contactless payment

What is a contactless payment?

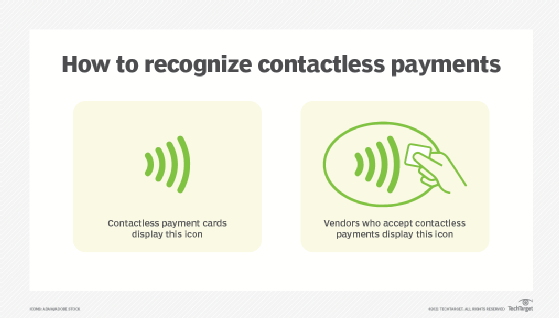

A contactless payment is a wireless financial transaction in which the customer makes a purchase by moving a security token in close proximity to the vendor's point of sale (POS) reader. Popular security tokens for contactless payment include chip-enabled bank cards and smartphone digital wallet apps.

Contactless payments can also be referred to as touch-free, tap-and-go or proximity payments. When goods or services are purchased through a contactless payment, the process can then be referred to as a frictionless checkout.

Contactless payments are known for being secure because the customer does not share billing or payment information directly with the vendor. Instead, all communication is encrypted, and each purchase is tokenized with a one-time transaction number. Should a wireless transmission be intercepted, the only information the attacker will get is the one-time code that was used to identify a particular transaction.

The adoption of contactless payment was accelerated by the COVID-19 pandemic and a desire for consumers to avoid person-to-person contact when making in-store purchases. The U.S. Payments Forum and EMV -- named for the organizations that established it, Europay, Mastercard and Visa -- are responsible for setting the technical standards for smart payment cards as well as for the POS readers that accept them.

History of contactless payment

Important events in the history of contactless payment include the following:

- 1995. The Seoul Bus Transport Association launches the world's first contactless payment card for commuters.

- 1996. The first version of the EMV security standard is published.

- 2004. Contactless cards are used for the first time in the U.S.

- 2008. Visa, American Express and Mastercard all start offering contactless credit cards.

- 2011. Google Wallet and Android Pay are launched, enabling contactless payments through smartphones rather than cards.

- 2015. The U.S. implements EMV, prompting thousands of merchants to switch over to near-field communication (NFC) terminals that enable contactless payments.

- 2018. Google Wallet and Android Pay unify as a single system named Google Pay.

- 2020. Concerns about COVID-19 increase contactless payment adoption in the U.S.

Standards that support contactless payments

Frictionless checkouts are supported by NFC, radio frequency identification (RFID), magnetic secure transmission and quick response code standards. Most retailers in the U.S. accept some form of contactless payment.

Visa, Mastercard and American Express offer contactless-enabled bank cards, while Apple Pay, Google Pay, Samsung Pay and Venmo are among the most popular digital and mobile wallet apps for smartphones.

How do contactless payments work?

Contactless payment cards and authorized mobile devices have an embedded RFID microchip, transponder and antenna. To make a purchase, the customer must be in close proximity to the vendor's reader.

Neither Apple Pay nor Google Pay processes or authorizes transactions. Instead, they tokenize the shopper's payment card and simply pass that information on to the appropriate credit card network.

The microchips used in contactless payments generate new verification values each time a card or authorized device is used in a transaction. This approach is very different from how magnetic stripe cards transmit data.

With a traditional magnetic card, the customer's billing information is transmitted to the card reader each time the card is swiped. That information can be intercepted and used by another person, or perhaps sold on the dark web. When a transaction is conducted wirelessly, however, the only information that can be intercepted is the unique authentication code that identifies that specific transaction has occurred.

Because a new code is generated each time a chip card is used, it is very difficult for thieves to clone the card and try to make purchases. The dynamic authentication technology is simply not capable of being duplicated in a manner that will return the same dynamic codes as those that a valid chip card would return. In addition, smartphones have added security methods for initiating contactless payments -- for example, requiring the user to authenticate their identity via a method such as facial recognition.

What benefits do contactless payments offer?

Aside from improved security, contactless payments can improve checkout speed. These payments take less time than standard credit card payments and are faster than cash transactions. This makes them a good fit for micropayments and other low-dollar-value purchases.

Contactless payment methods can also increase throughput for public transportation turnstiles, parking garage checkout terminals and road tolls. Although the actual amount of time saved per transaction might be less than a minute, the minutes saved can add up and significantly reduce the time customers spend waiting in lines.

As contactless payment technology gains acceptance, nontraditional banking institutions and third-party payment providers such as PayPal have begun to experiment with ways to improve frictionless checkout. For example, some payment providers offer GPS technology to help mobile customers locate ATMs. Other providers let customers opt in to loyalty promotions conducted through targeted geofenced campaigns.

Editor's note: This article was written in 2021. TechTarget editors revised it to improve the reader experience.