peer-to-peer (P2P)

What is peer-to-peer (P2P)?

Peer-to-peer (P2P) is a decentralized communications model in which each party has the same capabilities and either party can initiate a communication session.

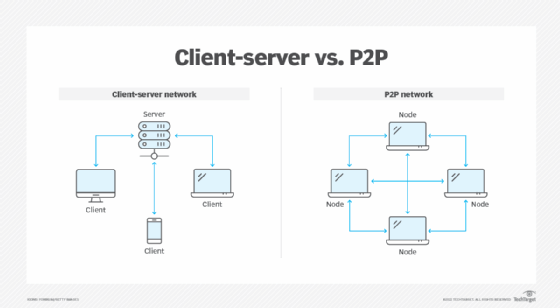

Unlike the client-server model, in which the client makes a service request and the server fulfills the request, the P2P network model enables each node to function as both a client and server.

P2P systems can provide anonymized routing of network traffic, massive parallel computing environments, distributed storage and other functions. Most P2P programs focus on media sharing, so P2P mostly associates with software piracy and copyright violation.

P2P applications typically enable users to control many parameters of operation. Some of those parameters are the following:

- how many member connections to seek or allow at one time;

- which systems to connect or avoid;

- which services to offer; and

- how many system resources to devote to the network.

Some P2P applications simply connect to some subset of active nodes in the network with little user control.

Use cases for the P2P networking topologies have existed since the days of Advanced Research Projects Agency Network, but the advantages of the P2P communications model didn't become obvious to the general public until the late 1990s when music-sharing P2P applications, like Napster, appeared. Napster and its successors, such as Gnutella and BitTorrent, cut into music and movie industry profits and changed how people thought about acquiring and consuming media.

System administrators tend to discourage the use of P2P applications for a few reasons. For one, P2P applications can tie up bandwidth. P2P applications can also bypass firewalls and distribute malware, which can possibly expose an administrator's organization legally. Network administrators often set up networks to prevent PCs from engaging in P2P side talk.

How do P2P networks work?

When a user downloads a file, the process is typically as follows: The user opens a web browser, visits the appropriate website and downloads the file. In this case, the website acts as a server, and the user's computer acts as a client that receives the data. This process is like a one-way street where the downloaded file transfers from point A, the website, to point B, the user's computer.

If the user downloads the same file through a P2P network, however, the process occurs differently. The user has to install P2P software on their computer, which creates a virtual network of P2P application users. When the user downloads a file, the file downloads in bits that come from various computers in the network that already have the file.

Simultaneously, data also travels from the user's computer to other computers in the network that ask for it. This situation is similar to a two-way street -- the file is like numerous small bits of data that come to the user's computer but also leave when requested. In fact, the file transfer load distributes between the peer computers.

P2P network architecture

In a P2P network architecture, each computer has the same responsibilities and capabilities. Since there is no server, the computers connect with each other in a workgroup to share files, printers and internet access. This architecture is practical for workgroups of 12 or fewer computers.

P2P architectures are common in small home networks or office environments where each PC acts as an independent workstation; each computer stores data on its own hard drive but has the ability to share data with other PCs on the network.

What are the advantages of P2P networks?

Some advantages of P2P networks are the following:

- P2P networks operate without an expensive server.

- Each user manages their own computer, eliminating the need for a network manager.

- P2P network configuration occurs via wizards in software.

- P2P networks can be set up in homes and small businesses.

- P2P networks typically have less network traffic than a client-server network.

What are the disadvantages of P2P networks?

Some disadvantages of P2P networks are the following:

- Users can't centrally back up files and folders.

- Each computer can access other computers, which slows performance.

- Files aren't centrally organized into a specific shared area, but rather stored on individual computers.

- Each user must ensure viruses aren't introduced into the network.

- There is limited security.

P2P vs. client-server

A P2P network involves two or more computers that share individual resources, such as DVD players, printers and disk drives. Each computer acts as both client and server and directly communicates with other computers in the network. In a P2P network, all computers on the network can access client devices directly connected to one specific computer on the network. The only requirement is a means of connection, such as a Wi-Fi router.

A client-server network involves numerous clients that connect to at least one central server where most applications and data are installed. Clients access these resources from the server. Client-server networks typically have faster access speeds because of the large number of clients they support.

Clients function as workstations without sharing resources. Clients can also upgrade applications and files more easily because only one computer stores files. In a client-server network, the server is what handles security, rather than each individual user.

History of P2P networks

The first use of P2P networks occurred shortly after the introduction of PCs in the 1980s. Internet Relay Chat, developed in August 1988, was one of the first P2P networks built for sharing text and chatting.

Napster released on June 1, 1999. The first iteration of the platform enabled music sharing on its own centralized P2P network. Napster, along with other first-generation P2P networks, directly connected users across the network to other individuals using copies of the same program.

Gnutella, the first decentralized P2P file-sharing network, released a year later in June 2000. Gnutella enables users to share files with each other rather than with a centralized file directory. Additional P2P media file-sharing services developed over the next few years, which set the stage for other P2P networks, such as Bitcoin networks, which released on Jan. 3, 2009.

Editor's note: This article was republished in November 2022 to improve the reader experience.