neobank

What is a neobank?

A neobank is a type of fintech that offers direct banking services to individuals and organizations, without traditional physical branches. A neobank is a financial services organization that is typically only accessible via digital means and is often driven by a mobile experience with smartphone apps.

Neobanks are also referred to as fintech banks or challenger banks, as they represent a competitive challenge to traditional banks.

The concept of a neobank first emerged in the 2010s. The basic premise of a neobank is that it is an easily accessible digital banking platform that provides a convenient and low-cost approach to providing financial services.

As a digital-first approach, neobanks aim to make it easier for new users to get signed up for a service. They are often directed at millennials and the digital native demographic. As neobanks don't have the same physical infrastructure as a traditional bank, they have a lower overhead cost structure, which can be passed on to consumers in the form of lower or no fees.

Neobanks generally offer a core set of common banking services, including online banking, direct deposit, checking accounts, savings accounts, debit cards, credit cards, money transfers and lending. Access to ATMs is another common attribute. In the U.S., many neobanks are also insured by the Federal Deposit Insurance Corporation via partnerships with traditional banks.

How neobanks work

While a neobank can provide several banking services similar to a traditional bank, neobanks work differently.

Many neobanks start by forming partnerships with established, chartered banks to handle the actual banking infrastructure to hold deposits, lend money and maintain regulatory compliance.

With the banking infrastructure in place, a neobank will then build a digital banking platform with mobile apps and websites to provide services online. Customers can sign up for accounts directly through the neobank's website or mobile app, avoiding physical branches.

The neobank provides the user-facing interface and customer service while the partner bank handles the banking functions in the background. Services such as checking accounts, savings accounts, debit cards, ATM access and loans are provided to customers digitally through the neobank platform. Customers can manage their accounts via the neobank's website or mobile app and access their money digitally. Transactions such as deposits, withdrawals and transfers initiated via the neobank app are processed using the systems of their partner bank.

Neobanks use lower overhead costs due to the lack of physical branches to enable features such as lower fees, higher interest rates, budgeting tools and instant access. In the typical neobank business model, interest, interchange fees and other revenue generated are shared between the neobank and their partner bank.

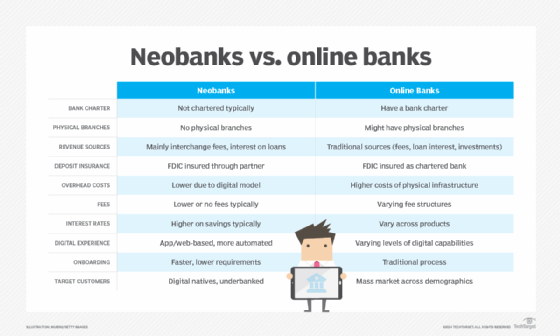

Neobanks vs online banks

Traditional banks have been offering various forms of online banking services since at least the early 2000s. There are numerous differences between online banks, which are extensions of existing traditional banks, and neobanks.

Popular neobanks

There is a growing number of neobanks around the world. Among some of the popular neobanks are the following.

Editor's note: The list of neobanks is based on internet research and is nonexhaustive. The companies listed represent a snapshot of neobanks available at the time of writing and ranked high in Google trends.

U.S.-based neobanks

- Aspiration.

- Atmos.

- Chime.

- Current.

- Douugh.

- GO2bank.

- MoneyLion.

- SoFi.

- Upgrade.

- Varo.

Global-based neobanks

- Atom.

- Monese.

- Monzo.

- N26.

- Nubank.

- Revolut.

- Starling Bank.

Pros and cons of neobanks

There are both positive and negative aspects to neobanks.

Pros of neobanks

- Convenience. Neobanks provide mobile and web-based access allowing customers to bank from anywhere at any time.

- Onboarding. Opening accounts can be easier and faster than a traditional bank.

- Lower fees. Neobanks typically have low or no monthly fees compared to traditional banks because of lower overhead costs.

- Higher interest rates. Due to lower overhead costs, neobanks can offer higher interest rates on savings accounts and other products.

- Budgeting and savings tools. Many neobanks provide tools to help customers manage budgets and reach savings goals.

Cons of neobanks

- Lack of physical branches. Neobanks don't have branch locations and rely on digital channels for customer service.

- Limited products. Compared to traditional banks, neobanks typically offer a smaller range of products and services.

- Security concerns. Some consumers may be hesitant to trust newer players with their finances and data security.

- Startup risks. As younger companies, neobanks carry risks including going out of business or being acquired. For example, Bank Simple (later rebranded as Simple) was one of the first neobanks, founded in 2009. In 2014, the company was acquired by Banco Bilbao Vizcaya Argentaria, which continued to operate Simple until 2021, when it shuttered operations and transitioned users to BBVA accounts.

The future of neobanks

The future of neobanks could hold any number of possibilities.

The overall growth outlook for neobanks looks to be largely positive. Research firm Spherical Insights estimated that the size of the global neobanking market was worth $51.42 billion in 2022. Spherical Insights forecasts that the market will grow at a compound annual growth rate of 49% from 2022 to 2032, with the global market reaching a high of nearly $2.8 trillion by 2032.

Statistica is forecasting an even more robust financial future for neobanks. The global transaction volume in the neobanking market is estimated to be $6.37 trillion in 2024. Statistica projects a 13.15% compound annual growth rate between 2024 and 2028 when the transaction volume is projected at $10.44 trillion. By 2027, Statistica estimates that there will be 386.3 million neobank users globally.

The future of neobanks could also include consolidation. There is always the possibility that neobanks can merge or, more likely, get acquired. As traditional banks look to gain share, the acquisition of a neobank's customer base might well be an attractive target.

The future of neobanks is also likely to include a series of different enhancements to products and services:

- More AI and personalization. With the growth of artificial intelligence usage and its potential to improve customer interactions, neobanks will be able to provide more personalization to users.

- Broader array of banking services. Neobanks will likely continue to grow various types of banking services to compete against traditional banks.

- Expansion into support for cryptocurrency and blockchain. There is the potential that some neobanks will integrate cryptocurrency offerings into the overall mix of products.

- Deeper integration with embedded finance. The growing market for embedded finance is likely to increasingly intersect with the neobank market.