putilov_denis - stock.adobe.com

Use of AI in business drives increase in consulting services

The slice of businesses using external providers for AI uptake is set to more than double, according to U.S. Census survey data. Industry leaders say that tracks with their outlook.

The portion of businesses using outside providers to deploy AI is expected to more than double in the next six months, according to a U.S. government survey on the use of AI in business.

The Census Bureau's "Business Trends and Outlook Survey" polls a sample of 1.2 million businesses, divided into six groups of about 200,000. The bureau periodically surveys businesses in each group, collecting data every two weeks. The bureau in March released its first set of AI usage data, obtained in a series of biweekly snapshots between September 2023 and February 2024. About 164,500 U.S. businesses responded.

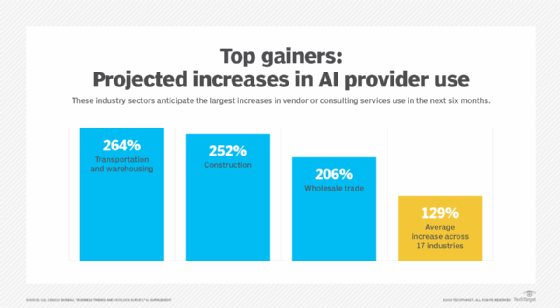

The research pointed to a 129% increase in the slice of businesses planning to use vendors or consulting services providers on AI projects in the next six months compared with their rate of use in the previous six months. That projected boost represents the average across 17 industry sectors.

Consulting execs confirm rising demand

Industry executives said the survey results track with what they see in the market: rapidly rising demand among customers asking for help with generative AI and large language models (LLMs).

"I would say at least double, and we'll probably see even more," said Scott Wheeler, AWS practice lead at Asperitas Consulting, referring to the demand for AI consulting services. "There's a lot of uptick around LLMs driving this."

Wheeler said service providers will find opportunities with out-of-the-box offerings such as Microsoft Copilot. But he suggested the more lucrative projects will involve customizing and tuning LLMs using customers' industry-specific data sets. For example, Asperitas, a cloud services company based in Chicago, consults with financial services clients on AI.

"The money is going to be made in helping them refine [generative AI] to get the cutting answer they want out of an LLM," Wheeler said.

Jared Burns, cloud data and machine learning architect with DoiT International, a multi-cloud services provider based in Santa Clara, Calif., also anticipates increasing demand for AI consulting. That comes as customers push beyond initial exploration of potential business uses for AI.

"We are seeing a very large increase in demand for AI services," he said. "Previously, customers would need help with coming up with use cases for AI. Now, customers are coming to us with a lot of ideas."

Those customers need help with use case validation, prioritization and project scoping for minimum viable products (MVPs) and proof-of-concept (PoC) projects, Burns noted. They might also need assistance with implementing AI on a wider scale, once the initial MVPs and PoCs have shown value, he added.

Asif Hasan, co-founder of Quantiphi, a digital engineering company in Marlborough, Mass., said the increase in consulting demand suggested in the Census data is consistent with the growth percentages the company sees in its opportunity funnel. The company works with customers on generative AI projects, from use case discovery to production applications.

Enterprises will increasingly look for outside expertise as they tap AI to automate tasks, drive innovation and pursue applications that "redefine the economics of their business," Hasan said.

Industry expertise rides the next wave of GenAI

Consulting firms and IT services providers often organize along vertical market lines. This approach could dovetail with developments in generative AI.

Mark Shank, cloud engineering principal at consultancy KPMG, said the initial crop of generative AI use cases revolved around general-purpose models that could do everything from draft a regulatory filing to respond to a customer's email. The next wave of use cases, however, will involve specialized AI agents that have greater influence on business outcomes, he noted.

The industry focus of consultants will become more important as more customers expect generative AI to drive business results.

"In that scenario, you really have to know the sector space," Shank said. "That is one of the biggest shifts occurring around enterprise AI."

KPMG earlier this month launched a Google Cloud Center of Excellence that will bring together Google Cloud's Gemini AI models and KPMG's industry expertise.

Growth in unsung industries

The industries showing the highest increase from previous to planned use of consulting services aren't generally associated with rapid AI adoption. Transportation and warehousing, construction, and wholesale trade all projected increases of more than 200%. Transportation led the way, with a 264% increase in projected external provider use.

Hasan said Quantiphi has seen increasing demand for AI services in transportation. Businesses in this sector look to AI to analyze traffic patterns, reduce accidents, and meet their environmental, social and governance targets, he noted. Quantiphi, for example, deployed a predictive AI offering for a customer in the railroad industry. That system classifies objects such as flags and signals along a railway so that locomotive operators can more readily detect them and make faster, better safety decisions, Hasan said.

In construction, meanwhile, businesses are tapping vendors and consultants for advice on AI technologies and how to implement them, according to Vijay Sankaran, CTO at Johnson Controls, a smart buildings company with international headquarters in Cork, Ireland. Johnson Controls provides building automation systems among other products and offers managed services for facilities. It also goes to market with channel partners.

Construction industry customers seek AI to boost energy efficiency, Sankaran said. He also cited embedding AI into smart buildings as an opportunity, noting that planning for a smart building during design and construction is more efficient than retrofitting the technology.

But the industries showing the highest growth rates in vendor or consulting services use aren't necessarily topping the list of consultants' busiest markets.

Hasan said healthcare, financial services, manufacturing, public sector and education are among the most active industries in his company's book of AI business. At DoiT, Burns said he has seen high AI activity among customers in industries such as SaaS and fintech.

John Moore is a writer for TechTarget Editorial covering the CIO role, economic trends and the IT services industry.