Getty Images

The clear business case for environmental sustainability

Environmental sustainability isn't just an exercise in 'doing good' -- it has a clear ROI. Here's how to get it.

The most successful companies recognize that sustainability initiatives can -- and must -- strengthen profitability, resilience and growth.

In an environment where regulatory support for sustainability fluctuates, leaders can take a pragmatic approach to pursue sustainability initiatives that deliver direct bottom-line results. There are win-win sustainability initiatives that strengthen profitability and market position, and deliver value to shareholders, customers and employees. Those are the areas where sustainability drives tangible business outcomes and where sustainability is integral to business strategy.

Leaders across lines of business can make a business case for sustainability initiatives based on tangible objectives: cost savings, risk reduction, revenue growth and competitive advantage.

Cost savings

One of the straightforward ways that sustainability drives business value is through operational efficiency. Improving energy efficiency, reducing material waste and optimizing logistics all translate directly into lower costs.

In manufacturing, leaner processes often mean less energy consumption and lower material waste, directly improving margins. In real estate, energy-efficient buildings not only reduce operational costs, but also retain higher asset values over time. By redesigning and optimizing delivery routes, logistics firms can minimize fuel usage and realize significant savings. Sustainability programs aimed at operational efficiency usually yield fast, measurable returns, and this is a critical way to strengthen executive support.

Risk reduction

Supply chain disruptions, resource scarcity and climate-related disasters are unfortunately frequent realities that affect businesses today. Sustainability can serve as a strategic tool to reduce exposure to these risks. Companies that diversify supply chains and invest in more resilient infrastructure are better positioned to weather such disruptions.

The goal is not to mitigate against every hypothetical risk, but to make investments where risk exposure is clear and financially material. For example, companies that invest in water-efficient manufacturing processes are better positioned during droughts or regional water shortages. Sustainability can be a key lever for ensuring business continuity.

Revenue growth

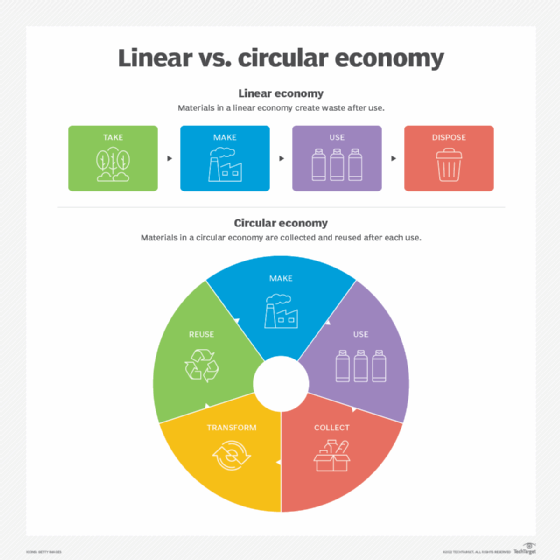

Sustainability can be a growth driver for new markets and new revenue streams. Resale, rental and refurbishment business models are unlocking new revenue streams in sectors like apparel, luxury goods, electronics and tech.

Consumers, especially younger demographics, are gravitating toward brands that reflect their environmental values. Products that deliver sustainability benefits that customers value -- such as longer durability, lower lifetime costs or improved energy performance -- can command higher margins and enhance loyalty. Success depends on premium brand equity, logistical efficiency and customer willingness to pay.

Business leaders should assess where they can profitably operationalize these circular business models -- such as with data centers -- and companies should assess whether there is a clear, scalable and profitable business case for green products and product extensions.

Competitive edge

When done right and authentically, sustainability can build meaningful competitive advantage. But superficial efforts without any substance are easily exposed and diminish credibility rather than enhance it. In consumer markets, authentic sustainability credentials that are backed by actual product or service improvements offer opportunities for differentiation without eroding margins.

For example, in procurement, companies offering lower-carbon or sustainably sourced products can secure preferred supplier status with major buyers that have established sustainability goals. Companies with credible sustainability track records also tend to outperform in talent acquisition and retention, as employees align with their sustainability goals.

How to ensure profitable ESG

Sustainability as a business driver doesn't just happen. It requires that business, sustainability and IT leaders work together to get strategic. Here are some best practices they can prioritize.

Prioritize financially material initiatives

Not all sustainability efforts are equal in financial impact. Companies must rigorously assess the ROI of potential initiatives and software, just as they would with any capital investment.

Best practices here include the following:

- Conduct a full cost-benefit analysis of each sustainability project. Start with initiatives that deliver fast savings or direct revenue gains -- for example, energy retrofits and waste reduction programs.

- Avoid spreading resources across too many projects. Focus on a small number of high-impact moves initially. Early financial wins build momentum and credibility, laying the foundation for longer-term initiatives.

Integrate sustainability into core strategy

Sustainability must be integrated into business strategy, not bolted on to make the company look good. It should be embedded where it reinforces what the company already does best. For example, leaders at energy companies should focus on storage and grid modernization, where incentives align with long-term market shifts. Leaders in manufacturing companies should focus on operational efficiency. Those at consumer brands should explore resale or rental models only if they enhance the company's core value proposition.

Best practices here include the following:

- Avoid tacking on sustainability programs that are disconnected from the company's core capabilities.

- Set sustainability targets that align directly with business KPIs, such as margin improvement, revenue growth or market expansion.

- Make business unit leaders, not just sustainability teams, accountable for sustainability outcomes.

Build resilience to policy and market fluctuations

Government policies and consumer expectations around sustainability are in constant flux. A sustainability strategy that depends on external support is fragile; one anchored in business value is resilient. Companies that succeed treat sustainability as a lever for long-term market resilience, not short-term political compliance.

Best practices here include the following:

- Monitor emerging ESG regulations to stay ahead rather than react.

- Position sustainability initiatives as value-creation plays, not compliance obligations.

- Focus on initiatives that reduce input costs or create premium revenue opportunities, regardless of external policy support.

Scale through partnerships

Sustainability challenges are often too complex for one company to solve alone. Strategic partnerships can accelerate results and reduce risk. Ecosystem thinking and shared investment models enable companies to scale sustainable innovation faster and keep it affordable.

Best practices here include the following:

- Collaborate across the supply chain to codevelop sustainable materials and processes.

- Partner with startups and innovators in clean tech, circular economy strategies and AI for sustainability.

- Participate in industry alliances that push for common sustainability standards and open new business opportunities.

Companies that treat sustainability as a compliance cost will find themselves outpaced. Those that embed sustainability into how they create, deliver and capture value will unlock new sources of competitive advantage and profits.

Sustainability need not be just about "doing good" -- it's also a great way to build companies that are more profitable, more resilient and better positioned for the future.

Kashyap Kompella is an industry analyst, author, educator and AI adviser to leading companies and startups across the U.S., Europe and the Asia-Pacific regions. Currently, he is CEO of RPA2AI Research, a global technology industry analyst firm.