Getty Images/iStockphoto

FTX scam explained: Everything you need to know

Cryptocurrency values rose in 2021 but started to decline in 2022, causing some exchange platforms to fold. FTX appeared to stay strong -- until news broke of an elaborate scam.

The popularity of cryptocurrency exchange platform FTX rose rapidly after it was launched in 2019. However, FTX came crashing down in November 2022.

Cryptocurrency has become popular for investments and sending payments to other people and merchants. Cryptocurrencies differ from other digital currencies because they are encrypted and use blockchain technology to track transactions.

Cryptocurrency coins quickly increased in value, such as the Shiba Inu coin's 45 million percent increase in 2021.

One way to get cryptocurrency is to open an account on a digital trading platform, which lets people buy one coin and trade for another. Through the trading platform, people can also convert cryptocurrency into cash or fiat currency.

Until late 2022, FTX was one of these trading platforms. Sam Bankman-Fried started FTX in 2019. Customers began opening accounts on FTX to trade and buy cryptocurrency, and top venture capital investors started pouring in. By January 2022, the company was worth $32 billion.

However, that came to an end in November 2022. What first appeared to be an accounting oversight turned out to be major fraud, and billions of dollars were lost by customers and investors. It was discovered that customer funds went to accounts controlled by Alameda Research -- a cryptocurrency trading firm headquartered in Hong Kong -- instead of FTX. After this revelation, FTX began to unravel.

What is FTX?

FTX was one of the largest digital currency exchange platforms for buying and selling cryptocurrencies. As more people invested in cryptocurrencies, they turned to these platforms because they provided a digital wallet to store cryptocurrencies directly in a personal account. Customers could also store cryptocurrencies on their own by creating a crypto wallet either using software or hardware, which is not part of the platform.

The growth of FTX

Soon after its inception, FTX quickly rose to dominate its market through high-profile acquisitions of struggling competitors, such as Liquid Global, LedgerX and Blockfolio. FTX used aggressive marketing campaigns, such as Super Bowl ads, celebrity endorsements and naming rights to the Miami Heat's arena. These marketing campaigns promised that people could put their money in these accounts and earn higher yields than the average bank.

Cryptocurrency began to boom in early 2021 and the price of Bitcoin peaked at $64,000, up from $10,000. Customers began to take notice and venture capital groups invested nearly $2 billion in FTX.

What is FTT?

Cryptocurrency platforms often create their own tokens to attract new customers. As more people invest and demand a digital token, its value increases, so platforms may offer perks. FTX created its own digital token called FTT in May 2019. FTX also offered other perks for staking FTT, such as discounts and NFT rewards.

The downfall of FTX

In late 2021 and early 2022, the price of Bitcoin started to decline drastically from its high in the beginning of 2021, and other cryptocurrencies started to follow. Many major platforms started shutting down, except for FTX, which continued acquiring competitors.

However, the rise of FTX came to an end in November 2022 when CoinDesk published an article stating that Alameda Research -- also founded by Bankman-Fried -- was heavily dependent on FTX's digital token FTT, with assets valued at $5 billion. FTX's balance sheet was leaked and showed there was a lack of diversification and the two companies were tied too closely together. The balance sheet listed $9 billion in liabilities and $900 million in assets, with poorly labeled entries showing a negative $8 billion balance.

Alameda borrowed as much capital as it needed from FTX. It was later found that this funding was mostly from customer deposits, and the trading firm would borrow money routinely from FTX customer assets.

FTX and its sister companies did not produce balance sheets showing assets and liabilities, which is standard financial reporting procedures. FTX's balance sheets were never audited because it was a private company. Without these audits, there was no record of cash flow or assets to show the company could cover liabilities or customer assets. FTX balance sheets showed assets were less than Bankman-Fried had stated.

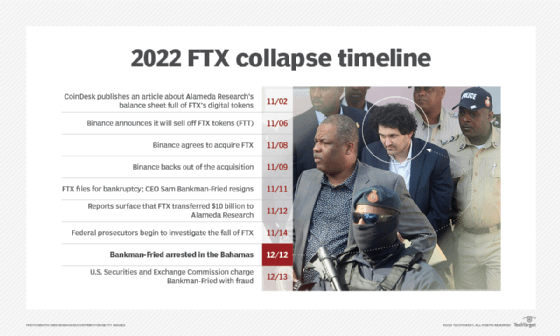

Binance, a cryptocurrency exchange platform and FTX competitor, agreed to buy out FTX on Nov. 8 before the full extent of its problems went public. Changpeng Zhao, CEO of Binance, was one of FTX's first investors. However, the deal fell through, and Binance cited the mishandling of customer funds and the U.S. investigations as the reason for backing out of the acquisition.

The collapse of FTX

In November 2022, FTX's collapse lasted 10 days, starting on Nov. 2 and ending on Nov. 12. It began with the CoinDesk article and the leaked balance sheet. Binance initially announced it would sell all its FTT tokens because of the mishandled and blurred funds.

The value of FTT dropped significantly, prompting FTX customers to withdraw money from their accounts. However, other cryptocurrency platform collapses, such as Celsius Network and Voyager Digital, had people worried about their investments.

During this mass withdrawal, FTX lost billions of dollars. Bankman-Fried ordered Alameda Research to sell assets to cover the needed capital from the withdrawals and he also looked for financing to cover the gap of about $8 billion between what was owed and what could be paid.

