non-fungible token (NFT)

What is a non-fungible token (NFT)?

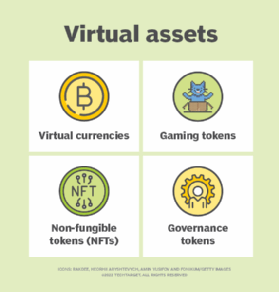

A non-fungible token (NFT) is a unique cryptographic asset used to create and authenticate ownership of digital assets. NFTs are used with cartoons, music, film and video clips, JPEGs, postcards, sports trading cards, and virtual real estate and pets. NFTs provide a secure record stamped with a unique identifying code that's stored on blockchain.

In contrast to stocks, bonds and other traditional investments, NFTs are considered an alternative investment that isn't fungible, or replaceable, with a similar item. NFTs are similar to rare collectibles. Demand for them increased in 2020 and grew dramatically in 2021. This drove up the price of digital artworks, with celebrities, content creators, auction houses and others participating in the market.

How do NFTs work?

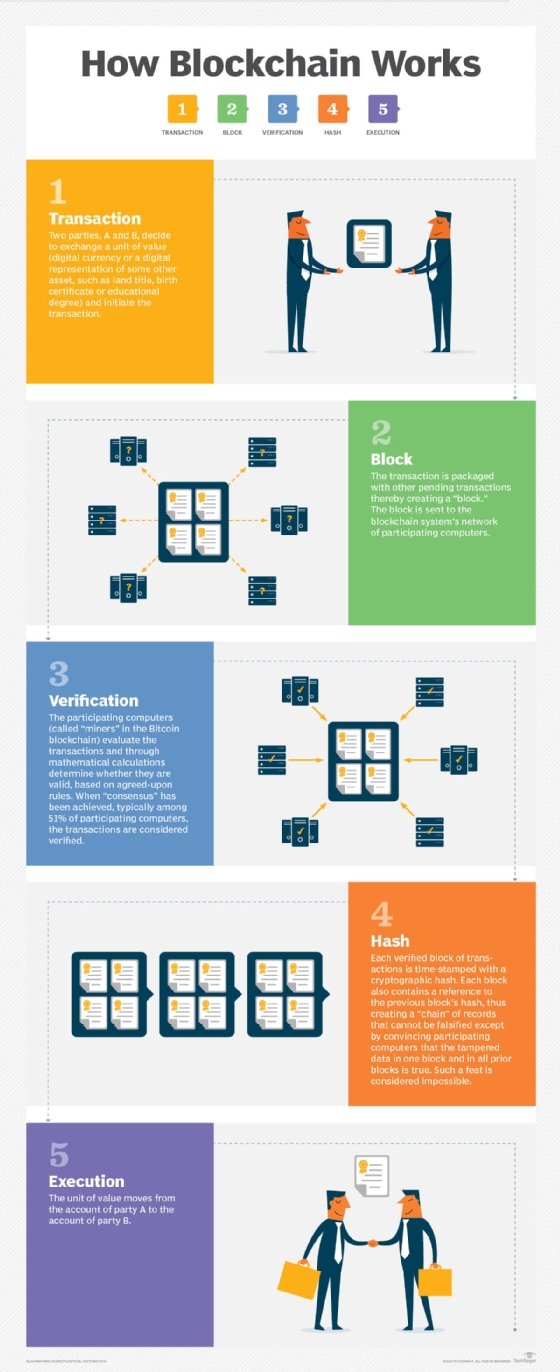

Blockchain technology establishes ownership of the NFT. Blockchain acts as a decentralized ledger, enabling NFTs to be authenticated publicly. The technology uses a digital signature to prove who owns the work and that it is original. An NFT buyer doesn't own a piece of art to hang on a wall, but rather a digital image of that artwork and digital certificate of authentication.

The NFT buyer does not own the copyright or trademark of the item. Although there may also be numerous versions of it on the internet, NFT buyers have an original in the virtual world. Royalties can be programmed into the token, enabling artists to collect a portion of sales in the future.

The one-of-a-kind qualities of NFTs make them non-fungible. This contrasts with fungible assets, such as Bitcoin and other cryptocurrencies, dollar bills, gold bars and stock, that are worth a specific amount and are interchangeable. Although one dollar bill can be exchanged for another dollar bill or one bitcoin can easily be swapped for another, that is not the case with NFTs.

