Getty Images/iStockphoto

Google unfazed by advertiser criticism of third-party cookie plan

Google is working with U.K. regulators on its plan to phase out third-party cookies this year, despite pushback from an advertisers group. Meanwhile, bots are affecting ad traffic.

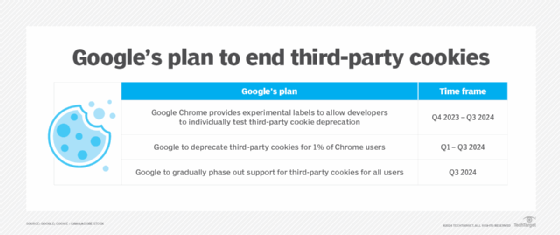

Google's timeline for deprecating Third-party cookies remains unchanged in the face of heavy criticism from an international trade association representing advertisers, media companies and tech vendors.

The Interactive Advertising Bureau (IAB) earlier this month released a report slamming Google's Privacy Sandbox, a set of APIs under development that purportedly will give Chrome users more privacy controls while delivering finely targeted, anonymized audiences to advertisers with the help of AI.

The IAB report said investments in procedures and infrastructure will cost advertisers, publishers and tech vendors too much to support. It also claimed that Google's technology is weak on features such as tracking across devices and providing data to create look-alike audiences.

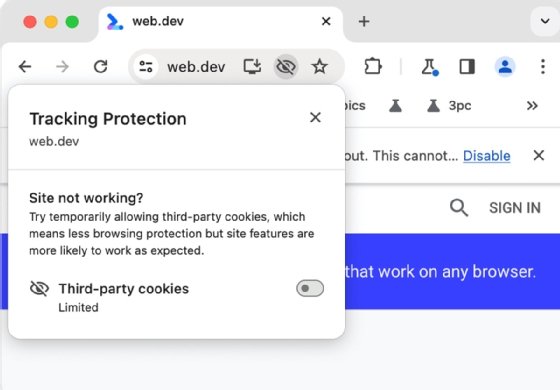

Google responded on its blog, saying IAB's issues with Privacy Sandbox features go beyond the scope of what third-party cookies do in the Chrome browser today. Tracking across devices, it said, isn't something that third-party cookies do, and Privacy Sandbox will not support it. Doing so would go against privacy policies and, potentially, regulatory compliance as it would allow individuals to be identified.

A Google spokesperson said the IAB feedback hasn't changed its schedule to do away with third-party cookies by the end of this year. IAB said it "received feedback from Google," but did not elaborate on whether the search giant provided more than the public response, which claimed the IAB report had "many misunderstandings and inaccuracies."

Cookie timeline firm, for now

Google's third-party cookie phaseout timeline looms large. It has been delayed twice, and it affects a large industry. Online advertisers will spend more than $690 billion on digital ads this year, IAB said -- and more on the technology and data analysis to support ad investments. Still, the only thing that will affect the timeline, Google maintains, is working out regulatory issues with the U.K.'s Competition and Markets Authority (CMA).

Google committed to redress a number of issues the CMA raised around consumer data use in Google Analytics, tracking across sites, browser history retention and other issues surrounding competition in the U.K. advertising market.

"Google still derives a decent amount of revenue from some of their cookie-based applications, which is why I think they're pushing to shift people toward those AI-driven models -- even though they are a bit more black box, and [adtech vendors will] have to start peeling back the layers of those AI tools to give advertisers the visibility that they want," Gartner analyst Mike Froggatt said. "I wouldn't speculate if they are going to delay again, but it's definitely possible."

For some time, martech vendors have urged companies to concentrate on first-party data that they own, which of course means moving away from adtech. Now, adtech users have more reason to focus on first-party data, too, in order to retarget potential customers who fall out of the funnel after visiting their websites.

They've already started working with anonymized audiences with social media platforms such as Meta. With the Privacy Sandbox, Google will behave more like those now.

"It's making brands reevaluate their digital product experiences and make sure that they're offering value to customers -- not just on their ads that appear on media and in other places, [but on their websites as well]," Froggatt said. "When they finally get [customers] to their site, they need to offer value in order to get that consent to personalize the site, track their usage across their site, and then leverage that data with partners like Facebook or Google to serve them ads."

That trend is making first-party data even more valuable, as technologies and regulations limit the consumer data advertisers have to work with. On top of that, AI-driven bots complicate ad traffic by making it more difficult to distinguish human customers from bots among website visitors.

Report: X ad traffic declines precipitously

Meanwhile, many major advertisers, including Disney, Apple and IBM, have stopped buying ads on X, formerly known as Twitter. It usually happens for one of two reasons, or both: They don't want to be associated with some of its unmoderated content, or they're concerned with bot traffic diluting their ads' return on investment.

On that latter note, research performed during the Super Bowl earlier this month suggested that bots comprised 75% of X's traffic, up 25 times from the same period in 2023.

It wasn't generally known how much bots have diluted traffic, and it still isn't. Israeli digital security firm Cheq specializes in verifying bot-vs.-human traffic for 15,000 advertising customers, large and small. The customers use the data to determine where to spend their advertising budgets.

Each year, Cheq surveys ad-driven traffic to its customers' websites during the Super Bowl from platforms such as Facebook, Instagram, TikTok and X. It verifies human traffic with a JavaScript tag that checks up to 2,000 data points, including browser, device and geolocation data matched to the user's claimed identity, as well as browser behavior.

The last couple of years have brought a general rise in bot traffic, thanks to evolving AI technology that has become more accessible, said Kerry Coppinger, data analyst and senior manager of brand marketing for Cheq, in previewing the research results to be published early next week. Social media tends to attract bot traffic because it's easy for individuals to employ AI to push a particular narrative.

Click farms still exist to either commit pay-per-click fraud or to drain a company's resources, Coppinger added.

But taking all that into account, the increase of bots on X from 2023 to 2024 was anomalous. While Cheq provides data reports and doesn't give advice to customers on where to advertise, anecdotally, customers have told her they're leaving X because of the bot problem.

"On a macro level, advertisers are pulling their ads from Twitter/X," Coppinger said. "We've seen that as well, just in the aftermath of releasing this data."

Despite the major advertisers' exodus from X and the platform's problems with bot traffic, X remains a top 10 online advertising platform -- and that isn't likely to change anytime soon, Froggatt said.

"It's still [viable for] advertisers, but I don't think it's going to be the cornerstone of campaigns," he said. Instead, advertisers will use it for remnant buys -- when an agency buys up unsold ad inventory at a discount and resells it to clients -- or demand-side platforms, which deliver highly filtered ad traffic at a premium.

Don Fluckinger is a senior news writer for TechTarget Editorial. He covers customer experience, digital experience management and end-user computing. Got a tip? Email him.