GAAP (generally accepted accounting principles)

What is GAAP (generally accepted accounting principles)?

GAAP (generally accepted accounting principles) is a collection of commonly followed accounting rules and standards for financial reporting. The acronym is pronounced gap.

GAAP specifications include definitions of concepts and principles, as well as industry-specific rules. The purpose of GAAP is to ensure that financial reporting is transparent and consistent from one public organization to another, and from one accounting period to another.

GAAP emerged in the 1970s and involved the following four major rules and standards:

- Accrual accounting methods. GAAP uses accrual accounting, which records revenue when a service or good is sold but not when payment is received; direct expenses for goods sold are recorded when a sale is transacted, and indirect expenses are recorded when expenses are paid.

- Depreciation and capital expenditures. Costs of major asset acquisitions are accounted for over the entire life of the asset. For example, an item with a 10-year life is accounted for at 10% for 10 years.

- Reporting of historical costs. Some assets -- such as property, equipment and facilities -- are accounted for using original purchase costs rather than current market values.

- Reporting of bad debts. Companies with significant money owed by customers, or accounts receivable, must report the possibility that some or all of that money may not be received and becomes lost revenue.

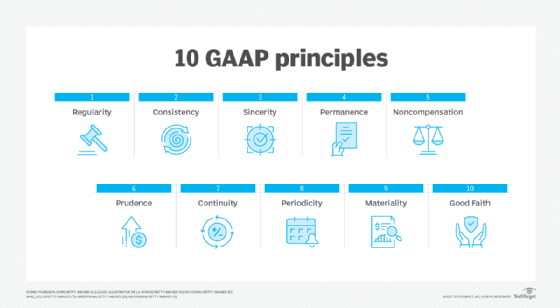

What are the 10 principles of GAAP?

GAAP is outlined by the following 10 general concepts or principles.

- Regularity. The business and accounting staff apply GAAP rules as standard practice.

- Consistency. Accounting staff apply the same standards through each step of the reporting process and from one reporting cycle to the next, paying careful attention to disclose any differences.

- Sincerity. Accounting staff provide objective and accurate information about business finances.

- Permanence. Accounting staff use consistent procedures in financial reporting, enabling business finances to be compared from report to report.

- Noncompensation. Accountants provide complete transparency of positive and negative factors without any compensation. In other words, they do not get paid based on how good or bad the reporting turns out.

- Prudence. Financial data is based on documented facts and is not influenced by guesswork.

- Continuity. Financial data collection and asset valuations should not disrupt normal business operations.

- Periodicity. Financial data should be organized and reported according to relevant accounting periods. For example, revenue or expenses should be reported within the corresponding quarter or other reporting period.

- Materiality. Accountants must rely on material facts and disclose all material financial and accounting facts in financial reports.

- Good Faith. There is an expectation of honesty and completeness in financial data collection and reporting.

Beyond these 10 general principles, public U.S. companies adhering to GAAP are expected to observe the following four additional guidelines to support the consistency and accuracy of financial statements.

- Recognition. Financial reporting should recognize and include all business assets, revenue, liabilities and expenses.

- Measurement. Financial statements should report financial results following GAAP standards.

- Presentation. Financial statements should include four major elements: income statement, balance sheet, cash flow statement, and a summary of shareholder equity or ownership.

- Disclosure. Financial reporting should include any notes and descriptions needed to completely explain financial information contained in reports.

Who uses GAAP?

Accountants and other financial professionals use GAAP rules and standards to organize and present the financial reporting periodically required by publicly traded companies within the U.S.

Since GAAP is intended to ensure complete, accurate and consistent financial reporting between businesses, it affects investment decisions by enabling investors to objectively compare business performance and influences the stability of the investment market.

There is no universal GAAP standard and the specifics vary from one geographic location or industry to another. The U.S. Securities and Exchange Commission (SEC) mandates that financial reports adhere to GAAP requirements. The Financial Accounting Standards Board stipulates GAAP overall and the Governmental Accounting Standards Board stipulates GAAP for state and local government. Publicly traded companies must comply with both SEC and GAAP requirements.

GAAP vs. IFRS: What is the difference?

Many countries around the world have adopted International Financial Reporting Standards (IFRS). IFRS is designed to provide a global framework for how public companies prepare and disclose their financial statements. Today, IFRS is the preeminent international accounting standard for financial reporting, and 144 out of 166 countries or jurisdictions around the world use IFRS. Although GAAP and IFRS serve the same fundamental purposes, there are some key differences between them, including the following.

- How inventory cost is handled. GAAP enables the last-in/first-out inventory cost method, but IFRS does not.

- How development costs are handled. GAAP treats development costs, such as the creation of software or other intellectual property as expenses, but IFRS treats development as a capital investment that is expensed and amortized over time.

- How write-downs are handled. GAAP does not allow inventory or asset write-downs or reductions in value to be reversed, but IFRS allows write-downs to be reversed if inventory or asset values change.

- How fixed assets are handled. GAAP records and reports fixed assets, including property, facilities and equipment at historical cost, while IFRS enables businesses to adjust fixed assets at fair market value.

Adopting a single set of worldwide standards simplifies accounting procedures for international countries and provides investors and auditors with a cohesive view of finances. IFRS provides general guidance for the preparation of financial statements, rather than rules for industry-specific reporting.