NFTs are generally nondivisible. The basic unit of the NFT is the token, which usually cannot be divided into smaller denominations, as a dollar might be divided into 10 dimes. However, fractional ownership of NFTs has been recently introduced by some platforms, such as Fractional. Fractional ownership allows an NFT to be divided into smaller NFTs, which can be sold to multiple buyers.

Additionally, NFTs are immutable. They can't be altered once they have been encoded using blockchain technology. The originality and legitimacy of the item are validated through the blockchain in which it is stored.

Why are NFTs important?

The surge in popularity of NFTs is a result of their "improved ease of onboarding, speculative nature as both a collectible and investment, and grassroots communities developed around the products," explained Justin Herzig, co-founder of Own the Moment NFT, which provides content, tools and analytics on NFTs.

NFTs let individuals buy and sell digital assets in new ways. They help artists and other content creators display their skills digitally and provide the ability to securely value, buy and exchange digital art using a digital ledger. Using NFTs, new and previously decentralized actors can develop innovative value exchanges to build new market structures.

NFTs are a significant form of alternative investment that appeals to buyers' personal interests and passions, Herzig said. With NFTs, retail investors will be able to invest in things they have a personal connection with, as well as things that provide financial and utility value.

The NFT buyer hopes the value of the token increases with time, similar to all investments. Just like their fungible cousins, NFTs are subject to shifts in supply and demand. According to Grand View Research, the NFT market was valued at $20.44 billion in 2022 and is expected to grow to $211.72 billion by 2030.

Benefits of NFTs

Digital artists, other creators and collectors obtain various advantages from NFTs. Some of the most important benefits are the following:

- Direct monetization. NFTs let digital artists monetize their work by selling it on online marketplaces like Niio without the need of galleries, auctions houses or other intermediaries.

- Immutable ownership and authenticity. NFTs enable owners to prove immutable ownership and authenticity of a digital asset. Unique NFT metadata verifies its origin, ownership and transaction history. This ensures that the ownership of an NFT can be easily verified and authenticated through blockchain technology, providing a sense of security and confidence in owners.

- Royalties. NFTs let artists program royalties into their work, ensuring they receive a percentage of future sales when it is resold on secondary markets. This feature enables artists to benefit from the increasing value of their creations, even after the initial sale. Moreover, royalties serve as an incentive for collectors to support artists and contribute to the overall growth of the NFT ecosystem.

- Fractional ownership and accessible investing. NFTs allow fractional ownership, enabling multiple individuals to collectively own a digital asset. Fractional ownership enables broader participation and investment in high-value assets, providing access to individual collectors who might otherwise be unable to afford one. This democratization of ownership expands the possibilities for both artists and collectors in the NFT space.

- Enhanced interactivity and utility. NFTs can go beyond static digital files and incorporate interactive elements, giving collectors a unique and immersive experience. For example, some NFTs grant access to exclusive events, experiences, or digital items or content related to the artwork or collectible. This can help boost customer loyalty.

What are uses and examples of NFTs?

An early use of NFTs was a game launched in 2017 called CryptoKitties, in which users could trade and sell virtual kittens. In 2021, NFTs that sparked attention included Twitter CEO Jack Dorsey's first-ever tweet and work by Beeple, the professional name used by artist Mike Winkelmann, who sold his piece "Everydays: the First 5000 Days" for $69 million.

NFTs are being used to sell a range of virtual collectibles and assets, including the following:

- National Basketball Association virtual trading cards.

- Digital sneakers from Nike.

- Trading cards featuring personal memorabilia from actor William Shatner.

- A full studio album by rock band Kings of Leon.

- The original Nyan Cat meme.

- Collectible virtual characters called CryptoPunks.

- A variety of GIFs and images commissioned by Taco Bell, with proceeds going toward the restaurant chain's charity organization.

- Virtual real estate in Decentraland, a 3D virtual reality (VR) platform.

- Tokenized real-world assets, such as real estate.

Today, the primary owners and collectors of NFTs are enthusiasts with a strong interest in a domain or project. However, NFTs are expected to become mainstream and attract retail investors eventually as the products and technology improve.

How are NFTs created?

NFTs are created using smart contracts. Smart contract code is incorporated into the token when it's created or minted. Stored on blockchain, the smart contract determines the NFT's qualities, such as ownership and transferability.

