multisig (multisignature)

What is multisig (multisignature)?

Multisig, also called multisignature, is the requirement for a transaction to have two or more signatures before it can be executed. Multisig provides more security than single-signature transactions.

In a multisig transaction, at least two signatures are required to approve a transaction. The idea is useful when more than one party has ownership and all parties are needed to execute the transaction. This way, no one party can execute a transaction without the other parties agreeing to it, ensuring greater transparency and security for all parties.

Multisig transactions are also referred to as M-of-N transactions, with M being the required number of signatures or keys and N being the total number of signatures or keys involved in the transaction.

The requirement for multiple signatures from authorized parties to execute on transactions is a long-established practice. For example, multisig is no different than paper-based financial transactions and contractual agreements that require more than one signature, such as corporate checks. Other past technologies, such as those that enable the electronic transfer of cash (wire transfer) also typically have multisignature requirements.

Today, the term multisig often refers to its application within the cryptocurrency bitcoin and similar electronic transactions. The concept is often applied in cryptocurrencies used by financial institutions as well as in the execution of contracts and private sales of digital resources. Its use in cryptocurrency transactions also contributes to the digital economy.

The idea of multisig transactions -- and also multisig wallets -- gained popularity after the FBI shut down the notorious online drug market Silk Road. The event demonstrated that cryptocurrency owners needed a better way to protect their crypto assets from being stolen by hackers and confiscated by authorities. This resulted in the increased popularity and adoption of multisig crypto wallets.

Single sig vs. multisig transactions

A single private key is easier to manage and lets the crypto owner access their funds faster. It is a suitable option for small and simple transactions, such as face-to-face payments. However, it introduces a single point of failure, where a lost key could result in the owner losing their funds with no way to recover them.

Expanding access to the funds across multiple parties via multisig acts as a safety measure since keys from different sources are required to access the crypto and initiate transactions. Multisig also reduces the probability of funds being lost or inaccessible. For these reasons, crypto owners who store or transact large amounts of bitcoin can benefit from multisig transactions.

What is an example of a multisig transaction?

An example of a multisig transaction is the purchase and sale of bitcoins. In a multisig bitcoin transaction, two signatures are required: the sender (the person spending their bitcoin) and a second private key. The additional signature ensures the transaction is only executable when both parties are satisfied that the terms of the transaction have been met.

If Party A is buying a product from Party B, then Party C can hold the bitcoin payment in an escrow-like arrangement, executing payment after the product has been exchanged. In contrast, a traditional or single-signature on a bitcoin transaction has one keyholder who has complete control over the funds.

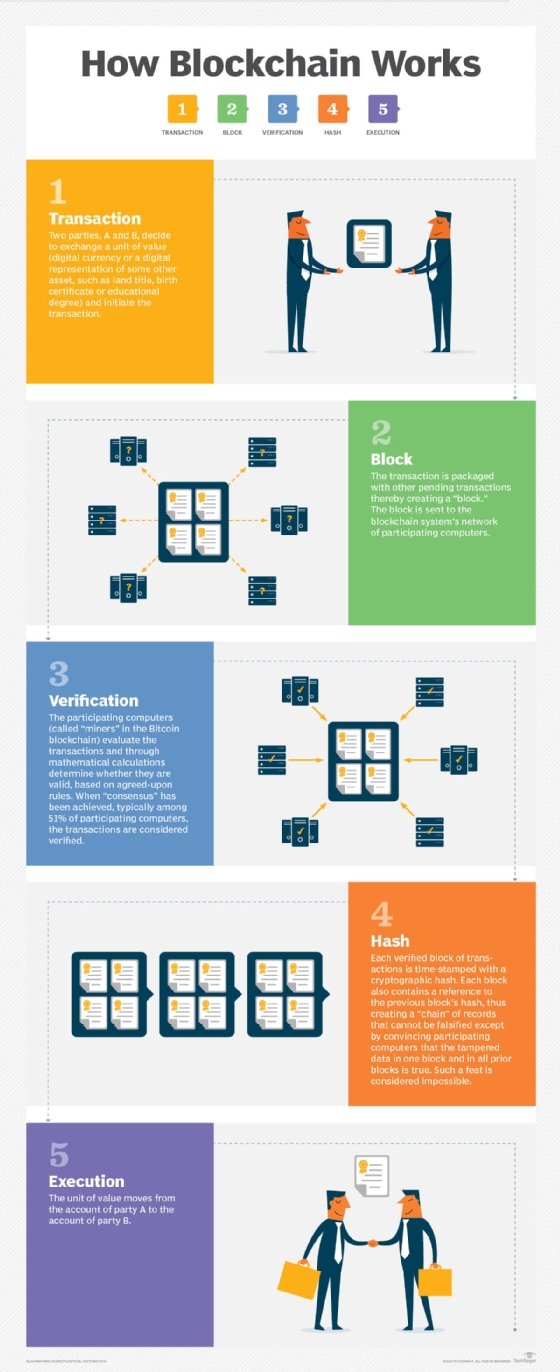

Multisig and blockchain

Multisig in bitcoin works with the underlying blockchain technology. It is this coupling of blockchain with multisignature requirements that represents an evolution in how electronic transactions will happen. Multisignature transactions on the blockchain are more transparent because there's a non-centralized record of those involved, which bolsters the security of the transaction and discourages illicit activity.

What is a multisig wallet?

A multisig wallet, also known as a multisig vault or multisig safe, is a digital application for securely storing cryptocurrency assets like bitcoins. Multiple signatures (private keys) are required to access the bitcoin stored in the wallet and to perform any transactions on those bitcoins. If one of those signatures is missing, the transaction will not go through. A multisig wallet is like a bank's safe deposit box that requires multiple keys to be used at the same time to open it.

By requiring two or more private keys, a multisig wallet adds additional security to the practice of crypto asset storage. It also secures the underlying funds represented by those assets.

Multisig wallets are based on the idea of smart contracts. The wallet is governed on the blockchain by its owners. It also automatically executes transactions when certain predetermined conditions are met (all the signatures are provided) and without the involvement of any third-party intermediary.

Because of these design considerations, multisig wallets are considered a type of "seedless self-custody" of cryptocurrencies. Self-custody lets crypto owners manage their own crypto assets. Seedless means that there's no need for a seed phrase to recover a lost or stolen bitcoin wallet. Instead, the wallet provides additional security by distributing key generation and signature among multiple parties (hence the term multisig).

Several types of multisig wallets are available:

- 1-of-2 signatures. A less-secure multisig wallet in which each party can access the funds in the wallet without needing the other party to authorize the transaction.

- 2-of-3 signatures. At least two of three private keys are needed to authorize transactions, providing greater security.

- 3-of-5 signatures. A highly secure crypto wallet that requires at least three private keys to authorize transactions two keys that are geographically separated and a third party that belongs to a security company.

Why use a multisig wallet?

A multisig crypto wallet lets crypto users avoid the problems caused by the loss of a single private key. Thus, even if a key is lost or stolen, the crypto and underlying funds in the wallet remain safe since the other keys can be used to operate the wallet.

The need for multiple signatures also means a hacker would need access to all the private keys to access an owner's funds. Since this is difficult to do, it's unlikely that they will be able to authorize transactions without the owner's knowledge or permission. To this extent, a multisig wallet functions like two-factor authentication, providing greater security for crypto owners.

Explore key concepts of public vs. enterprise blockchain. Learn about top digital wallet companies and how cryptocurrency is valued, and compare NFTs vs. cryptocurrency vs. digital currency. Check out today's top blockchain use cases and industry applications and the top e-signature software providers. Discover the best practices for securing blockchain.