digital cash (e-cash)

What is digital cash (e-cash)?

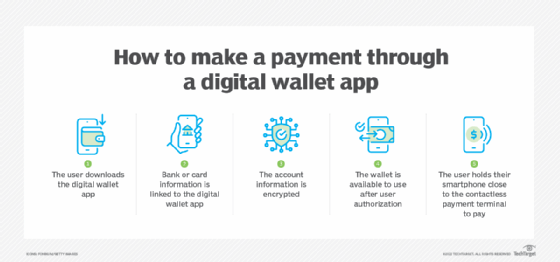

Digital cash is a system of purchasing cash credits, storing the credits in your computer or digital wallet, and then spending them when making electronic purchases over the internet or in person on a mobile device at the point of sale.

Digital cash allows individuals to make online transactions using Digital currency. It is designed to be a convenient and secure alternative to traditional payment methods, such as credit cards or cash.

Examples of digital wallets include the following:

- Apple Pay

- Cash App

- Dwolla

- Google Pay

- PayPal

- Samsung Wallet

- Venmo

- Zelle

When did digital cash originate?

The concept of digital cash dates to the 1980s, when it was first proposed as a way to facilitate electronic transactions. However, it was not until the widespread adoption of the internet and the development of secure online payment systems that digital cash became a viable alternative to traditional payment methods.

How is digital cash used today?

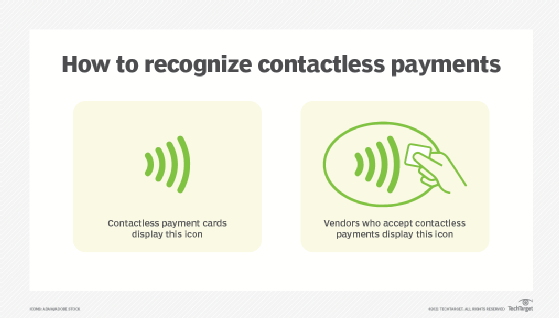

Over the past few decades, digital cash has evolved significantly. It is now used for a wide range of online transactions -- both online and in person (through contactless payments) -- including for the purchase of goods and services, the transfer of funds between individuals and the payment of bills and fees.

What are the benefits of digital cash?

One of the key advantages of digital cash is its convenience. With digital cash, individuals can make payments and transfer funds online without having to physically visit a bank or ATM. This is especially useful for individuals who live in remote or underserved areas, as they may not have easy access to traditional financial institutions.

Digital cash is also generally considered to be more secure than traditional payment methods, as it uses advanced encryption and authentication technologies such as multifactor authentication to protect against fraud and identity theft. In addition, digital cash transactions are typically completed in real time, which means there is less risk of fraud or chargebacks.

The role of digital cash in e-commerce

The role of digital cash in e-commerce is particularly significant, as it allows individuals to make online purchases without having to provide sensitive financial information, such as credit card numbers or bank account information.

This can be especially important for individuals who are concerned about the security of their financial information or who do not have access to traditional payment methods.

In addition to its convenience and security, digital cash is also popular among e-commerce merchants because it allows for faster and more efficient payment processing. With digital cash, merchants can receive payment almost immediately after a transaction is completed, which can help to speed up the fulfillment of orders and reduce the risk of fraud or chargebacks.

Today, digital cash is a valuable tool for facilitating online transactions and has played a significant role in the growth of e-commerce. As more and more individuals and businesses become comfortable with making and receiving digital payments, it is likely that digital cash will continue to evolve and become an increasingly important part of the global economic system.

Compare NFTs vs. cryptocurrency vs. digital currency and explore 8 top digital wallet companies.