The smart contract is autonomous, containing the terms and conditions of an agreement directly within the lines of code. Each NFT is linked to a single token that is stored in a smart contract, which runs on top of the distributed ledger to provide proof of ownership and verifiable originality. Even though there are other copies of the same content, only one person can own the particular token that authenticates ownership of the NFT.

Smart contracts are a crucial feature of blockchain technology. While many NFTs reside on the Ethereum blockchain, some are based on other blockchain technologies, such as Tron and Neo. Blockchain also helps ensure that NFTs remain secure.

While NFTs gain popularity, market participants and observers are becoming increasingly aware of the impact that NFTs have on the environment. The use of blockchain generates greenhouse gases, which have a significant effect on the world's carbon footprint.

How are NFTs bought and sold?

As demand for NFTs grows, new marketplaces continue to surface. Popular marketplaces for creators to sell NFTs include the following:

- AtomicMarket.

- BakerySwap.

- Enjin.

- Foundation.

- KnownOrigin.

- Myth Market.

- OpenSea.

- Portion.

- Rarible.

- SuperRare.

The following outlines the steps involved in buying and selling NFTs:

- Set up a digital wallet, and buy cryptocurrency, such as ether, using an app, such as Coinbase, MetaMask or Robinhood.

- Connect the digital wallet to an NFT marketplace.

- Mint or list the NFT for sale, or start bidding on or purchasing pieces of content. Users can auction bids or purchase outright, depending on the seller and marketplace.

NFT scams

There are several scams in the NFT space to be aware of, including the following:

- Phishing scams. Phishing scams involve deceptive links or pop-ups that trick users into revealing sensitive information or transferring funds to fraudulent accounts. NFT phishers create fake marketplaces or accounts on social media, tricking users into giving them their private keys under the guise of making payments for nonexistent NFTs. To avoid falling for phishing scams, it's crucial to verify the authenticity of websites and double-check the URLs before entering any personal information or making transactions. Keeping keys private is an important way to avoid NFT cons.

- Counterfeit NFTs. Counterfeit NFTs involve scammers selling other people's work as their own original creations. Fraudulent NFTs appear identical to genuine pieces of digital collectibles or art, making it challenging for collectors to distinguish between authentic and counterfeit tokens. To mitigate the risk of purchasing counterfeit NFTs, users should conduct research, verify the reputation and authenticity of the artist, and buy from reputable marketplaces and verified sources.

- Pump-and-dump schemes. These schemes are deceptive practices involving the artificial inflation of an NFT's price through coordinated marketing efforts, often driven by influential individuals or groups. Pump and dumpers drive the price of an NFT to a peak and then liquidate their holdings, causing the value to plummet and leaving other investors with substantial losses. Users should conduct thorough, independent research and assess the long-term value of an NFT, refraining from making impulsive investments based on hype.

- Free mint scams. Free mint scams involve scammers enticing users to participate in deceptive mints, promising exclusive NFTs or rewards. However, instead of receiving the promised NFT, victims inadvertently sign away control of their wallets or provide access to their private keys, resulting in unauthorized access to their funds or assets. To protect against free mint scams, it's crucial to use caution when engaging in NFT minting processes and verify the legitimacy and security of the platforms or projects involved.

The future of NFTs

The principles of supply and demand apply to the NFT marketplace. As with any investment, buyers should be cautious and watch closely as the market evolves.

"An NFT is only as valuable as what others are willing to pay for it," Herzig said. "NFTs that can build a deep connection with collectors and investors have shown an increased likelihood of having long-term staying power."

Collectors and investors should view previous and similar sales on established marketplaces to understand NFT value. NFTs' long-term viability will depend on how their utility value is perceived. Like with other collectables, this will happen once owners view NFTs as uniquely valuable experiences or features. NFT communities will develop and grow, helping to maintain prices and markets; this will increase trust in their long-term survival.

NFTs are also linked to future uses in the metaverse, the VR world and healthcare. Because NFTs can prove immutable ownership of an asset, they could be used to protect patient data in healthcare. Other potential uses include proving digital ownership in the metaverse and other VR worlds. Retailers have begun using NFTs to sell digital products in the metaverse and prove ownership of digital deeds.

NFTs are one of the new uses of blockchain technology. Learn the difference between NFTs and cryptocurrency.