Rawpixel.com - stock.adobe.com

FinOps vs. DevOps: What's the difference?

While they might seem inherently different, both FinOps and DevOps encourage practices to improve business efficiency and success. Review the concepts and how they compare.

Modern businesses focus on improving efficiency. This influences the practices, processes and tools needed to consolidate and share resources, streamline operations, and use metrics to measure the organization's performance. Essentially, the goal is to break down the traditional silos that waste time and money. The push to improve business efficiency takes many forms, each fostering a new discipline that promises to transform the business.

Perhaps the most pervasive influence has been the importance of operations, or Ops, which recognizes the processes, practices and tools involved in running a business. In business vernacular, operations typically refers to the various departments, staff and efforts involved in running the business, including finance, accounting, sales and service.

However, recent years have seen a rise of new initiatives that seem to mash the term Ops into other areas of technology and business. Two important examples include DevOps and FinOps. It's easy to become confused by the meanings and differences between these and other terms, so let's examine these two terms and consider the differences between them.

What is FinOps and why is it important?

FinOps, a combination of finance and operations, grew as a means of addressing the quality and efficiency of business investments and expenditures. Rather than simply cutting costs, FinOps attempts to create cross-departmental collaboration among business, finance, technology and engineering teams. It then seeks to right-size a cloud budget to achieve an optimal balance of performance, quality and cost for business workloads and services.

While the logic and approach of FinOps can apply to almost any business problem, the principal use of FinOps has been around the business value of cloud computing usage.

Ultimately, FinOps is a means of addressing cloud complexity. A public cloud involves countless interrelated services and resources -- all generating billable costs that can be difficult to understand and track. When a business allows any developer, department head or stakeholder to deploy and operate a workload, the business can quickly experience unexpectedly high costs and problematic performance.

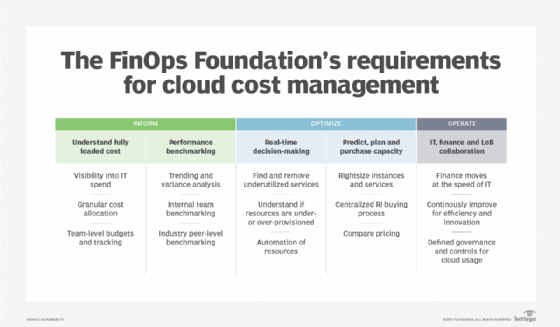

FinOps is driven by the FinOps Foundation and relies on an iterative series of steps to achieve these goals: inform, optimize and operate.

- Inform gathers information for FinOps team members. This might include cost analytics, performance metrics, and correlations to business workloads and operating units. Simply put: What is running in the cloud, how well is it working, and what does it cost?

- Optimize is about right-sizing costs. This might be as simple as turning off unneeded cloud resources or services. It could also involve reengineering to deploy a better-performing and more cost-effective infrastructure for a workload.

- Operate is the set of processes and best practices used to run workloads in the cloud, set metric benchmarks, establish cloud budgets, forecast future cloud costs and so on.

By using a knowledgeable FinOps team to consolidate cloud services and negotiate costs with service providers, the business can operate workloads more efficiently, with better performance and -- sometimes -- for lower costs.

What is DevOps and why is it important?

DevOps, an amalgam of development and operations, is a set of principles, best practices and tools intended to accelerate software development. It also aims to deliver software to users at higher velocities and with better quality than traditional software development paradigms.

A typical DevOps cycle involves a series of steps, such as coding, building, testing and deployment. Additional steps are often inserted to help manage building and testing through automation, version controls, analytics and reporting.

DevOps is noted for its iterative and highly collaborative nature. Rather than trying to build a complete software product in one cycle, DevOps seeks to build, test and deploy a product as an ongoing series of incremental steps or cycles. The cycles themselves can be extremely fast -- sometimes several per day -- though it's more likely for a cycle to take several weeks from planning to deployment. This requires close cooperation among developers, business leaders, product stakeholders and even users.

DevOps regularly adopts a shift left approach intended to improve software quality by evaluating and testing builds earlier in the development process. This helps to catch and correct more flaws while they can still be fixed more quickly and cheaply than later.

DevOps is particularly noteworthy for its inclusion of operations -- or software deployment and management -- as an integral part of the development cycle. DevOps deliberately erases the traditional silos between developers and IT, allowing developers to drive the actual deployment of software for the organization. This is another vital timesaving advantage of DevOps, freeing IT staff to focus on running and maintaining the infrastructure rather than handling routine software deployments and updates.

DevOps vs. FinOps

On the surface, DevOps and FinOps seem distinctly different. After all, DevOps refers to software development and IT operations involved in producing and fielding a software product, while FinOps focuses on the cost and performance efficiency of cloud usage across the business -- fielding a software product effectively in the cloud.

Yet the two concepts are more alike than they are different. Both concepts share the following business-friendly attributes:

- reduced time to market

- cost containment and management

- quality and performance improvement

- reduced problems or simplified troubleshooting

- iterative approach throughout the lifecycle

- highly collaborative

Both concepts speak to deploying software for the business. With DevOps, the software is developed internally and traditionally deployed to the local data center -- though the cloud can certainly be an attractive deployment target for DevOps projects. With FinOps, the software intended to run in the cloud is already factored in, whether developed internally or purchased commercially. However, the cloud infrastructure is certainly the intended deployment target. It could be argued that the operations side of a DevOps project intended for the cloud could be the responsibility of a FinOps team.

The future of FinOps

Cloud FinOps is a relatively new paradigm for businesses. Although the fundamental purpose and cycle are not expected to change significantly, FinOps is expected to expand its reach and influence across businesses. Soon, FinOps frameworks might include or focus on issues such as the following:

- guidelines and governance for infrastructure provisioning in a multi-cloud environment;

- greater implementation and adherence to a FinOps delivery maturity model;

- greater use of business and technology metrics;

- more uniform cloud cost management dashboards and real-time reporting, such as real-time cloud pricing;

- integrating FinOps with IT service management ticketing or other service platforms;

- federated cloud cost optimization and management that compares or organizes different lines of business;

- greater use and reliance on data analytics and AI to understand resource usage, usage patterns and resource management for optimization;

- emphasis on cloud migration factory implementation and operation for larger organizations with many business units and workloads to migrate to the cloud and roll into FinOps; and

- more attention to tagging hygiene and best practices to keep resource searches and reporting organized and efficient.

These and other initiatives will demand strong FinOps fundamentals, well-proven FinOps tool sets and experienced FinOps team members -- perhaps led by a dedicated and certified FinOps practitioner.