What is corporate performance management (CPM)?

Corporate performance management (CPM) encompasses the processes and methodologies used to align an organization's strategies and goals to its plans and actions as a business. CPM products are generally data-driven, using many data sources and business processes. Software and other management tools facilitate the development of operational plans that drive CPM goals. Numerous providers offer corporate performance tools.

CPM is a subset of business intelligence (BI). It involves monitoring and managing an organization's performance, according to key performance indicators (KPIs) such as revenue, return on investment, overhead and operational costs.

Gartner coined the term corporate performance management and developed the concept in 2001. Since then, CPM has evolved as workplace practices and technologies have changed. The increased use of Agile methodologies affected the concept significantly.

Today, Gartner describes strategic CPM in terms of corporate financial planning and other types of planning, such as operational risk, human resources and sales planning. CPM is also known as business performance management, enterprise performance management and financial performance management.

How does corporate performance management work?

CPM is a framework and not a specific strategy. For CPM to be useful, organizations must create a suite of analytical applications that can support the decision-making processes, methods, metrics and outputs used in CPM.

Some of the strategic frameworks and management methods used in CPM include the following:

- Balanced scorecard.

- Six Sigma.

- The European Foundation for Quality Management Excellence Model.

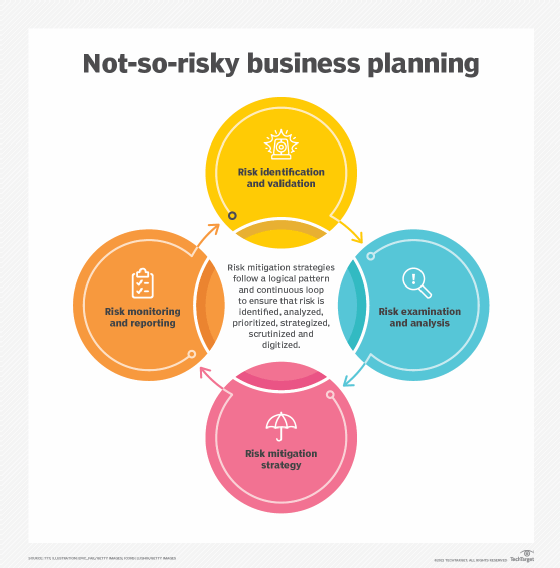

The goal of CPM is to provide companies with significant business insights through processes like budgeting, scenario analysis, financial planning, financial consolidation, forecasting and data reporting. CPM is also aligned with supply chain management (SCM) and risk management practices.

SCM is responsible for planning, controlling and executing a product's journey from materials to production to distribution in the most efficient, economical way possible. Risk management enables organizations to track the related risks of each plan or process alongside the performance results.

Importance of corporate performance management

CPM is a primary focus for most senior executives. By integrating business planning, sales, marketing, forecasting and budgeting for finance, human resources and operations, organizations can link their organizational goals and strategies to their plans and execution. Alignment around a company's strategic priorities puts the focus on key business operations drivers and the business metrics that must be optimized to improve revenue and grow profits.

CPM includes important management processes such as the following:

- Creating a business model and identifying business goals.

- Budgeting, planning and forecasting.

- Merging results and closing financial books.

- Sharing results with all internal and external stakeholders.

- Analyzing business performance versus plans, previous years, and across products and divisions.

- Remodeling based on the results and new forecasts.

CPM is especially crucial for companies looking to cut operational costs, improve the KPI alignment, remodel the budget, upgrade financial planning processes or improve organizational strategies.

Since CPM matters to C-level executives, many organizations have a department dedicated to strategy and performance management. This department is often associated with risk management and project management functions.

The goal of a performance management department is to use CPM methods and tools to handle the measuring and reporting of performance results, and for easy management of strategic projects, communications, alignment and strategic planning. The department is sometimes referred to as the office of strategy management or the project management office. Certification programs are available to train performance management experts.

CPM metrics

The business metrics or KPIs that CPM uses provide measurable values that reveal how a company has progressed relative to its strategic goals. The information used to create these metrics often comes from books of accounts, including income statements, balance sheets and cash flow statements. It can also come from budgeting and forecasting data, such as revenue, expenses and inventory reports.

