Getty Images/iStockphoto

5 examples of records management

Examples of records management vary by types of records, such as front- and back-office records, and processes, such as retention schedule management and records disposal.

Organizations that want to implement a records management program must first create records policies and processes.

Common records management processes include maintaining retention schedules, creating audit trails and disposing of records. However, the exact procedures records managers use to execute these can vary based on a record's type, like whether it's paper, electronic, back-office or front-office. The balance of risk between regulatory mandates and business requirements also depends on the specific record type.

To implement an effective records program, content management professionals should understand common examples of records management processes and how they relate to different types of records.

Types of records

Although organizations can categorize records in many ways, content managers commonly think of records in terms of their formats and business purposes.

Paper and electronic

The most obvious distinction is between paper and electronic records. While most paper records are older documents that organizations must retain for business or legal reasons, many businesses still generate new paper records.

The same retention policies and regulatory requirements that govern paper documents also govern electronic records. However, paper records require more manual processes, such as physically locking cabinets and shredding documents.

Back- and front-office

Another difference is between back- and front-office records. Back-office records track everyday business transactions, like invoices or receipts, and have clear rules about how long organizations must keep them, regardless of industry.

Front-office records, also known as mission records, are unique to each organization and often contain personally identifiable information (PII) from clients and partners. Examples include customer profiles, marketing plans and customer correspondence.

Most front-office records have complex lifecycles and require strong information governance programs to identify and protect the information for ongoing value. Organizations often want to keep these records longer than required because they can inform future business strategies. For example, a retailer might want to keep customer behavioral data for years to identify and learn from long-term trends. However, the long-term retention of customer data can increase compliance risk.

Examples of records management

Most organizations use the same core processes, such as managing retention schedules and creating audit trails, to create effective records management programs.

1. Manage retention schedules

Records management teams must create retention schedules that ensure compliance with external regulations, such as the Sarbanes-Oxley Act, and internal business requirements. Regulations and requirements specify how long organizations may keep different records, such as financial documents or customer data.

Organizations must also continually review and update their policies because retention requirements might change due to evolving regulatory and business environments. These periodic reviews can ensure compliance in quickly changing regulatory landscapes.

2. Integrate into workflows

Organizations must integrate records management best practices into their workflows to ensure employees follow them. Most organizations generate more front-office records than back-office, so integrating front-office records within existing workflows can challenge organizations the most.

Organizations typically send paper documents to a records center where trained employees apply the proper policies without slowing the flow of business. To ensure workers can easily manage electronic records, on the other hand, organizations can automate certain management processes.

Automation tools can identify key information, such as the file type, author and keywords, from a record's context, to help employees properly manage that document. This automation frees people to perform their core job duties.

3. Create audit trails

Paper records can leave obvious clues when people alter them, such as the inclusion of new handwriting or ink colors. However, people can struggle to detect changes in electronic records, so organizations should keep an audit trail of every action to prove an electronic record's authenticity.

Front-office records have long, complex lifecycles, and audit trails can capture the entire history of these records. They can also help organizations prove they followed regulatory best practices and, in turn, resolve potential lawsuits against the organization.

4. Dispose of outdated or unnecessary records

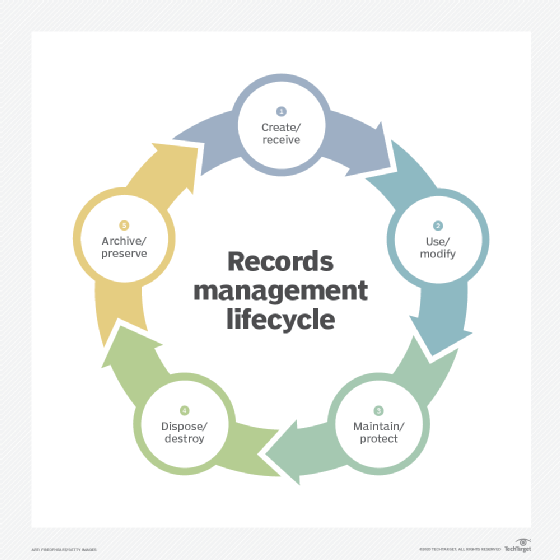

Disposal is the most important step in a record's lifecycle, especially for legal departments. As organizations delete records, they remove most of the risk related to those documents, which can come from PII spills or embarrassing information leaks.

However, some records have historical importance and business value outside of the norms defined in the retention schedule. To identify those traits or other key exceptions, employees should gather proper approvals from business leaders before they dispose of any records. Records management teams should document strong reasons as to why those records sit outside the retention schedules because a well-documented approval process can help organizations defend their disposal practices in court.

5. Monitor the program

Like any ongoing business effort, organizations must evaluate records management programs for effectiveness. Can people quickly find and access records? Do employees use front-office records frequently enough over the years to justify retention periods longer than those required by law?

Records management teams base their strategies and programs on the regulatory and business environments at the time. As a result, they should reevaluate these strategies every few years to ensure they meet current needs.

Key takeaways

A properly executed records program boosts efficiency over time. Like any business program, it comes with an investment period. However, once the records management team implements it, people can more easily find and use records, which can lead to improved productivity.

A records program also reduces legal risks. Although organizations might struggle to quantify this benefit, the records program should bring comfort to executives, as it protects their organizations from legal challenges competitors might face.

Laurence Hart is director of consulting services at CGI Federal and has more than 20 years of IT experience.