Discover what or whom could be harmed. Determine which business assets would be negatively influenced if the risk came to fruition. Business assets deemed at risk can include critical infrastructure, IT systems, business operations, company reputation and employee safety.

- Evaluate the level of risk and develop control measures. A risk analysis can help identify how hazards will impact business assets, as well as define a risk management framework to minimize or eliminate the effect of these hazards on business assets. Other threats include property damage, business interruption, financial loss and legal penalties.

- Record the findings. The risk assessment findings should be recorded by the company and filed as easily accessible, official documents. The records should include details on potential hazards, their associated risks and management plans to prevent the hazards.

- Review and update the risk assessment regularly. Potential hazards, risks and their resulting controls can change rapidly in a modern business environment. For example, workplace changes, from updated equipment to new hires, bring their own set of potential safety challenges. Therefore, it's important for companies to update their risk assessments regularly to adapt to these changes.

Risk assessment tools and frameworks, such as risk assessment templates, are available for different industries. They might prove useful to companies developing their first risk assessments or for updating older ones. Some examples of these frameworks include the National Institute of Standards and Technology Cybersecurity Framework for cybersecurity purposes, ISO 27001 for IT purposes or the CSA Standard Z1002 for health and safety purposes.

Examples of risk assessments by field

The components of a risk assessment differ, depending on an organization's industry. Typically, an assessment considers specific needs and provides corresponding security control measures.

Some examples of risk assessments include the following:

- Cybersecurity risk assessments. Team members within an organization use these to identify and prioritize risks from cyberthreats associated with the organization's systems and data.

- IT risk assessments. IT or network staff use these to identify any risks facing information systems, networks and data.

- Health and safety risk assessments. Safety managers use these to identify hazards that fall under biological, chemical, energy and environmental risks that apply to a workplace or job.

- Workplace risk assessments. Both office and school administrators use these to ensure a workplace is free from health and safety hazards.

- Project management risk assessments. Project managers and team members use these to identify potential risks, hazards and impacts that a project faces.

- Environmental risk assessments. Risk assessors and organizations such as the U.S. Environmental Protection Agency use these to assess any human or ecological health risks associated with exposure to possible environmental contaminants. This type of assessment determines an acceptable level of contaminants that doesn't threaten public health.

- Climate risk assessments. Organizations and climate risk analysts use these to assess the potential of climate-related events and trends that could cause damage and loss, such as high or low temperatures, precipitation and hurricanes.

- Aerospace and transport risk assessments. Organizations use these to analyze risks, assess flight safety, evaluate vehicle malfunction probabilities and identify operational risk hazards for accident prevention.

- Education risk assessments. These assessments evaluate risks related to student safety, emergency preparedness and cybersecurity in digital learning environments.

What are the benefits of risk assessments?

Risk assessment offers numerous advantages, helping organizations proactively identify and address potential threats. Some key benefits include the following:

- Identification of potential hazards. Risk assessments enable organizations to have a proactive risk management strategy that identifies threats to individuals, processes and assets. This lets them address risks before they escalate into serious issues.

- Improved decision-making. By systematically evaluating risks, organizations can make informed decisions about resource allocation and strategic priorities.

- Enhanced safety and compliance. Risk assessment ensures adherence to regulatory requirements and industry standards such as the Occupational Safety and Health Administration and the International Organization for Standardization (ISO). This reduces liabilities and prevents accidents and legal violations.

- Minimized financial losses. Risk assessments identify cost-effective mitigation strategies, reducing the potential effects of unforeseen risks.

- Business continuity. Risk assessments identify critical vulnerabilities that could disrupt business functions, ensuring operational resilience. By proactively assessing potential risks, such as supply chain failures, data breaches, cybersecurity threats and natural disasters, organizations can develop effective contingency plans.

- Improved customer trust. Risk assessments demonstrate a proactive and responsible approach to risk that builds trust with customers, stakeholders and regulators.

How to use a risk assessment matrix

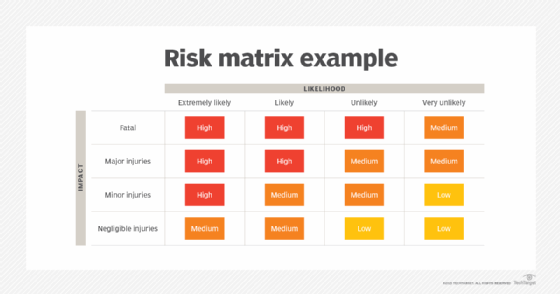

A risk assessment matrix shows the likelihood of events happening and the potential consequences. It categorizes risks by assigning impact levels such as high, medium or low, on a numerical scale, ranging from 1 to 25 for effective risk analysis.

In the following example, Likelihood refers to the level of possibility that a person could be injured if exposed to a hazard, while Impact refers to the severity of the injury.

Risk matrixes can be created as 2×2, 3×3, 4×4 or 5×5 charts -- the level of detail required can help determine the size. Color coding the matrix is critical, as this represents the probability and impact of the risks that have been identified. Injury severity and consequence could be assessed as fatal, major injury, minor injury or negligible injuries. Similarly, likelihood could be assessed as extremely likely, likely, unlikely or highly unlikely.

Risk assessment vs. risk analysis

The distinction between risk assessment and risk analysis is subtle but important. Essentially, risk assessment is about understanding the risks, while risk analysis is about deciding how to handle them.

Risk assessment

This is the broader risk management process of identifying, analyzing and measuring potential risks. It involves assessing the likelihood and effects of various risk factors, often using qualitative or quantitative methods. Steps such as risk identification, risk analysis and risk prioritization are typically included in a risk assessment.

Risk analysis

Also called risk evaluation, this is a more focused step within risk assessment. The identified risks are compared against predefined criteria or benchmarks to determine their significance. In this stage, an organizations decides whether risks are acceptable or require mitigation, based on the organization's risk appetite and tolerance.

Quantitative vs. qualitative risk assessment

Risk assessments can be quantitative or qualitative.

Quantitative risk assessment

This involves assigning numerical values to the probability of an event occurring and its potential impact. The CRO or risk manager uses these values to calculate an event's risk factor, which, in turn, can be mapped to a dollar amount. Methods in quantitative risk assessment typically include probability analysis, cost-benefit analysis or Monte Carlo simulations to calculate the event's risk factor, which can then be translated into a dollar amount.

Qualitative risk assessment

This approach is used more often and doesn't involve numerical probabilities or predictions of loss. The goal of a qualitative approach is to simply rank which risks pose the most danger.

While qualitative risk assessment is based on a person's judgment of risk, quantitative risk assessment is based on specific data. It often involves risk matrices, scenario planning or interviews. This approach is beneficial when precise data isn't available or when assessing broader organizational risks.

Learn more about how risk assessment differs from risk management and risk analysis.