On Nov. 8, FTX blocked customers from taking money out of the platform by removing that option online, which meant hundreds of thousands of customers did not have access to their money. When FTX could not pay the $8 billion gap, the company filed for bankruptcy. FTX crashed due to mismanagement of funds, lack of liquidity and the large volume of withdrawals. Binance announced it would buy FTX to prevent a larger market crash, but quickly bailed out of the deal as more news reports of mishandled customer funds surfaced.

Bankman-Fried used FTX funds to buy personal luxury items, finance elaborate advertising campaigns and make political donations.

Criminal charges and lawsuits

Authorities arrested Bankman-Fried on Dec. 12, 2022, for multiple fraud charges with FTX. Bankman-Fried was indicted by the U.S. District Court on eight criminal charges, including money laundering, wire fraud, campaign finance violations and securities fraud.

Bankman-Fried was released from custody with a $250 million bond, which is the largest in history.

As of January 2023, $5 billion in assets has been recovered in cash and liquid assets. The total assets missing was estimated at $8 billion.

FTX investors filed a class action lawsuit against FTX and its celebrity endorsers on Nov. 15, 2022. The civil suit claimed FTX used "false representation and deceptive conduct." The lawsuit also accused FTX of using a Ponzi scheme to misuse funds and move customer money between entities.

How the FTX crash affects other digital currencies

While the overall demand for cryptocurrency fell after the FTX scandal, Bitcoin has made a comeback as of January 2023 with values above $21,000. Values had gone below $16,000 in November 2022 as the FTX news was breaking.

After the arrest of Bankman-Fried, the Securities and Exchange Commission, along with the U.S. Congress, planned to discuss regulations of the cryptocurrency industry. If a cryptocurrency exchange files bankruptcy, there is no backup -- unlike U.S. banks, where the government insures the funds up to certain limits.

More cryptocurrency companies have fallen on hard times. Genesis, a cryptocurrency lender, filed bankruptcy on Jan. 20, 2023. Genesis owed creditors nearly $3.4 billion after the downturn of the cryptocurrency market with the FTX news.

People are already skeptical because of the stability of cryptocurrency, its security and increased scams. The broader consequences on the cryptocurrency market are unknown, but this large collapse in cryptocurrency's short history may deter a lot of investors.

FTX debtors’ report

On April 9, 2023, FTX debtors released their first report outlining the failures of FTX Group’s management team before bankruptcy. “The FTX Group lacked appropriate management, governance and organizational structure,” the report stated.

The findings included security failures, such as private keys to move crypto assets often left in unencrypted files and crypto assets left unsecured in hot wallets connected to the internet. It also named failures to use multifactor authentication in critical areas and several people with access to the billions of dollars in the crypto wallets.

In addition, FTX lacked accounting and financial controls. FTX did not have experienced personnel to handle financial reporting, risk management, audits or accounting procedures. Most financial policies were generic or did not exist for a firm handling significant financial assets, according to the report. There were also no formalities for intercompany transactions, allowing liabilities and assets to transfer between insiders and FTX Group entities without any documentation or checks and balances.

FTX sues Bankman-Fried’s parents

FTX is suing Bankman-Fried’s parents on suspicion of embezzling millions of dollars from the business for personal gain and "pet causes." The suit was filed Sept. 18, 2023.

The corporation is suing to recoup money that Bankman-Fried's parents allegedly fraudulently transferred and misappropriated.

The lawsuit alleges Joe Bankman and Barbara Fried either knew of or ignored the red flags of fraud at the hands of their son and his associates at FTX. Both Bankman and Fried are tenured Stanford law professors.

The lawsuit also alleges that Barbara Fried encouraged her son to avoid federal campaign finance disclosure rules and discussed the transfer of Bankman-Fried’s home in the Bahamas along with a $10 million cash gift; and that Joe Bankman tried covering up the whistleblower complaint in 2019.

Bankman-Fried found guilty of all charges

On Nov. 2, 2023, Bankman-Fried was found guilty on seven federal counts. He was convicted of the following fraud and money laundering charges:

- Two counts of wire fraud conspiracy.

- Two counts of wire fraud.

- One count of conspiracy to commit money laundering.

- One count of conspiracy to commit commodities fraud.

- One count of conspiracy to commit securities fraud.

On March 28, 2024, Bankman-Fried was sentenced to 25 years in federal prison -- shorter than the 40-50 year sentence that prosecutors were pushing for. In addition to the prison sentence, Bankman-Fried was ordered to pay a more than $11 billion forfeiture.

FTX to repay customers and will not relaunch

On Jan. 31, 2024, FTX announced it would not restart its cryptocurrency exchange. Instead, it would liquidate all assets and return the money to customers.

The exchange was in negotiations for months with investors and bidders but could not get enough money to rebuild.

On Oct. 7, 2024, a Delaware bankruptcy judge approved FTX’s reorganization plan. This plan will give 98% of FTX’s creditors 119% of their allowed claims as of November 2022 -- when the platform received bankruptcy protection.

Since filing bankruptcy, FTX has recovered nearly $16 billion to repay its customers.

FTX executives' prison sentences reduced

Two convicted FTX executives are expected to get out of jail ahead of schedule. Ryan Salame was originally sentenced to 7.5 years for his role in the FTX scandal. The Federal Bureau of Prisons lists his release date as more than a year earlier than his original sentencing. His new release date is March 1, 2031, compared to his initial release date in April 2032.

Caroline Ellison was originally sentenced to two years after pleading guilty to seven federal counts of fraud and conspiracy. Ellison was a key witness against Bankman-Fried. Her release date is now three months earlier.