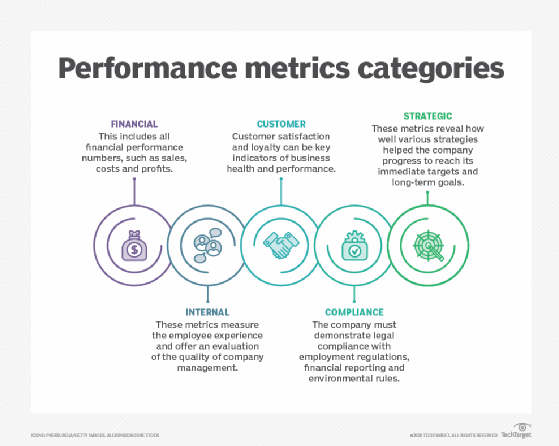

CPM performance metrics can be organized into the following categories:

- Financial. This includes all financial performance numbers, such as sales, costs and profits.

- Internal. The employee experience can have a significant impact on the company's performance. Internal metrics help evaluate the quality of company management.

- Customer. Customers provide the company's income. Customer satisfaction and loyalty are key indicators of business health.

- Compliance. The company must demonstrate legal compliance with employment regulations, financial reporting and environmental rules.

- Strategic. These metrics reveal how well the company executed the strategies that management articulated to reach immediate targets and move toward long-term organizational goals.

Risk is another important metric of broad impact. Being aware of external and internal risks, threats and vulnerabilities -- and how to mitigate them -- helps ensure performance goals can be achieved.

The following are some examples of specific metrics in these categories:

- Sales revenue. This financial metric reveals month-over-month sales results. It's also a gauge of whether marketing efforts are paying off, if people are interested in buying the product or service, and whether the company still holds a competitive market position.

- Net profit margin. This financial metric shows how efficiently a company generates profit on its revenue and can be used to predict long-term business growth. Generated income must exceed operational costs for a company to have a sustainable future.

- Gross margin. This is another financial metric that measures a company's productivity. The higher the gross margin, the more a company earns from every sales dollar. This metric can reveal if processes and production have improved, making it a beneficial metric for new companies.

- Sales growth. This financial metric shows the pace at which a business's sales revenue is increasing or decreasing. Sales growth should be monitored over various periods, such as monthly, annually and longer-term, for holistic insight.

- Employee well-being. This internal metric measures employee satisfaction rates using surveys and other HR tools. Employees happy in their job are more productive and engaged. High satisfaction levels can lead to increased employee retention rates and long-term business success.

- Qualified leads per month. This customer metric reveals whether a company is targeting the right audience or market and is capable of generating new customers. If this metric declines, it's an indication that the company should reevaluate its sales and marketing strategies.

- Customer retention rate. The number of customers who make repeat purchases or continue using the company's product over an extended time is the customer retention rate. A decline in retention rate is a red flag that prompts quick action, such as a potential redesign of how customers are served.

Corporate performance management software

CPM software has historically been used in finance departments. Today's products are designed to be used enterprise-wide, often as a complement to BI systems, providing historical and real-time data. CPM software includes forecasting, budgeting and planning functions, as well as graphical scorecards, visualizations and dashboards to display and deliver corporate information.

Analysts use a CPM user interface to get the bigger picture and insights from bringing all this data together in one place. It displays KPIs so that employees can track individual and project performance against corporate goals and strategies.

The following benefits come from CPM software and the data integration it provides:

- A more streamlined, productive workflow.

- Reduced operational costs.

- Identification of risks to success.

- Automation of manual tasks.

- Complete data analysis.

- Simplified calculations.

Cloud-based CPM software provides additional benefits, such as making the tools easier and faster to deploy, increasing speed to innovation, decreasing the cost of ownership and enhancing collaboration throughout the company.

Corporate performance management vs. human performance management

While both practices focus on performance management, CPM and human performance management (HPM) differ in the areas they monitor.

HPM is a subset of HR that aims to improve operational capability as well as employee productivity and satisfaction. Employee reviews and retention rates can be used as key indicators of HPM success.

As a subset of BI, CPM sometimes includes employee satisfaction and retention measures; however, it doesn't use employee reviews. CPM instead focuses on improving communication throughout the organization, and aligning and executing organizational strategies.

How to choose and deploy a CPM system

Selecting and deploying a CPM system requires extensive research and analysis. The following are some important steps in the process:

- Determine the need for a CPM system and how it can benefit the company.

- Research on-site, cloud-based and open source CPM software.

- Obtain senior management support and funding for a CPM project.

- Establish a project plan and project team.

- Determine how the system will interface with existing business systems and operational processes.

- Prepare and send out requests for proposals.

- Review the results and make a selection, evaluating issues including installation, training, documentation, maintenance, warranties and use of service-level agreements.

- Decide on the installation approach, such as a phased approach or a full system.

- Provide awareness briefings to employees on the system.

- Conduct training.

- Complete installation and acceptance testing.

- Launch the system and brief senior management.

- Establish a schedule of periodic reviews, performance assessments and continuous improvement activities.