Accenture: Channel partner ecosystem taps cloud, innovation

Times have changed for channel partners. Companies today drive most business through cloud providers and seek to co-innovate industry-specific offerings with technology partners.

The channel partner ecosystem has undergone a sea change, where cloud providers now represent key allies and vendors are rated for innovation rather than money-making potential.

That observation comes from an Accenture report published in 2021 on partner-vendor relations in the cloud-first era. The report, "Building high impact partner ecosystems," was based on a survey that polled 1,150 channel companies, including resellers, systems integrators, service providers and ISVs.

Michael Heald

Michael Heald

The report depicts an industry sector with a dramatically different approach to conducting business and creating alliances. "It's a once-in-generation shift," said Michael Heald, senior managing director and ecosystem and growth lead at Accenture Strategy, after the report was released. "The movement to this new type of model is highly accelerated."

Channel partners have embraced "the ascent of cloud providers," the report found. The survey asked respondents which vendors made up the majority of their revenue. Channel companies identified Microsoft, Google Cloud and AWS -- the leading platform vendors -- as their top three partners with regard to wallet share, said Dave Sovie, senior managing director of globalization for Japan-based clients and a global account lead at Accenture.

Not so long ago, companies such as Dell, Cisco, Hewlett Packard Enterprise and IBM would have topped the list on a similar survey, he added.

In addition, as partners work more closely with different types of vendors, they have more options in doing so. Seventy-seven percent of partners said they had more technology provider choices than they did three years earlier, the Accenture report noted.

Partners emphasize innovation

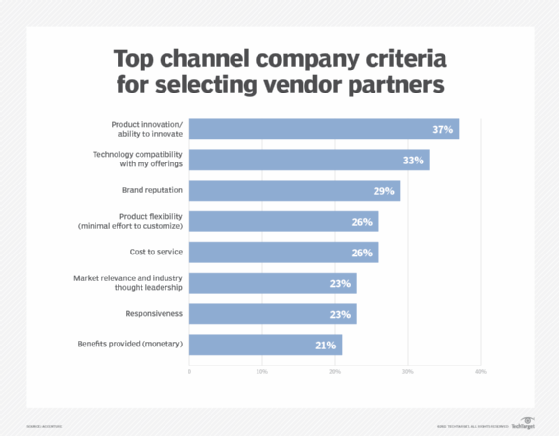

In another sharp break with the past, partners surveyed by Accenture ranked the "ability to innovate" as the No. 1 vendor selection criteria. Partners look for companies that will "co-innovate with [them] to develop unique solutions for clients," Sovie said.

In past years, partners would typically cite ease of doing business and profit potential as their main reasons for working with one vendor over another, Sovie noted. Monetary benefits, however, ranked last among the list of eight vendor attributes in Accenture's survey. "The channel has operated in a traditional way since the rise of the PC industry" in the 1980s, he said. But the rapid growth of cloud computing has sparked an industrywide reevaluation of long-established approaches.

Dave Sovie

Dave Sovie

Partners' prioritization of vendors' innovation capabilities partly stems from customer requirements. Businesses increasingly expect channel partners to "bring innovation to them," Sovie explained. Indeed, growth through innovation ranked as the top business objective among the partners surveyed, with 45% of partners seeking to innovate their products and services.

The innovation customers expect is tied to industries and business outcomes. "[Partners] need to develop deeper industry and/or functional expertise to really drive innovation," Sovie said.

"If you can't bring that level of industry experience, you are at a disadvantage in the market," Heald, who co-authored the report, added.

Partners and their vendor partners must deliver metrics-based business outcomes with their industry-specific offerings, Sovie and Heald said. That requirement has prompted more customers to pursue outcome-based contracting, an approach that ties payments or future sales to meeting performance objectives. While this approach involves some risk, customers, vendors and channel partners are more open to this model, the executives said.

"The more customers demand a true solution versus just buying a product and being self-integrators, the more likely they are to ask for outcome-based models," Heald said.

Partners and vendors have become more confident with outcome-based arrangements as they gain experience with the model and differentiate themselves through their industry knowledge and relevance, he added.

Co-innovation, ecosystem trends

As the channel partner ecosystem changes, co-innovation relationships have emerged as an appealing option for partners and vendors. Partners no longer expect to just resell off-the-shelf hardware or software but seek instead to innovate and create joint offerings with vendors, Heald noted.

Vendors, however, might have to revamp their channel programs to support co-innovation. Channel incentives, for instance, should transition from programs built for a product reselling world to one based on recurring revenue and cloud services, Sovie said. "You need to rethink the value proposition and economic equation with your channel," he said.

SAP, for example, retooled its partner program's revenue-sharing model in 2021 to reflect the economics of cloud computing.

Digital platforms call for partner ecosystems

Enterprises looking to build platform business models, which digitally connect producers of goods and services with customers, might consider cultivating a partner ecosystem.

An Accenture report, "Level up: Elevate your business with a platform strategy," cited an appetite for creating ecosystems as a key requirement for such platforms. "Transitioning to a platform business involves more than just changing a business model; it's about building and nurturing a vibrant ecosystem of users and partners," the March 2024 report noted.

A platform strategy lets ecosystem participants share costs and risks in large capital projects, according to Accenture.

Market development funds (MDF) is another partner program component ripe for change. Innovation requires highly focused offerings with defined outcomes, Heald said. MDF, a traditional incentive model designed to support sales of standard hardware or software products, doesn't address those needs. "The whole innovation side is much more specific," he said.

Vendors, however, can transfer their MDF investments into co-innovation development funds instead, Sovie added.

Looking ahead, the web of partner-to-partner and partner-to-vendor relationships are poised to expand. The channel companies Accenture surveyed cited the ability to collaborate across multiple partners as the top capability they need for the future, according to Sovie. That finding points toward a multipartner ecosystem that will involve more "analytics and sharing of insights," he said.

Editor's note: This article was updated in August 2024 for timeliness and to add information on a related report.

John Moore is a writer for TechTarget Editorial covering the CIO role, economic trends and the IT services industry.